Proctor and Gamble 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Review 27The Procter & Gamble Company and Subsidiaries

In July 2003, the Company announced it was exploring strategic alter-

natives with respect to the global juice business, which could include

the sale of its brands and related assets. The impacts of any potential

sale of this business are not currently determinable. While clearly a

significant portion of Snacks and Beverages, the ongoing impacts of a

potential divestiture are not expected to be material to the Company’s

operations or financial condition.

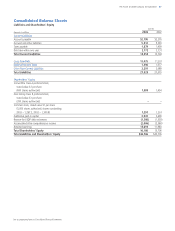

Corporate

Corporate includes certain operating and non-operating activities as

well as eliminations to adjust management reporting principles to U.S.

GAAP. Operating activities in Corporate include the results of incidental

businesses managed at the corporate level along with the elimination

of individual line item results for companies over which the Company

exerts significant influence, but does not control the operations. Oper-

ating elements also include intangible asset amortization charges,

restructuring program charges, certain employee benefit costs and

other general corporate items. The non-operating elements include

financing and investing activities. In addition, Corporate includes the

historical results of certain divested businesses of the former Food and

Beverage segment.

Corporate net sales in 2003 primarily reflected the elimination of sales

by companies over which the Company exerts significant influence, but

does not control. Sales in 2002 included these eliminations along with

net sales of the divested businesses of the former Food and Beverage

segment. Lower Corporate earnings in 2003 primarily reflected the

impact of the Jif and Crisco operations in the base period. Corporate

earnings were also lower due to financing elements of employee bene-

fit plans and hedging impacts from a stronger Euro, partially offset by

decreased restructuring costs.

In 2002, Corporate earnings reflected lower restructuring costs, lower

interest expense and the discontinuation of amortization of goodwill

and indefinite-lived intangibles. These were partially offset by reduced

gains from hedging.

negative mix impact of 2%. The negative product mix impact was

primarily driven by growth in developing regions and a shift in Actonel

volume mix, which is sold under an alliance agreement, to support the

global Once-a-week dosage launch. Under the agreement, the sales

rate differs based upon geography.

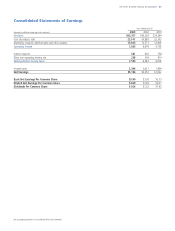

Net earnings for Health Care were $706 million, an increase of 35%.

The majority of the increase was driven by volume growth and the shift

to higher margin products, partially offset by additional marketing

investments to support product initiatives, including Actonel, Crest

Whitestrips and Crest Night Effects.

In 2002, Health Care delivered a 15% increase in unit volume, driven

by growth in the oral care and pharmaceutical businesses. Net sales

increased 14% to $4.98 billion, including a 1% negative impact of for-

eign exchange. Health Care’s volume growth from high-margin prod-

ucts funded increased marketing investments while still delivering a net

earnings increase of 34% to $521 million.

Snacks and Beverages

Snacks and Beverages unit volume declined 2% reflecting the impact of

the business interruption on snacks shipments caused by tornado dam-

age to the Jackson, Tennessee manufacturing facility, as well as softness

in the juice category. Net sales were $3.24 billion, or essentially flat

versus the prior year, as a positive 3% impact from foreign exchange

and 1% from mix were partially offset by a negative 2% impact from

pricing, primarily driven by price declines in the coffee category in

response to increased competitive promotional spending. Despite the

impact of the tornado and lower volume, net earnings increased 1% to

$306 million, driven by reductions in cost of products sold, reflecting

the impact of both base business and restructuring savings.

In 2002, Snacks and Beverages delivered earnings growth despite

top-line challenges. Unit volume declined 2% and sales declined 6%

to $3.25 billion driven by commodity-related pricing actions in coffee

and negative foreign exchange impacts. Net earnings grew 25%, to

$303 million, as broad-based cost reductions more than offset declin-

ing volumes.