Proctor and Gamble 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

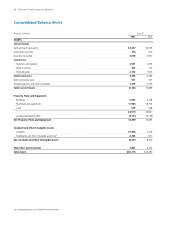

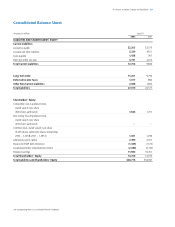

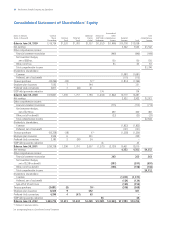

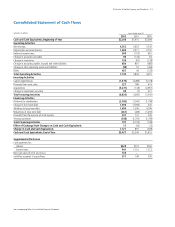

Millions of dollars except per share amounts

33The Procter & Gamble Company and Subsidiaries

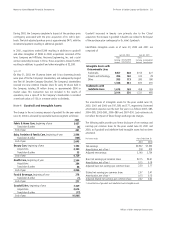

indefinite-lived intangibles are evaluated annually for impairment.

Beginning in 2002, such determination of fair value is based on

valuation models that incorporate expected future cash flows and

profitability projections. Prior to 2002, goodwill was amortized over

periods not exceeding 40 years.

Property, Plant and Equipment: Property, plant and equipment are

recorded at cost reduced by accumulated depreciation. Depreciation

expense is recognized over the assets’ estimated useful lives using the

straight-line method. Estimated useful lives are based on Company

averages and range from 3 to 20 years for machinery and equipment

and 40 years for buildings. Estimated useful lives are periodically

reviewed and, where appropriate, changes are made prospectively.

Fair Values of Financial Instruments: Fair values of cash equivalents,

short- and long-term investments and short-term debt approximate

cost. The estimated fair values of other financial instruments, including

debt, equity and risk management instruments, have been determined

using market information and valuation methodologies, primarily

discounted cash flow analysis. These estimates require considerable

judgment in interpreting market data, and changes in assumptions or

estimation methods could significantly affect the fair value estimates.

Reclassifications: Certain reclassifications of prior years’ amounts have

been made to conform to the current year presentation.

Note 2 Restructuring Program

In 1999, concurrent with a reorganization of its operations into

product-based global business units, the Company initiated a multi-year

restructuring program. The program is designed to accelerate growth

and deliver cost reductions by streamlining management decision-

making, manufacturing and other work processes and discontinuing

under-performing businesses and initiatives. Technology improvements

as well as standardization of manufacturing and other work processes

allow the Company to streamline operations, resulting in the consolida-

tion of manufacturing activity and various business processes.

Costs to be incurred include separation related costs, asset

write-downs, accelerated depreciation and other costs directly related

to the restructuring effort.

Due to the nature of the charges and the duration of the program,

estimates of the timing and amount of costs and savings require

significant judgment and may change over time. Based on current

estimates, the overall program is expected to result in total charges of

$5.6 billion ($4.4 billion after tax) over the six-year period that began in

1999. Through 2002, cumulative charges are $4.1 billion ($3.3 billion

after tax). Under current accounting rules, many restructuring charges

may not be recognized at project initiation, but rather are charged to

expense as established criteria for recognition are met. This accounting

yields ongoing charges over the entire restructuring period, rather than

a large reserve at initiation.

Before-tax restructuring activity was as follows:

Charges for the program are reflected in the corporate segment.

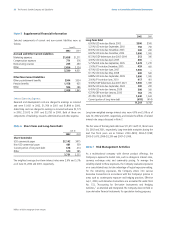

Separation Costs

Employee separation charges relate to severance packages for

approximately 7,400 people in 2002, 6000 people in 2001, 2800

people in 2000 and 400 people in 1999. The packages are predomi-

nantly voluntary and are formula driven based on salary levels and past

service. Severance costs related to voluntary separations are charged to

earnings when the employee accepts the offer. The current and planned

separations span the entire organization, including manufacturing,

selling, research and administrative positions.

Notes to Consolidated Financial Statements

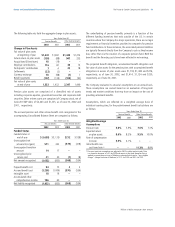

TotalOther

Accelerated

Depreciation

Asset

Write-Downs

$44

814

(320)

(450)

88

1,850

(385)

(1,093)

460

958

(813)

(360)

245

$9

211

(220)

–

–

502

(199)

(86)

217

222

(336)

(17)

86

$ –

386

–

(386)

–

276

–

(276)

–

135

–

(135)

–

Separations

$35

153

(100)

–

88

341

(186)

–

243

393

(477)

–

159

$ –

64

–

(64)

–

731

–

(731)

–

208

–

(208)

–

Reserve balance

June 30, 1999

2000:

Charges

Cash spent

Charged against

assets

Reserve balance

June 30, 2000

2001:

Charges

Cash spent

Charged against

assets

Reserve balance

June 30, 2001

2002:

Charges

Cash spent

Charged against

assets

Reserve balance

June 30, 2002