Proctor and Gamble 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.impact from divestitures. Volume declines and commodity-

related pricing actions in coffee drove an 8% decrease in net

sales, to $3.80 billion. Net earnings grew 16%, to $384

million, as broad-based cost reductions more than offset

declining volumes.

The fourth quarter marked the completion of the Jif and

Crisco spin-off. This transaction, which is accounted for simi-

lar to a dividend, delivered excellent value to shareholders –

equivalent to approximately $0.60 per share.

In 2001, food and beverage unit volume declined 10%,

including a 2% impact from divestitures. Unit volume was

negatively affected by reduced trade merchandising and the

impact of snacks pricing actions in North America and West-

ern Europe and the divestiture of the institutional shortening

and oils business. Net sales were $4.14 billion, down 11%.

Net earnings were $332 million, down 9% versus 2000.

Corporate

The corporate segment includes both operating and non-

operating elements such as financing and investing activities,

certain benefit costs, restructuring charges, segment

eliminations and other general corporate items.

Corporate includes adjustments from management reporting

conventions to conform with accounting principles generally

accepted in the United States of America. These primarily

affect the treatment of entities over which the Company

exerts significant influence but does not control, and income

taxes, which are reflected in the business segments using

estimated local statutory tax rates.

Corporate results reflect a decrease in one-time gains from

the Company’s non-strategic divestiture program. Moreover,

reduced corporate hedging gains versus 2001 were partially

offset by decreased restructuring costs, lower interest

expense and the discontinuation of amortizing goodwill and

certain indefinite-lived intangibles.

In 2001, corporate results reflect increased restructuring

costs, higher benefit costs and certain tax impacts not

reflected in the businesses. These were partially offset by

one-time gains from the Company’s divestiture program,

reduced overhead spending and corporate hedging gains.

Critical Accounting Policies

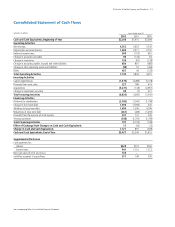

The Company makes various estimates when applying

accounting policies affecting the Consolidated Balance

Sheet, Consolidated Statement of Cash Flows and

Consolidated Statement of Earnings. Due to the nature of

the Company’s business, these estimates generally are not

considered highly uncertain at the time of estimation –

meaning they are not expected to result in a period-to-period

change that would materially affect the Company’s results of

operations or financial condition.

The Company does apply certain key accounting policies as

required by accounting principles generally accepted in the

United States of America. These key accounting policies

govern revenue recognition, restructuring, income taxes and

certain employee benefits.

Revenue Recognition

Revenue is recognized when it is realized or realizable and

earned. The vast majority of the Company’s revenue relates

to sale of inventory to customers, and revenue is recognized

when title and the risks and rewards of ownership pass to

the customer. Given the nature of the Company’s business

and the applicable rules guiding revenue recognition, the

Company’s revenue recognition practices do not contain

estimates that materially affect results of operations.

Restructuring

Restructuring charges relate to the restructuring program

that began in 1999. The Company provides forward-looking

information about the overall program, including estimated

costs and savings. Such disclosures represent management’s

best estimate, but do require significant estimates about the

program that may change over time. However, the specific

reserves recorded in each year under the restructuring

program are not considered highly uncertain, see Note 2 to

the Consolidated Financial Statements.

Income Taxes

Under SFAS No. 109, ”Accounting for Income Taxes,”

income taxes are recorded based on the current year

amounts payable or refundable, as well as the consequences

of events that give rise to deferred tax assets and liabilities

based on differences in how those events are treated for tax

purposes (see Note 11). The Company bases its estimate of

deferred tax assets and liabilities on current tax laws and

rates and, in certain cases, business plans and other

expectations about future outcomes.

Changes in existing regulatory tax laws and rates may affect

Financial Review22 The Procter & Gamble Company and Subsidiaries