Proctor and Gamble 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review 19The Procter & Gamble Company and Subsidiaries

2001. This increase is indicative of the heightened emphasis

on cash generation the Company has placed on all of its

operating units. Free cash flow was $3.32 billion in 2001 and

$1.66 billion in 2000.

The Company continues to generate strong cash flow from

operations. In 2002, cash flow from operations was $7.74

billion, up $1.94 billion from $5.80 billion in 2001, which

was an increase of $1.12 billion from $4.68 billion in 2000.

Higher earnings were the primary contributor. In addition,

taxes payable increased approximately $500 million versus

the prior year, primarily driven by utilization of prior year

overpayments and deferred tax assets. Depreciation and

amortization charges declined by $578 million versus the

prior year. Of this decrease, $235 million is attributable to

the adoption of Statement of Financial Accounting Standards

(SFAS) No. 142, under which goodwill and indefinite-lived

intangible assets are no longer being amortized. The

remaining decline is primarily driven by lower accelerated

depreciation from the restructuring program in fiscal 2002

versus 2001.

Net cash used for acquisitions completed during 2002 to-

taled $5.47 billion, primarily driven by the Clairol acquisition.

This compares to $138 million in 2001 and $2.97 billion in

2000, which included the Iams and PUR acquisitions.

The Company continues to divest certain non-strategic

brands in order to focus resources on core businesses. The

divestitures declined significantly in the current year,

returning to historical levels. The proceeds from these and

other asset sales generated $227 million in cash flow in the

current year, which is significantly reduced when compared

to the $788 million generated in 2001 and $419 million

generated in 2000.

The Company maintains a share repurchase program, which

authorizes the purchase of shares annually on the open

market. A primary purpose of the program is to mitigate the

dilutive impact of stock option grants – effectively pre-

funding the exercise obligation. Additionally, there is a

discretionary component under which it may repurchase

additional outstanding shares. Current year purchases under

the combined programs were $568 million, compared to

$1.25 billion in 2001 and $1.77 billion in 2000. The decline in

the current year is primarily due to cash requirements associ-

ated with the Clairol acquisition. The Company anticipates

the buy-back program will return to historical levels in 2003.

Common share dividends grew 9% to $1.52 per share in

2002 versus $1.40 in 2001 and $1.28 in 2000. The annual

dividend rate will increase to $1.64 per common share in

2003, marking the 47th consecutive year of increased

common share dividend payments. Total dividend payments,

to both common and preferred shareholders, were $2.10

billion, $1.94 billion and $1.80 billion in 2002, 2001 and

2000, respectively.

Total debt increased $2.91 billion to $14.93 billion compared

to $12.02 billion in 2001 and $12.25 billion in 2000. This

increase was primarily driven by the Clairol acquisition –

which had a purchase price of approximately $5.00 billion.

Long-term borrowing available under the Company’s current

shelf registration statement filed in March 2002 was $4.00

billion at June 30, 2002. Additionally, the Company is able to

issue commercial paper at favorable rates and to access

general bank financing.

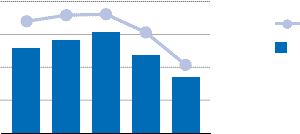

Capital Spending

Capital spending efficiency has been a focus area for the

Company. Spending decreased $807 million to $1.68 billion

in 2002, compared to $2.49 billion in 2001 and $3.02 billion

in 2000. Current year spending is 4.2% of net sales, com-

pared to 6.3% and 7.6% in 2001 and 2000, respectively.

This current year reduction of more than $800 million versus

the prior year surpasses the Company’s 6% of net sales goal

two years earlier than originally anticipated. This improve-

ment in capital spending is the result of three main factors: 1)

completing the majority of the re-platforming and capacity

expansion investment in the baby, feminine and family care

business unit, 2) sourcing consolidation and improved capaci-

ty utilization; and, 3) increasing emphasis on reduced but sus-

tainable capital spending levels to improve shareholder value.

Liquidity

The Company does not have off-balance sheet arrangements,

1998

0

1999 2000 2001 2002

2

1

3

$4

0%

4%

2%

6%

8%

% of Net Sales

Capital Spending

Capital Spending

(in billions of dollars)