Proctor and Gamble 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40The Procter & Gamble Company and Subsidiaries

Notes to Consolidated Financial Statements

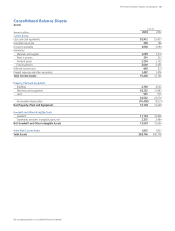

approximately one year. Accruals for expected payouts under these pro-

grams are included as accrued marketing and promotion in the accrued

and other current liabilities line in the Consolidated Balance Sheets (see

Note 5).

Cost of Products Sold

Cost of products sold primarily comprises direct materials and supplies

consumed in the manufacture of product, as well as manufacturing

labor and direct overhead expense necessary to acquire and convert the

purchased materials and supplies into finished product. Cost of prod-

ucts sold also includes the cost to distribute products to customers,

inbound freight costs, internal transfer costs, warehousing costs and

other shipping and handling activity. Reimbursements of shipping and

handling costs charged to customers are included in net sales.

Marketing, Research, Administrative and Other

Marketing, research, administrative and other expenses primarily

include: the cost of media, advertising and related marketing costs; sell-

ing expenses; research and development; corporate, administrative and

other indirect overhead costs; and other miscellaneous operating items.

Currency Translation

Financial statements of subsidiaries outside the United States generally

are measured using the local currency as the functional currency. Adjust-

ments to translate those statements into U.S. dollars are recorded in

other comprehensive income (OCI). For subsidiaries operating in highly

inflationary economies, the U.S. dollar is the functional currency. Remea-

surement adjustments for highly inflationary economies and other trans-

actional exchange gains and losses are reflected in earnings.

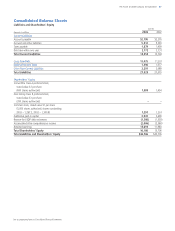

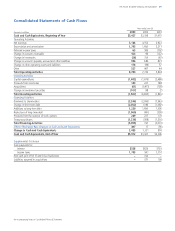

Cash Flow Presentation

The statement of cash flows is prepared using the indirect method,

which reconciles net earnings to cash flow from operating activities.

These adjustments include the removal of timing differences between

the occurrence of operating receipts and payments and their recogni-

tion in net earnings. The adjustments also remove cash flows arising

from investing and financing activities, which are presented separately

from operating activities. Cash flows from foreign currency transactions

and operations are translated at an average exchange rate for the peri-

od. Cash flows from hedging activities are included in the same catego-

ry as cash flows from the items being hedged. Cash flows from

derivative instruments designated as net investment hedges are classi-

fied as financing activities. Cash flows from other derivative instruments

used to manage interest, commodity or currency exposures are classi-

fied as operating activities.

Note 1 Summary of Significant Accounting Policies

Basis of Presentation

The Consolidated Financial Statements include The Procter & Gamble

Company and its controlled subsidiaries (the Company). Intercompany

transactions are eliminated in consolidation, except for certain transla-

tion impacts resulting from the application of Statement of Financial

Accounting Standards (SFAS) No. 52, “Foreign Currency Translation.”

Investments in companies over which the Company exerts significant

influence, but does not control the financial and operating decisions,

are managed as integral parts of the Company’s business units. Consis-

tent with internal management reporting, these investments are

accounted for as if they were consolidated subsidiaries in segment

reporting, with 100% recognition of the individual income statement

line items and separate elimination of the minority interest. Entries to

eliminate the individual revenues and expenses, adjusting the method

of accounting to the equity method as required by accounting principles

generally accepted in the United States of America (U.S. GAAP), are

included in Corporate.

Use of Estimates

Preparation of financial statements in conformity with U.S. GAAP

requires management to make estimates and assumptions that affect

the amounts reported in the Consolidated Financial Statements and

accompanying disclosures. These estimates are based on management’s

best knowledge of current events and actions the Company may under-

take in the future. Actual results may ultimately differ from estimates,

although management does not believe such changes will materially

affect the financial statements in any individual year.

Revenue Recognition

Sales are recognized when revenue is realized or realizable and has been

earned. Most revenue transactions represent sales of inventory, and the

revenue recorded includes shipping and handling costs, which generally

are included in the list price to the customer. The Company’s policy is to

recognize revenue when risk and title to the product transfers to the

customer, which generally is on the date of shipment. A provision for

payment discounts and product return allowances is recorded as a

reduction of sales within the same period that the revenue is recognized.

Trade promotions, consisting primarily of customer pricing allowances,

merchandising funds and consumer coupons, are offered through vari-

ous programs to customers and consumers. Sales are recorded net of

trade promotion spending, which is recognized as incurred, generally at

the time of the sale. Most of these arrangements have terms of

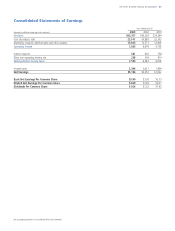

Millions of dollars except per share amounts