Proctor and Gamble 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Review 25The Procter & Gamble Company and Subsidiaries

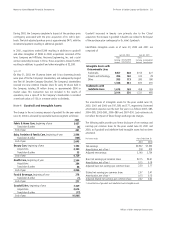

Accelerated depreciation relates to long-lived assets that will

be taken out of service prior to the end of their normal

service period due to manufacturing consolidations, technol-

ogy standardization, plant closures or strategic choices to

discontinue initiatives. The Company has shortened the

estimated useful lives of such assets, resulting in incremental

depreciation expense. For segment and management report-

ing purposes, normal depreciation expense is reported by the

business segments, with the incremental accelerated

depreciation reported in the corporate segment. Accelerated

depreciation and write-downs are charged to cost of

products sold for manufacturing assets and marketing, re-

search, administrative and other expense for all other assets.

Asset write-downs relate to establishment of new fair-value

bases for assets held for sale or disposal and for assets whose

future cash flow expectations have declined significantly as a

direct result of restructuring decisions. Assets held for sale or

disposal represent excess capacity that is in the process of

being removed from service as well as businesses held for

sale within the next 12 months. Such assets are written down

to the net amount expected to be realized upon sale or

disposal. Assets continuing in operation, but whose nominal

cash flows are no longer sufficient to recover existing book

values, are written down to estimated fair value, generally

determined by reference to discounted expected future cash

flows. Write-downs of assets that will continue to be used

were approximately $45 million before tax ($33 million after

tax) in 2002, $160 million before tax ($133 million after tax)

in 2001 and $0 in 2000. Asset write-downs are not expected

to significantly impact future annual depreciation expense.

Other contains charges incurred as a direct result of restruc-

turing decisions including relocation, training, discontinua-

tion of initiatives and the establishment of global business

services and the new legal and organization structure. These

costs are charged to the applicable income statement line

item based on the underlying nature of the charge.

Most restructuring accruals are classified as current liabilities.

Reserve balances were $245 million, $460 million and $88

million at June 30, 2002, 2001 and 2000, respectively.

During the current year, approximately 60% of restructuring

charges were cash compared to 40% in 2001 and 55% in

2000. Going forward, approximately 60% of future charges

are expected to be cash – primarily separations.

Savings from the restructuring program are difficult to

estimate, given the nature of the activities, the corollary

benefits achieved, timing and the degree of reinvestment.

Overall, the program is expected to deliver nearly $2 billion in

after tax annual savings by fiscal 2004. Estimated incremen-

tal savings were $700 million in 2002, $235 million in 2001

and $65 million in 2000. Incremental savings in 2003 are es-

timated to be approximately $400 to $500 million after tax.

Forward-Looking Statements

The Company has made and will make certain forward-

looking statements in the Annual Report and in other

contexts relating to volume growth, increases in market

shares, financial goals and cost reduction, among others.

These forward-looking statements are based on assumptions

and estimates regarding competitive activity, pricing, product

introductions, economic conditions, technological innova-

tion, currency movements, governmental action and the

development of certain markets. Among the key factors

necessary to achieve the Company’s goals are: (1) the

successful integration of the Company’s new organization

structure, including achievement of expected cost and tax

savings; (2) the ability to achieve business plans, including

growing volume profitably, despite high levels of competitive

activity, especially with respect to the product categories and

geographical markets in which the Company has chosen to

focus; (3) the ability to maintain key customer relationships;

(4) the achievement of growth in significant developing

markets such as China, Turkey, Mexico, the Southern Cone

of Latin America, the countries of Central and Eastern

Europe and the countries of Southeast Asia; (5) the ability to

successfully manage regulatory, tax and legal matters,

including resolution of pending matters within current

estimates; (6) the successful and timely execution of planned

brand divestitures; (7) the ability to successfully implement,

achieve and sustain cost improvement plans in manu-

facturing and overhead areas; (8) the ability to successfully

manage currency (including currency issues in Latin America),

interest rate and certain commodity cost exposures; and

(9) the ability to manage the continued political and/or

economic uncertainty in Latin America and the Middle East,

as well as any political and/or economic uncertainty due to

terrorist activities. If the Company’s assumptions and

estimates are incorrect or do not come to fruition, or if the

Company does not achieve all of these key factors, then the

Company’s actual performance could vary materially from

the forward-looking statements made herein.