Proctor and Gamble 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review 29The Procter & Gamble Company and Subsidiaries

Key Accounting Policies

The Company applies certain key accounting policies as required by

accounting principles generally accepted in the United States of Ameri-

ca. These key accounting policies govern revenue recognition, restruc-

turing, income taxes, certain employee benefits and goodwill and

intangible assets. These accounting policies, and others set forth in Note

1 to the Consolidated Financial Statements, are integral to understand-

ing the results of operations and financial condition of the Company.

Inherent in the application of accounting principles are necessary esti-

mates, judgments and assumptions that affect the reported amount of

assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the periods pre-

sented. Due to the nature of the Company’s business, these estimates

generally are not considered highly uncertain at the time of estimation,

meaning they are not expected to result in a change that would mate-

rially affect the Company’s results of operations or financial condition in

any given year.

The Company has discussed the selection of key accounting policies

and the effect of estimates with the Audit Committee of the Company’s

Board of Directors.

Revenue Recognition

Sales are recognized when revenue is realized or realizable and earned.

Most revenue transactions represent sales of inventory, and revenue is

recognized when risk and title to the product transfers to the customer.

A provision for payment discounts and product return allowances is

recorded as a reduction of sales within the same period that the reve-

nue is recognized. Given the nature of the Company’s business, revenue

recognition practices do not contain estimates that materially affect

results of operations.

Restructuring

Restructuring charges relate to the restructuring program that began in

1999 and was substantially complete at the end of 2003. The Company

provides forward-looking information about the overall program,

including estimated savings and costs. Such disclosures represent man-

agement’s best estimate and do require significant estimates about the

program. The specific reserves related to the restructuring program also

require judgment and estimation, but are not considered highly uncer-

tain. See Note 2 to the Consolidated Financial Statements.

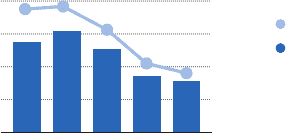

respectively. This is a result of the systemic interventions the Company

has made to improve capital spending efficiencies and asset utilization

and is primarily the result of lower spending in Baby and Family Care.

On an ongoing basis, while there may be exceptional years when spe-

cific business circumstances, such as capacity additions, may lead to

higher spending, the Company’s goal is to maintain capital spending at

about 4% of net sales.

Guarantees and Other Off-Balance Sheet Arrangements

The Company does not have guarantees or other off-balance sheet

financing arrangements that the Company believes could have a mate-

rial impact on financial condition or liquidity.

Purchase Commitments

The Company has purchase commitments for materials, supplies, serv-

ices and fixed assets as part of the normal course of business. Due to

the proprietary nature of many of the Company’s materials and proc-

esses, certain supply contracts contain penalty provisions for either ear-

ly termination or failure to purchase contracted quantities. The

Company does not expect potential payments under these provisions to

materially affect results of operations or financial condition. This con-

clusion is made based upon reasonably likely outcomes assumed by

reference to historical experience and current business plans.

Liquidity

As discussed previously, the Company’s primary source of liquidity is

cash generated from operations. Additionally, the Company is able to

support its short-term liquidity, if necessary, through agreements with a

diverse group of creditworthy financial institutions. The Company has

never drawn on these facilities and does not intend to do so in the fore-

seeable future. However, should the facilities be needed, when combined

with cash on hand, the Company believes they would provide sufficient

credit funding to meet any short-term financing requirements. The Com-

pany does not have other commitments or related party transactions

that are considered material to the Consolidated Financial Statements.

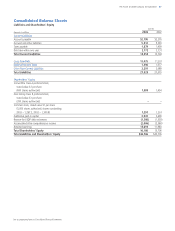

Capital Spending

(in billions of dollars)

20001999

0

1

2

3

$4

2%

0%

4%

6%

8%

2001 2002 2003

% of Net Sales

Capital Spending