Proctor and Gamble 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43The Procter & Gamble Company and Subsidiaries

Realization of certain deferred tax assets is dependent upon generating

sufficient taxable income in the appropriate jurisdiction prior to

expiration of the carryforward periods. Although realization is not

assured, management believes it is more likely than not the deferred tax

assets net of applicable valuation allowances will be realized.

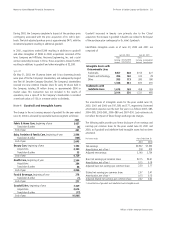

Deferred income tax assets and liabilities are comprised of the

following:

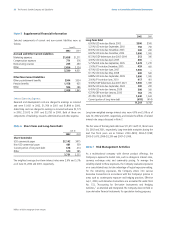

Net operating losses and other tax credit carryforwards were $1,211

and $1,220 as of June 30, 2002 and 2001, respectively. If unused,

$711 will expire between 2003 and 2012. The remainder, totaling $500

at June 30, 2002, may be carried forward indefinitely.

Note 12 Commitments and Contingencies

The Company’s business creates a need to enter into commitments with

suppliers that could affect liquidity and capital resources. These

commitments do not create immediate liabilities for the Company.

The Company has purchase commitments for materials, supplies and

property, plant and equipment incidental to the ordinary conduct of

business. In the aggregate, such commitments are not in excess of

current market prices. Additionally, the Company normally commits to

some level of marketing related expenditures that extend beyond the

fiscal year. These marketing related commitments are necessary in order

to maintain a normal course of business and the risk associated with

them is limited. It is not expected that these commitments will have a

material effect on the Company’s financial condition.

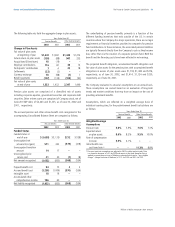

At various points from 2007 to 2017, the minority partner in a

subsidiary that holds most of the Company’s China operations has the

right to exercise a put option to require the Company to purchase from

half to all of its outstanding 20% interest at a price not greater than

fair market value. The impact of this put option is dependent on factors

that can change prior to its exercise. Given the put price cannot exceed

fair market value and the Company’s current liquidity, the Company

does not believe that exercise of the put would materially impact its re-

sults of operations or financial condition.

The Company leases certain property and equipment for varying periods

under operating leases. Future minimum rental payments with terms in

excess of one year total approximately $500.

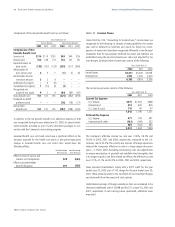

The Company is subject to various lawsuits and claims with respect to

matters such as governmental regulations, income taxes and other

actions arising out of the normal course of business. The Company is

also subject to contingencies pursuant to environmental laws and

regulations that in the future may require the Company to take action

to correct the effects on the environment of prior manufacturing and

waste disposal practices. Accrued environmental liabilities for

remediation and closure costs were $39 and $43 at June 30, 2002 and

2001, respectively. In management’s opinion, such accruals are

appropriate based on existing facts and circumstances. Current year

expenditures were not material.

While considerable uncertainty exists, in the opinion of management

and Company counsel, the ultimate liabilities resulting from such

lawsuits and claims would not materially affect the Company’s financial

statements.

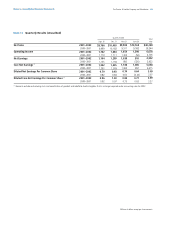

June 30

2002

Total Deferred Tax Assets

Other postretirement benefits

Loss and other carryforwards

Other

Valuation allowances

Total Deferred Tax Liabilities

Fixed assets

Other

Notes to Consolidated Financial Statements

Millions of dollars except per share amounts

$109

454

742

(106)

1,199

(1,110)

(495)

(1,605)

$196

516

350

(104)

958

(1,093)

(362)

(1,455)

2001