Proctor and Gamble 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35The Procter & Gamble Company and Subsidiaries

During 2002, the Company completed a buyout of the purchase price

contingency associated with the prior acquisition of Dr. John’s Spin-

brush. The total adjusted purchase price is approximately $475, with the

incremental payment resulting in additional goodwill.

In 2001, acquisitions totaled $246 resulting in additions to goodwill

and other intangibles of $208. In 2000, acquisitions consisted of The

Iams Company and Affiliates, Recovery Engineering, Inc. and a joint

venture ownership increase in China. These acquisitions totaled $2,967,

resulting in additions to goodwill and other intangibles of $2,508.

Spin-off

On May 31, 2002, the Jif peanut butter and Crisco shortening brands

were spun off to the Company’s shareholders, and subsequently merged

into The J.M. Smucker Company (Smucker). The Company’s shareholders

received one new common Smucker share for every 50 shares held in

the Company, totaling 26 million shares, or approximately $900 in

market value. This transaction was not included in the results of

operations, since a spin-off to the Company’s shareholders is recorded

at net book value, or $150, in a manner similar to dividends.

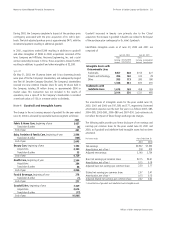

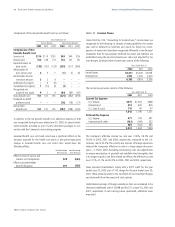

Note 4 Goodwill and Intangible Assets

The change in the net carrying amount of goodwill for the year ended

June 30, 2002 is allocated by reportable business segment as follows:

Goodwill increased in beauty care primarily due to the Clairol

acquisition. The increase in goodwill in health care related to the buyout

of the purchase price contingency for Dr. John’s Spinbrush.

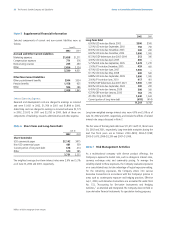

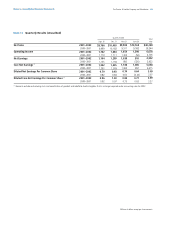

Identifiable intangible assets as of June 30, 2002 and 2001 are

comprised of:

The amortization of intangible assets for the years ended June 30,

2002, 2001 and 2000 was $97, $80 and $77, respectively. Estimated

amortization expense over the next five years is as follows: 2003–$85,

2004–$85, 2005–$80, 2006–$80 and 2007–$50. Such estimates do

not reflect the impact of future foreign exchange rate changes.

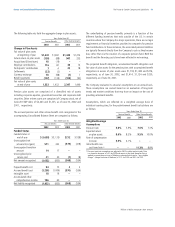

The following table provides pro forma disclosure of net earnings and

earnings per common share for the years ended June 30, 2001 and

2000, as if goodwill and indefinite-lived intangible assets had not been

amortized.

Notes to Consolidated Financial Statements

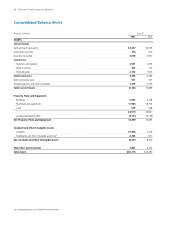

Millions of dollars except per share amounts

Intangible Assets with

Determinable Lives

Trademarks

Patents and technology

Other

Trademarks with

Indefinite Lives

June 30, 2002 June 30, 2001

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

$27

78

186

291

169

460

$155

333

385

873

458

1,331

$457

494

385

1,336

1,678

3,014

$48

160

173

381

169

550

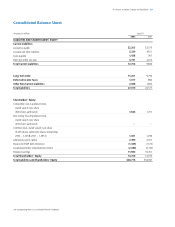

Fabric & Home Care, beginning of year

Translation & other

End of year

Baby, Feminine & Family Care, beginning of year

Translation & other

End of year

Beauty Care, beginning of year

Acquisitions

Translation & other

End of year

Health Care, beginning of year

Acquisitions

Translation & other

End of year

Food & Beverage, beginning of year

Translation & other

End of year

Goodwill, Net, beginning of year

Acquisitions

Translation & other

End of year

2002

$457

(6)

451

2,806

(163)

2,643

1,344

3,330

55

4,729

2,544

284

38

2,866

278

(1)

277

7,429

3,614

(77)

10,966

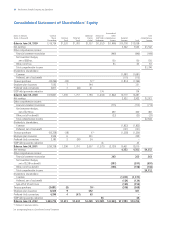

Years Ended June 30 Pro forma results

2001

Net earnings

Amortization, net of tax (1)

Adjusted net earnings

Basic net earnings per common share

Amortization, net of tax (1)

Adjusted basic net earnings per common share

Diluted net earnings per common share

Amortization, net of tax (1)

Adjusted diluted net earnings per common share

$3,542

212

3,754

$2.61

0.16

2.77

2.47

0.15

2.62

$2,922

218

3,140

$2.15

0.15

2.30

2.07

0.15

2.22

(1) Amortization of goodwill and indefinite-lived intangible assets.

2000