Proctor and Gamble 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and AnalysisThe Procter & Gamble Company 37

of credit markets. Such events could negatively impact our ability to

collect receipts due from governments, including refunds of value

added taxes, create significant credit risks relative to our local custom-

ers and depository institutions, and/or negatively impact our overall

liquidity.

Regulatory Environment.Changes in laws, regulations and the related

interpretations may alter the environment in which we do business.

This includes changes in environmental, competitive and product-

related laws, as well as changes in accounting standards and taxation

requirements. Our ability to manage regulatory, tax and legalmatters

(including product liability, patent, intellectual property, competition

law matters and tax policy) and to resolve pending legal matters within

current estimates may impact our results.

RESULTS OF OPERATIONS

Net Sales

Net sales increased 5% in 2011 to $82.6billion on a 6% increase in

unit volume. Volume grew behind market and share growth. Global

market growth, in categories that we compete, grew 3% on a constant

currency basis. Volume increased low single digits in developed regions

and double digits in developing regions. All geographic regions

contributed to volume growth, led by double-digit growth in Asia,

high single-digit growth in Latin America and mid-single-digit growth

in CEEMEA and Western Europe. All six of the business segments

contributed to volume growth with high single-digit growth in the

Baby Care and Family Care and Fabric Care and Home Care segments,

mid-single-digit growth in the Beauty and Health Care segments, and

a low single-digit growth in the Grooming and Snacks and Pet Care

segments. Organic volume, which excludes acquisitions and divestitures,

was up 5%. Mix reduced net sales by 2% due mainly to dispropor-

tionate growth in developing regions and mid-tier products, both of

which have lower than Company average selling prices, and declines

in the premium-priced professional salon and prestige categories.

Pricing added 1% to net sales behind price increases to offset higher

commodity costs and foreign exchange. Organic sales were up 4%,

led by high single-digit growth in the Baby and Family Care segment,

as well as mid-single-digit growth across the Grooming and Health

Care segments.

$.

$.

$.

11

09

10

NET SALES

($ billions)

%

35%

%

11

09

10

DEVELOPING MARKETS

(% of net sales)

Net sales increased 3% in 2010 to $78.9billion on a 4% increase in

unit volume. Volume increased low single digits in developed regions

and mid-single digits in developing regions. All geographic regions

contributed to volume growth, led by high single-digit growth in Asia

and CEEMEA. Volume growth for the reportable segments was mixed,

with low single-digit increases in the Beauty, Grooming and Health

Care segments, a mid-single-digit increase in the Fabric Care and

Home Care segment and a high single-digit increase in the Baby Care

and Family Care segment, partially offset by a low single-digit decline

in the Snacks and Pet Care segment. Price increases added 1% to

netsales as increases taken primarily in developing regions to offset

local currency devaluations were partially offset by price reductions

toimprove consumer value. Mix reduced net sales by 1% behind

disproportionate growth in developing regions, which have lower

than Company average selling prices, and relatively weaker shipments

of Salon Professional, Prestige, Personal Health Care and Pet Care,

which have higher than Company average selling prices. Organic sales

were up 3%, led by mid-single-digit growth across the Fabric Care and

Home Care and the Baby Care and Family Care segments. Unfavorable

foreign exchange reduced net sales growth by 1% as the U.S. dollar

strengthened versus key foreign currencies.

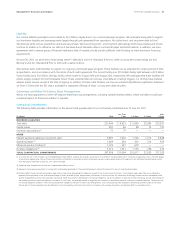

Operating Costs

Comparisons as a percentage of net sales; Years ended June30 2011

BasisPoint

Change 2010

BasisPoint

Change 2009

Gross margin 50.6% (140)52.0% 250 49.5%

Selling, general and administrative expense 31.4% (30)31.7% 220 29.5%

Operating margin 19.2% (110)20.3% 30 20.0%

Earnings from continuing operations before income taxes 18.4% (70)19.1% 30 18.8%

Net earnings from continuing operations 14.3% 40 13.9% 013.9%