Proctor and Gamble 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements 49The Procter and Gamble Company and Subsidiaries

Under the defined contribution plans, the Company generally makes

annual contributions to participants’ accounts based on individual base

salaries and years of service. In the United States, the Company makes

annual contributions to participants’ accounts that do not exceed 15%

of total participants’ annual wages and salaries.

The Company maintains The Procter & Gamble Profit Sharing Trust

(Trust) and Employee Stock Ownership Plan (ESOP) to provide funding

for the U.S. defined contribution plan, as well as other retiree benefits.

Operating details of the ESOP are provided at the end of this Note. The

fair value of the ESOP Series A shares serves to reduce the Company’s

cash contribution required to fund the profit sharing plan contributions

earned. Under the American Institute of Certified Public Accountants

(AICPA) Statement of Position (SOP) 76-3, shares of the ESOP are allo-

cated at original cost based on debt service requirements, net of advan-

ces made by the Company to the Trust.

Defined contribution expense pursuant to this plan was $286, $279

and $303 in 2003, 2002 and 2001, respectively, which approximates

the amount funded by the Company.

Defined Benefit Retirement Plans and Other Retiree Benefits

Certain other employees, primarily outside the United States, are cov-

ered by local defined benefit pension, as well as other retiree benefit

plans.

The Company also provides certain other retiree benefits, primarily

health care and life insurance, for substantially all U.S. employees who

become eligible for these benefits when they meet minimum age and

service requirements. Generally, the health care plans require contribu-

tions from retirees and pay a stated percentage of expenses, reduced by

deductibles and other coverages. These benefits primarily are funded by

ESOP Series B shares as well as certain other assets contributed by the

Company.

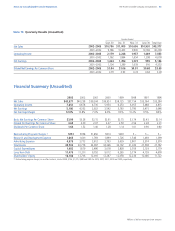

Stock options outstanding at June 30, 2003 were in the following exer-

cise price ranges:

Stock options exercisable at June 30, 2003 were in the following exer-

cise price ranges:

As a component of its treasury share repurchase program, the Company

generally repurchases common shares to fund the stock options granted.

In limited cases, the Company also issues stock appreciation rights,

generally in countries where stock options are not permitted by local

governments. The obligations and associated compensation expense are

adjusted for changes in intrinsic value. The impact of these adjustments

is insignificant.

Note 9 Postretirement Benefits and

Employee Stock Ownership Plan

The Company offers various postretirement benefits to its employees.

Defined Contribution Retirement Plans

The most prevalent employee benefit plans offered are defined contri-

bution plans, which cover substantially all employees in the United

States as well as employees in certain other countries. These plans are

fully funded.

Millions of dollars except per share amounts

Range of Prices

Number

Exercisable

(Thousands)

15,847

7,938

16,826

18,490

$28 to 46

54 to 66

67 to 85

85 to 106

Weighted

Average

Exercise Price

$35.78

59.77

82.63

95.02

Exercisable Options

Range of Prices

Weighted Avg.

Remaining

Contractual

Life Years

2.0

10.2

9.7

10.0

Number

Outstanding

(Thousands)

15,847

36,470

40,575

36,907

$28 to 46

54 to 66

67 to 85

85 to 106

Weighted Avg.

Exercise Price

$35.78

61.35

74.85

93.17

Outstanding Options