Proctor and Gamble 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

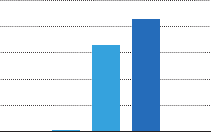

Unit Volume Growth

(% increase versus previous year)

2001 2002 2003

8.3%

0.2%

6.7%

The fundamental strengths that have driven this performance over time remain relevant and

important. The strategic choices we’ve made over the past three years remain right. And the

capabilities and systems we have developed throughout the Company are key reasons to

believe that we can build on what we’ve done in the past to keep P&G growing in the future.

Strategic Choices

We made five key choices to get P&G back on track. There are considerable opportunities for

continued growth within each area of strategic focus.

Build existing core businesses and leading brands into stronger leaders. P&G’s four core

categories – Fabric Care, Hair Care, Baby Care and Feminine Care – account for nearly 50%

of sales and an even greater percentage of profit. It’s essential that we keep these businesses

healthy and growing. And we are. In Fabric Care, where P&G is the global leader, we have a

worldwide share of over 30%. In Hair Care, we are also the global leader – yet we have only

about a 20% share. There’s plenty of upside in all four categories.

Grow faster with leading customers. In the U.S., the top 10 retailers increased their share

of the market from 30% to 55% in the past five years. In Europe, concentration at the country

level is even greater. This plays to P&G strengths. We understand shoppers and partner with

retailers in ways and on a scale few competitors can match. We’re helping retailers grow with

joint business plans, P&G’s leading brand portfolio, and category-leading new product

innovation. As leading retailers grow, so do P&G brands.

Grow in big countries. More than 80% of P&G sales come from the top 10 markets. We

need to keep driving P&G growth in these countries, which are some of the biggest and

strongest economies in the world. P&G’s business in the top 10 countries taken together is

growing at a rate of 11% per year. P&G is a leader in these markets. We have deep

understanding of local consumers, strong retail partnerships and important scale advantages.

Yet, despite this strength in P&G’s 10 largest countries, we still have significant opportunities

to grow. In the U.S. for example, P&G is the leader in 23 categories, but we have shares above

30% in only 18. We know we can extend P&G leadership in these big countries.

Develop and invest in faster-growing, higher-margin businesses. We’re strengthening

P&G’s leadership in Health Care and Beauty Care, two of the fastest-growing categories in

which we compete. We have five billion-dollar health and beauty brands today. The acquisition

of Wella will add a sixth. In fact, with the addition of Wella, Health Care and Beauty Care will

account for nearly half of P&G sales and profits, up from about one-fourth at the beginning

of the 1990s. We expect these two high-growth businesses to represent an increasing share of

P&G’s total business in the future.

Build P&G leadership in fast-growing developing markets. The consumer products

business is driven significantly by three basic demographic factors: population growth,

household formation and household income growth. These factors have driven developed-

market growth for decades, and are now driving strong growth in many developing markets.

China, for example, is now P&G’s sixth largest market – up from tenth just three years ago.

We’ve focused decisively on higher-growth, structurally attractive markets where P&G can

achieve sustainable growth.

2

100% of P&G’s

growth this year

was organic.