Proctor and Gamble 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements 46The Procter & Gamble Company and Subsidiaries

Long-term weighted average interest rates were 3.7% and 4.0% as of

June 30, 2003 and 2002, respectively, and included the effects of relat-

ed interest rate swaps discussed in Note 7.

The fair value of the long-term debt was $12,396 and $11,673 at June

30, 2003 and 2002, respectively. Long-term debt maturities during the

next five fiscal years are as follows: 2004-$1,093; 2005-$1,495; 2006-

$2,463; 2007-$1,091 and 2008-$804. The Company has no material

obligations that are secured.

Note 7 Risk Management Activities

As a multinational company with diverse product offerings, the Compa-

ny is exposed to market risks, such as changes in interest rates, currency

exchange rates and commodity pricing. To manage the volatility related

to these exposures, the Company evaluates exposures on a consolidat-

ed basis to take advantage of logical exposure netting. For the remain-

ing exposures, the Company enters into various derivative transactions

in accordance with the Company’s policies in areas such as counterpar-

ty exposure and hedging practices. For all periods presented, such de-

rivative transactions are accounted for under SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” as

amended and interpreted. The Company does not hold or issue deriva-

tive financial instruments for speculative trading purposes.

At inception, the Company formally designates and documents the fi-

nancial instrument as a hedge of a specific underlying exposure. The

Company formally assesses, both at inception and at least quarterly on

an ongoing basis, whether the financial instruments used in hedging

transactions are effective at offsetting changes in either the fair value or

cash flows of the related underlying exposure. Fluctuations in the deriv-

ative value generally are offset by changes in the fair value or cash

flows of the exposures being hedged. This offset is driven by the high

degree of effectiveness between the exposure being hedged and the

hedging instrument. Any ineffective portion of an instrument’s change

in fair value is immediately recognized in earnings.

Credit Risk

The Company has established strict counterparty credit guidelines and

normally enters into transactions with investment grade financial insti-

tutions. Counterparty exposures are monitored daily and downgrades in

credit rating are reviewed on a timely basis. Credit risk arising from the

inability of a counterparty to meet the terms of the Company’s financial

instrument contracts generally is limited to the amounts, if any, by

which the counterparty’s obligations exceed the obligations of the

Company. The Company does not expect to incur material credit losses

on its risk management or other financial instruments.

Selected Operating Expenses

Research and development costs are charged to earnings as incurred

and were $1,665 in 2003, $1,601 in 2002 and $1,769 in 2001. Adver-

tising costs are charged to earnings as incurred and were $4,373 in

2003, $3,773 in 2002 and $3,612 in 2001. Both of these are compo-

nents of marketing, research, administrative and other expense.

Note 6 Short-Term and Long-Term Debt

The weighted average short-term interest rates were 3.6% and 2.9% as

of June 30, 2003 and 2002, respectively. The rate increase reflected a

change in mix between short-term debt and the current portion of long-

term debt.

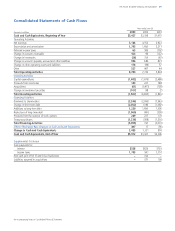

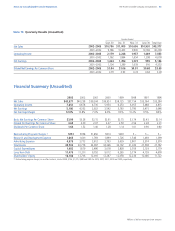

Millions of dollars except per share amounts

2002

$2,142

461

618

510

3,731

Short-Term Debt

USD commercial paper

Non-USD commercial paper

Current portion of long-term debt

Other

2003

$717

147

1,093

215

2,172

June 30

2002

$750

200

1,000

400

1,478

459

201

1,000

500

–

1,000

417

1,000

200

300

763

–

2,151

(618)

11,201

Long-Term Debt

5.25% USD note due September, 2003

8.00% USD note due November, 2003

6.60% USD note due December, 2004

4.00% USD note due April, 2005

5.75% EUR note due September, 2005

1.50% JPY note due December, 2005

3.50% CHF note due February, 2006

4.75% USD note due June, 2007

6.13% USD note due May, 2008

4.30% USD note due August, 2008

6.88% USD note due September, 2009

2.00% JPY note due June, 2010

9.36% Series B ESOP debentures due 2007-2021

8.00% USD note due September, 2024

6.45% USD note due January, 2026

6.25% GBP note due January, 2030

5.25% GBP note due January, 2033

All other long-term debt

Current portion of long-term debt

2003

$750

200

1,000

400

1,725

459

222

1,000

500

500

1,000

417

1,000

200

300

827

331

1,737

(1,093)

11,475

June 30