Proctor and Gamble 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

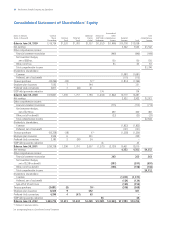

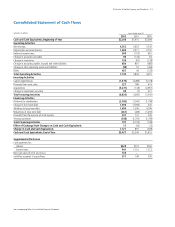

40 The Procter & Gamble Company and Subsidiaries

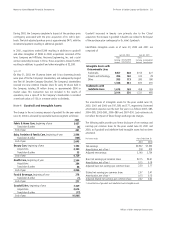

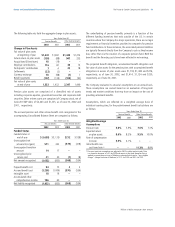

The number of preferred shares outstanding were:

As permitted by American Institute of Certified Public Accountants

(AICPA) Statement of Position 93-6, “Employers’ Accounting for

Employee Stock Ownership Plans,” the Company has elected, where

applicable, to continue its practices, which are based on Statement of

Position 76-3, “Accounting Practices for Certain Employee Stock

Ownership Plans.” ESOP debt which is guaranteed by the Company is

recorded in short- and long-term liabilities (see Note 6). Preferred

shares issued to the ESOP are offset by the reserve for ESOP debt

retirement in the Consolidated Balance Sheet and the Consolidated

Statement of Shareholders’ Equity. Interest incurred on the ESOP debt is

recorded as interest expense. Dividends on all preferred shares, net of

related tax benefits, are charged to retained earnings.

The preferred shares held by the ESOP are considered outstanding from

inception for purposes of calculating diluted net earnings per common

share. Diluted net earnings are calculated assuming that all preferred

shares are converted to common, and therefore are adjusted to reflect

the incremental ESOP funding that would be required due to the

difference in dividend rate between preferred and common shares (see

Note 8).

Note 10 Postretirement Benefits

The Company offers various postretirement benefits to its employees.

Defined Contribution Retirement Plans

The most significant employee benefit plan offered is the defined

contribution plan in the United States, which is fully funded.

Under the defined contribution profit sharing plan, annual credits to

participants’ accounts are based on individual base salaries and years

of service and do not exceed 15% of total participants’ annual salaries

and wages. The fair value of the ESOP Series A shares serves to reduce

the Company’s cash contribution required to fund the profit sharing

plan contributions earned. Under SOP 76-3, shares of the ESOP are

allocated at original cost based on debt service requirements, net of

advances made by the Company to the trust. The defined contribution

expense pursuant to this plan was $279, $303 and $89 in 2002, 2001

and 2000, respectively.

Other Retiree Benefits

The Company also provides certain health care and life insurance

benefits for substantially all U.S. employees who become eligible for

these benefits when they meet minimum age and service requirements.

Generally, the health care plans require contributions from retirees and

pay a stated percentage of expenses, reduced by deductibles and other

coverages. Retiree contributions change annually in line with health

care cost trends. These benefits primarily are funded by ESOP Series B

shares as well as certain other assets contributed by the Company.

Certain other employees, primarily outside the U.S., are covered by local

defined benefit pension, health care and life insurance plans.

The following table sets forth the aggregate change in benefit

obligation for the Company‘s defined benefit plans:

Notes to Consolidated Financial Statements

Millions of dollars except per share amounts

2002

June 30

Shares in thousands

Outstanding, June 30

Allocated

Unallocated

Total Series A

Allocated

Unallocated

Total Series B

34,459

19,761

54,220

9,267

27,338

36,605

33,095

17,687

50,782

9,869

26,454

36,323

33,610

22,315

55,925

8,661

28,424

37,085

2000

2001

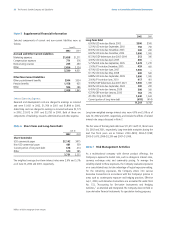

Years Ended June 30

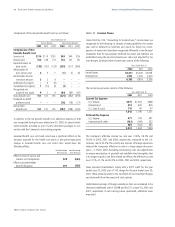

Other Retiree Benefits

Pension Benefits

2002

Change in Benefit Obligation

Benefit obligation

at beginning of year

Service cost

Interest cost

Participants’ contributions

Amendments

Actuarial loss

Acquisitions/(Divestitures)

Curtailments and

settlements

Special termination benefits

Currency exchange

Benefit payments

Benefit obligation

at end of year

$ 2,567

114

153

7

1

72

40

(101)

9

255

(147)

2,970

$2,627

115

149

4

(10)

86

(14)

(22)

–

(232)

(136)

2,567

$1,577

49

116

22

5

401

32

(1)

37

5

(108)

2,135

$1,270

40

101

18

–

250

(5)

–

–

(4)

(93)

1,577

2001

2002 2001