Proctor and Gamble 2011 Annual Report Download - page 47

Download and view the complete annual report

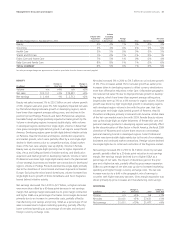

Please find page 47 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and AnalysisThe Procter & Gamble Company 45

Net earnings increased % to $.billion in behind net sales

growth and basis points of net earnings margin expansion driven

by higher gross margin, partially offset by higher SG&A as a percentage

of net sales. Gross margin increased mainly due to lower commodity

costs and manufacturing cost savings. SG&A as a percentage of net

sales increased primarily behind incremental marketing investments

and higher foreign currency exchange costs.

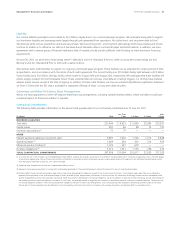

Corporate

Corporate includes certain operating and non-operating activities not

allocated to specific business units. These include: the incidental

businesses managed at the corporate level; financing and investing

activities; other general corporate items; the historical results of certain

divested brands and categories; and certain restructuring-type activities

to maintain a competitive cost structure, including manufacturing

and workforce optimization. Corporate also includes reconciling items

to adjust the accounting policies used in the segments to U.S. GAAP.

The most significant reconciling items include income taxes (to adjust

from statutory rates that are reflected in the segments to the overall

Company effective tax rate), adjustments for unconsolidated entities

(to eliminate net sales, cost of products sold and SG&A for entities

that are consolidated in the segments but accounted for using the

equity method for U.S. GAAP) and noncontrolling interest adjustments

for subsidiaries where we do not have % ownership. Since certain

unconsolidated entities and less than%-owned subsidiaries are

managed as integral parts of the Company, they are accounted for

similar to a wholly-owned subsidiary for management and segment

purposes. This means our segment results recognize % of each

income statement component through before-tax earnings in the

segments, with eliminations for unconsolidated entities and noncon-

trolling interests in Corporate. In determining segment net earnings,

we apply the statutory tax rates (with adjustments to arrive at the

Company’s effective tax rate in Corporate) and eliminate the share of

earnings applicable to other ownership interests, in a manner similar

to noncontrolling interest.

Corporate net sales primarily reflect the adjustment to eliminate the

sales of unconsolidated entities included in business segment results.

Accordingly, Corporate net sales are generally a negative balance. In

, negative net sales in Corporate were down $98 million due to

adjustments required to eliminate sales of unconsolidated entities.

Net income from continuing operations increased $1.3billion to

$456million. The increase was due to current-period net discrete

adjustments to reverse reserves for uncertain tax positions, prior-period

charges for the taxation of certain future retiree prescription drug

subsidy payments in the U.S., lower current-period interest expense,

areduction in restructuring-type charges, and current-year divestiture

gains. Additional discussion of the items impacting net income in

Corporate are included in the Results of Operations section.

In 2010, negative net sales in Corporate were up 2% mainly due to

adjustments required to eliminate sales of unconsolidated entities.

Net expenses from continuing operations increased $603 million to

$817 million. The increase was primarily due to 2010 charges for

competition law fines and for enacted legislation impacting the

taxation of certain future retiree prescription drug subsidy payments

in the U.S. and the impact of higher prior-period divestiture gains and

tax audit settlements. These impacts were partially offset by lower

interest expense and restructuring charges in 2010.

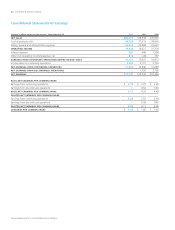

FINANCIAL CONDITION

We believe our financial condition continues to be of high quality, as

evidenced by our ability to generate substantial cash from operations

and ready access to capital markets at competitive rates.

Operating cash flow provides the primary source of funds to finance

operating needs and capital expenditures. Excess operating cash is

used first to fund shareholder dividends. Other discretionary uses

include share repurchases and tack-on acquisitions to complement

our portfolio of brands and geographies. As necessary, we may

supplement operating cash flow with debt to fund these activities.

The overall cash position of the Company reflects our strong business

results and a global cash management strategy that takes into account

liquidity management, economic factors and tax considerations.

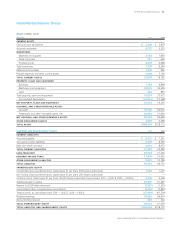

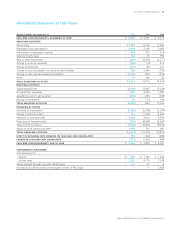

Operating Activities

Operating cash flow was $13.2billion in 2011, an 18% decrease versus

the prior year. Operating cash flow resulted primarily from net earnings

adjusted for non-cash items (depreciation and amortization, stock-

based compensation, deferred income taxes and gain on the sale of

businesses), partially offset by an increase in working capital. The net

of accounts receivable, inventory and accounts payable consumed

$569 million of operating cash flow in 2011 mainly due to increases in

inventories and accounts receivables. Inventory consumed $501 million

driven by higher commodity costs, business growth and increased

stock levels in advance of initiatives and sourcing changes. Inventory

days on hand increased by five days due to the impact of foreign

exchange, higher commodity costs and increased safety stock levels.

Accounts receivable used $426 million primarily to support business

growth. Accounts receivable days sales outstanding were up three

days due to timing of sales and the impact of foreign exchange.

Inventory and accounts receivable increases were partially offset by

accounts payable, accrued and other liabilities, which increased to

support business growth. Other operating assets and liabilities were

also a significant use of operating cash flow due primarily to net

reductions in reserves for uncertain tax positions and an increase in

the amount of value added taxes due from various governmental

authorities. In the prior year, working capital was a net source of cash.

Operating cash flow was $16.1billion in 2010, an 8% increase versus

the prior year. Operating cash flow resulted primarily from net earn-

ings adjusted for non-cash items (depreciation and amortization,

stock-based compensation, deferred income taxes and gain on the

sale of businesses) and a reduction in working capital. The increase in

operating cash flow versus2009 was primarily due to the 2010

reduction in working capital balances, partially offset by a decline in

earnings versus 2009. The net of accounts receivable, inventory, and

accounts payable contributed $2.5billion to operating cash flow in