Proctor and Gamble 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50Notes to Consolidated Financial Statements The Procter & Gamble Company and Subsidiaries

plan assets were comprised of Company stock, net of Series B ESOP

debt (see Note 6), of $2,182 and $2,243, as of June 30, 2003 and

2002, respectively.

The accrued pension and other retiree benefit costs recognized in the

accompanying Consolidated Balance Sheets were computed as follows:

The underfunding of pension benefits primarily is a function of the dif-

ferent funding incentives that exist outside of the United States. In cer-

tain countries where the Company has major operations, there are no

legal requirements or financial incentives provided to companies for

pension fund contributions. In these instances, the associated pension

liabilities are typically financed directly from the Company’s cash as they

become due, rather than through the creation of a separate pension

fund. Both the benefit and the financing costs have been reflected in

net earnings.

The projected benefit obligation, accumulated benefit obligation and

fair value of plan assets for the defined benefit pension plans with

accumulated benefit obligations in excess of plan assets were $2,945,

$2,310 and $979, respectively, as of June 30, 2003, and $1,718,

$1,385 and $276, respectively, as of June 30, 2002.

The recent underfunding of other retiree benefits is primarily due to

changes in the assumed discount and health care cost trend rates. Benefit

obligations exceed the fair value of plan assets for each retiree benefit

plan. Annual funding requirements are met through cash from operations.

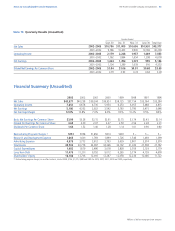

The following table sets forth the aggregate change in benefit obliga-

tion for the Company’s defined benefit and other retiree benefit plans:

The following table sets forth the aggregate change in plan assets, as

well as the cash contributions made for each plan:

Pension plan assets comprise a diversified mix of assets including cor-

porate equities, government securities and corporate debt securities. The

asset allocation is based on the structure of the liability. Other retiree

Millions of dollars except per share amounts

2003 2002

$2,970 $2,567

124 114

173 153

7 7

(33) 1

138 72

42 40

(29) (101)

1 9

305 255

(155) (147)

3,543 2,970

Benefit obligation at

beginning of year

Service cost

Interest cost

Participants’ contributions

Amendments

Actuarial loss

Acquisitions

Curtailments and

settlements

Special termination

benefits

Currency translation

Benefit payments

Benefit obligation

at end of year

2003 2002

$2,135 $1,577

62 49

150 116

27 22

(2) 5

645 401

– 32

– (1)

7 37

13 5

(123) (108)

2,914 2,135

Years ended June 30

Pension Benefits Other Retiree Benefits

2002

$1,432

(150)

18

116

7

(22)

78

(147)

1,332

Fair value of plan assets

at beginning of year

Actual return

on plan assets

Acquisitions

Employer contributions

Participants’ contributions

Settlements

Currency translation

Benefit payments

Fair value of plan assets

at end of year

Years ended June 30

2003

$1,332

(36)

1

337

7

(27)

99

(155)

1,558

2002

$1,449

947

–

38

22

–

(1)

(108)

2,347

2003

$2,347

1

–

25

27

–

–

(123)

2,277

Pension Benefits Other Retiree Benefits

2002

$(1,638)

571

14

21

(1,032)

94

(1,250)

18

106

(1,032)

Funded status

at end of year

Unrecognized net

actuarial loss (gain)

Unrecognized

transition amount

Unrecognized

prior service cost

Net amount recognized

Prepaid benefit cost

Accrued benefit cost

Intangible asset

Accumulated other

comprehensive income

Net liability recognized

2003

$(1,985)

930

13

(9)

(1,051)

173

(1,407)

31

152

(1,051)

2002

$212

(579)

–

(1)

(368)

2

(370)

–

–

(368)

2003

$(637)

435

–

(2)

(204)

2

(206)

–

–

(204)

Years ended June 30

Pension Benefits Other Retiree Benefits