Proctor and Gamble 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

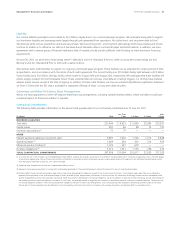

Management’s Discussion and AnalysisThe Procter & Gamble Company 47

Liquidity

Our current liabilities exceeded current assets by $.3billion, largely due to our commercial paper program. Weanticipate being able to support

our short-term liquidity and operating needs largely through cash generated from operations. Weutilize short- and long-term debt to fund

discretionary items such as acquisitions and share repurchases. We have strong short- and long-term debt ratings which have enabled and should

continue to enable us to refinance our debt as it becomes due at favorable rates in commercial paper and bond markets. In addition, we have

agreements with a diverse group of financial institutions that, if needed, should provide sufficient credit funding to meet short-term financing

requirements.

On June30,2011, our short-term credit ratings were P-1(Moody’s) and A-1+ (Standard& Poor’s), while our long-term credit ratings are Aa3

(Moody’s) and AA- (Standard& Poor’s), both with a stable outlook.

We maintain bank credit facilities to support our ongoing commercial paper program. These facilities can be extended for certain periods of time

as specified in, and in accordance with, the terms of each credit agreement. The current facility is an $11.0billion facility split between a $7.0billion

5-year facility and a $4.0billion 364-day facility, which expire in August 2016 and August 2012, respectively. We anticipate that these facilities will

remain largely undrawn for the foreseeable future. These credit facilities do not have cross-default or ratings triggers, nor do they have material

adverse events clauses, except at the time of signing. In addition to these credit facilities, we have an automatically effective registration statement

on Form S-3filed with the SEC that is available for registered offerings of short- or long-term debt securities.

Guarantees and Other Off-Balance Sheet Arrangements

We do not have guarantees or other off-balance sheet financing arrangements, including variable interest entities, which we believe could have

a material impact on financial condition or liquidity.

Contractual Commitments

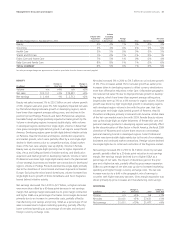

The following table provides information on the amount and payable date of our contractual commitments as of June30,2011.

($ millions) Total

LessThan

1Year 1–3Years 3–5Years

After

5Years

RECORDED LIABILITIES

Total debt $31,494 $ 9,933 $5,959 $5,095 $10,507

Capital leases 407 46 89 75 197

Uncertain tax positions(1)77 77 ———

OTHER

Interest payments relating to long-term debt 9,897 1,002 1,744 1,313 5,838

Operating leases(2)1,499 264 416 314 505

Minimum pension funding(3)1,070 391 679 — —

Purchase obligations(4)3,012 1,351 1,130 258 273

TOTAL CONTRACTUAL COMMITMENTS $47,456 $13,064 $10,017 $7,055 $17,320

(1) As of June30, 2011, the Company’s Consolidated Balance Sheet reflects a liability for uncertain tax positions of $2.4 billion, including $555 million of interest and penalties. Due to the high degree

of uncertainty regarding the timing of future cash outflows of liabilities for uncertain tax positions beyond one year, a reasonable estimate of the period of cash settlement beyond twelve months

from the balance sheet date of June30, 2011 cannot be made.

(2) Operating lease obligations are shown net of guaranteed sublease income.

(3) Represents future pension payments to comply with local funding requirements. The projected payments beyond fiscal year 2014 are not currently determinable.

(4) Primarily reflects future contractual payments under various take-or-pay arrangements entered into as part of the normal course of business. Commitments made under take-or-pay obligations

represent future purchases in line with expected usage to obtain favorable pricing. Approximately 26% relates to service contracts for information technology, human resources management and

facilities management activities that have been outsourced. While the amounts listed represent contractual obligations, we do not believe it is likely that the full contractual amount would be paid if

the underlying contracts were canceled prior to maturity. In such cases, we generally are able to negotiate new contracts or cancellation penalties, resulting in a reduced payment. The amounts do

not include obligations related to other contractual purchase obligations that are not take-or-pay arrangements. Such contractual purchase obligations are primarily purchase orders at fair value

that are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such purchase obligations will adversely affect our liquidity position.