Proctor and Gamble 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Results of Operations

The Company’s fiscal year ended June 30, 2002 reflects the

benefits of clear strategic choices, operational excellence and

financial discipline. The Company kept its commitment to

deliver consistent, reliable earnings and cash growth. In fact,

it delivered its long-term sales and earnings growth targets

ahead of the established objective and substantially

increased free cash flow.

During 2002, the Company completed the acquisition and

integration of Clairol – its largest acquisition ever – providing a

strong presence in the high-margin hair colorants business. It

also divested Comet and spun off Jif and Crisco. These trans-

actions are part of the Company’s choice to focus on building

big brands that offer the greatest potential for global growth.

The Company continues to make clear choices about where

to play and how to win. The framework for these is

grounded in focus areas that include: building core catego-

ries and leading brands; growing with the biggest retail

customers in the biggest geographic markets; and investing

in faster-growing, higher-margin, more asset-efficient

businesses. This requires some difficult decisions, including

those reflected in the Company’s restructuring program to

reduce overheads and streamline manufacturing and other

work processes. As the fiscal year results demonstrate, these

strategic choices are paying off.

Volume and Net Sales

Record sales in 2002 of $40.24 billion exceeded 2001 sales by

$994 million, or 3%. Excluding an unfavorable exchange rate

impact of 1% in the current year, net sales grew 4%. Core

net sales, which exclude restructuring impacts, were $40.17

billion, up 2% versus $39.38 billion in 2001. Excluding an

unfavorable exchange rate impact of 2% in the current year,

core net sales grew 4%. This is in line with the Company’s

long-term objective of 4% to 6% sales growth, excluding

the impacts of foreign exchange. Sales growth in 2002 was

driven by 7% unit volume growth – with particularly strong

performances in the health care and beauty care segments.

Fiscal year 2001 sales were $39.24 billion compared to

$39.95 billion in 2000. Excluding unfavorable exchange

effects of 3%, sales increased 2%, reflecting improved

pricing in beauty care, fabric and home care and baby,

feminine and family care. Unit volume was flat in 2001, as

exceptionally strong performance by new businesses in

health care was offset by softness in food and beverage.

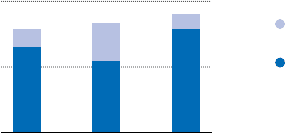

Net Earnings

In 2002, net earnings were $4.35 billion, compared to $2.92

billion in 2001 and $3.54 billion in 2000. Reported results

include after-tax restructuring charges of $706 million,

$1,475 million, and $688 million in 2002, 2001 and 2000,

respectively. This restructuring program covers a significant

reduction in enrollment, manufacturing consolidations

and portfolio choices to scale back or discontinue under-

performing businesses and initiatives.

The Company’s long-term earnings goal is to consistently

deliver double-digit core net earnings per share growth. Core

diluted net earnings per share, which excludes the impact of

restructuring charges and the prior years’ amortization of

goodwill and indefinite-lived intangibles, increased 10% to

$3.59 in 2002. This compares to core diluted net earnings

per share of $3.27 in 2001 and $3.10 in 2000. The goodwill

adjustment was $0.15 per share in both 2001 and 2000. In

the current year, every business unit delivered net earnings

growth above the corporate objective. Clear strategic focus

and operational excellence are enabling improved business

performance across all fronts. Core diluted net earnings per

share growth in the prior year of 5% reflected cost increases

and exchange impacts, which were mitigated by pricing

improvements, lower taxes and divestiture gains.

Operating Costs

Costs of products sold was $20.99 billion in 2002, compared

to $22.10 billion in 2001 and $21.51 billion in 2000. Restruc-

turing costs included in cost of products sold were $508 mil-

lion in 2002, $1.14 billion in 2001, and $496 million in 2000.

Excluding restructuring charges, as a percent of core net sales,

cost of products sold was 51.0% in 2002, compared to

53.2% in 2001 and 52.6% in 2000. The progress in the cur-

rent year reflects a decline in material costs and a continued

focus on savings projects, including restructuring. Gross

margin progress accelerated throughout the year, as restruc-

turing benefits and ongoing operational savings increased.

17The Procter & Gamble Company and Subsidiaries

2000

0

2001 2002

2

$4

Net Earnings Per Share

(on a diluted basis)

Core Earnings

Per Share

Reported

Earnings

Per Share