Proctor and Gamble 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

Notes to Consolidated Financial Statements The Procter & Gamble Company and Subsidiaries

the need for a guarantor to recognize, at the inception of certain guar-

antees, a liability for the fair value of the obligation undertaken in issu-

ing the guarantee. The initial recognition and measurement provisions

of the Interpretation were adopted by the Company for guarantees

issued or modified after December 31, 2002. Adoption of FIN No. 45

did not have a material impact on the Company’s financial statements.

In January 2003, the FASB issued FIN No. 46, “Consolidation of Variable

Interest Entities.” FIN No. 46 addresses the requirements for business

enterprises to consolidate related entities in which they are determined

to be the primary economic beneficiary as a result of their variable eco-

nomic interests. The adoption of FIN No. 46 on July 1,2003 did not have

a material impact on the Company’s financial statements.

In April 2003, the FASB issued SFAS No. 149, “Amendment of State-

ment 133 on Derivative Instruments and Hedging Activities.” In May

2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial

Instruments with Characteristics of both Liabilities and Equity.” The

Company will adopt both SFAS No. 149 and SFAS No. 150 on July 1,

2003 and does not expect these Statements to materially impact the

Company’s financial statements.

Note 2 Restructuring Program

In 1999, concurrent with a reorganization of its operations into prod-

uct-based global business units, the Company initiated a multi-year

restructuring program. The program was designed to accelerate growth

and deliver cost reductions by streamlining management decision mak-

ing, manufacturing and other work processes and discontinuing under-

performing businesses and initiatives. Costs include separation-related

costs, asset write-downs, accelerated depreciation and other costs

directly related to the restructuring effort.

Since inception, the overall program resulted in total charges of $4.85

billion before tax ($3.79 billion after tax). At the end of 2003, this

restructuring program was substantially complete.

Many restructuring charges are not recognized at project initiation, but

rather are charged to expense as established criteria for recognition are

met. This accounting yields ongoing charges over the entire restructur-

ing period, rather than a large reserve at initiation. Charges for the pro-

gram are reflected in Corporate because they are corporate-driven

decisions and are not reflected in the operating results used internally

to measure and evaluate the operating segments.

Reclassifications

Certain reclassifications of prior years’ amounts have been made to

conform to the current year presentation.

New Pronouncements

On July 1, 2001, the Company adopted SFAS No. 142, “Goodwill and

Other Intangible Assets.” SFAS No. 142 eliminates the amortization of

goodwill and indefinite-lived intangible assets and initiates an annual

review for impairment. Identifiable intangible assets with determinable

useful lives continue to be amortized.

On July 1, 2002, the Company adopted SFAS No. 143, “Accounting for

Asset Retirement Obligations,” and SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets.” SFAS No. 143 addresses

the financial accounting and reporting for obligations associated with

the retirement of tangible long-lived assets and the associated asset

retirement costs. Adoption of this Statement did not have a material

impact on the Company’s financial statements. SFAS No. 144 addresses

the financial accounting and reporting for the impairment or disposal of

long-lived assets. This Statement did not have a material impact on the

Company’s financial statements.

The Company adopted SFAS No. 146, “Accounting for Costs Associated

with Exit or Disposal Activities,” for exit or disposal activities that were

initiated after December 31, 2002. This Statement requires these costs

to be recognized pursuant to specific guidance on when the liability is

incurred and not at project initiation. This Statement did not have a

material impact on the Company’s financial statements.

In December 2002, the Financial Accounting Standards Board (FASB)

issued SFAS No. 148, “Accounting for Stock-Based Compensation –

Transition and Disclosure.” This Statement amends the transition alter-

natives for companies choosing to adopt the fair value method of

accounting for the compensation cost of options issued to employees

and requires additional disclosure on all stock-based compensation

plans. The Company has adopted the disclosure provisions.

In November 2002, the FASB issued FASB Interpretation (FIN) No. 45,

“Guarantor’s Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others.” FIN No. 45

addresses the disclosures to be made by a guarantor in its financial

statements about its obligations under certain guarantees and clarifies

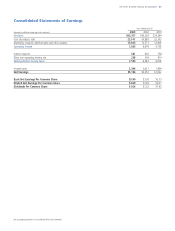

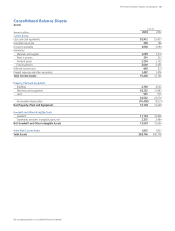

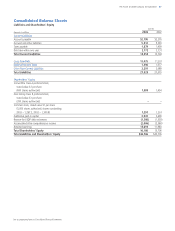

Millions of dollars except per share amounts