Proctor and Gamble 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

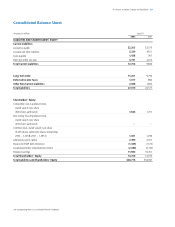

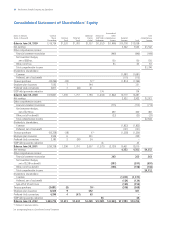

2002 Net Sales by Business Segment

29%

9%

30%

12% 20%

Health Care

Fabric and Home Care

Baby, Feminine

and Family Care

Beauty Care

Food and Beverage

Health Care

Fabric and Home Care

Baby, Feminine

and Family Care

Beauty Care

Food and Beverage

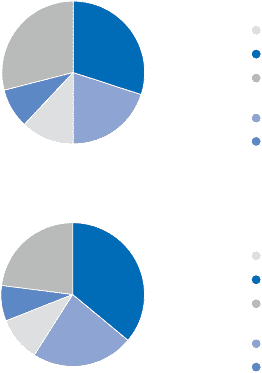

2002 Net Earnings by Business Segment

Financial Review20 The Procter & Gamble Company and Subsidiaries

commitments or related party transactions that are

considered material. The Company is not aware of factors

that are reasonably likely to adversely affect liquidity trends,

other than the factors discussed in the Forward-Looking

Statements.

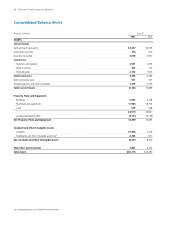

Purchase Commitments

The Company has purchase commitments for materials,

supplies, services and fixed assets as part of the normal

course of business. In the aggregate, such commitments are

not at prices in excess of current market rates. Due to the

proprietary nature of many of the Company’s materials and

processes, certain supply contracts contain penalty provisions

for early termination. The Company does not expect changes

in such provisions to materially affect results of operations or

its financial condition. This conclusion is made based upon

reasonably likely outcomes assumed by reference to historical

experience and current business plans.

As discussed previously, the Company’s primary source of

liquidity is cash generated from operations. Additionally, the

Company is able to support its short-term liquidity, if

necessary, through agreements with a diverse group of

creditworthy financial institutions. The Company has never

drawn on these facilities and does not intend to do so in the

foreseeable future. However, should the facilities be needed,

when combined with cash on hand, the Company believes

they would provide the Company with sufficient credit fund-

ing to cover any short-term financing requirements.

Segment Results

The following pages provide perspective on the Company’s

business segments. Product-based segment results exclude

items that are not included in measuring business perform-

ance for management reporting purposes, most notably

certain financing, investing, employee benefit and restructur-

ing costs.

Sales in companies over which the Company exerts signifi-

cant influence, but does not control the financial and

operating decisions, are reported for segment purposes in

a manner similar to consolidated subsidiaries. Taxes are

reflected in the business segments at estimated local statuto-

ry tax rates. The effects of these conventions are eliminated

in the corporate segment to adjust management reporting

conventions to accounting principles generally accepted in

the United States of America.

Health Care

Health care delivered exceptional results, as strength in the

oral care and pharmaceutical businesses drove a 15%

increase in unit volume and a 14% increase in net sales. Net

sales were $4.98 billion in 2002. Excluding a 1% negative

impact of foreign exchange, net sales grew 15%. Health

care’s volume growth from high-margin products funded in-

creased marketing investments and yielded a net earnings

increase of 34% to $521 million.

Oral care led the volume growth, up significantly versus

2001. The global Crest brand continued to grow behind

strength across the portfolio, including Crest SpinBrush,

Crest Whitestrips and the base dentifrice business. In 2002,

Crest joined the ranks of the Company’s billion dollar brands.

Pet health and nutrition volume increased 10% behind

continued growth in the United States. Global growth was

driven by new product innovation and expansion into new

geographies and channels outside the United States in the

second half of the year.

Pharmaceuticals continued to deliver strong results with

worldwide volume up 29%, behind the strength of Actonel,

the Company’s post-menopausal osteoporosis drug.

In 2001, health care unit volume increased 15%, driven by

the excellent performance of the pet health and nutrition,

pharmaceuticals and oral care businesses. Net sales were

36%

8%

23%

10%

23%