Proctor and Gamble 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review18 The Procter & Gamble Company and Subsidiaries

Additionally, the Company is beginning to see gross margin

improvement from the shift to higher-margin businesses,

such as health care and beauty care. Excluding restructuring

charges, gross margin in 2001 reflects fairly stable cost of

products sold, despite raw material price increases – high-

lighting the benefits of cost control efforts.

Marketing, research, administrative and other expense

(MRA&O) was $12.57 billion in 2002 versus $12.41 billion in

2001 and $12.48 billion in 2000. These include restructuring

costs of $519 million in 2002, $583 million in 2001 and $318

million in 2000. Excluding restructuring charges and

amortization of goodwill and indefinite-lived intangibles,

MRA&O was $12.05 billion in the current year versus $11.59

billion in 2001 and $11.94 billion in 2000. As a percent of

core net sales, MRA&O was 30.0% in 2002, 29.4% in 2001

and 29.9% in 2000. The Company achieved good progress

on restructuring savings that have reduced base selling,

research and administrative costs. The increase in the current

year was due primarily to Clairol integration costs and

increases in other operating charges. Additionally, marketing

support efficiencies realized in the prior year continued in the

current year – although marketing costs did not decline as

dramatically due to the significant progress made in the

prior year.

Operating & Net Earnings Margins

Operating margin was 16.6% compared to 12.1% in 2001

and 14.9% in 2000. Excluding restructuring charges and

amortization of goodwill and indefinite-lived intangibles, core

operating margin increased 170 basis points to 19.0%, from

17.3% in 2001. Core operating margin was 17.5% in 2000.

Net earnings margin was 10.8% versus 7.4% in 2001 and

8.9% in 2000. Excluding restructuring charges and

amortization of goodwill and indefinite-lived intangibles,

core net earnings margin was 12.6%, up from 11.7% in

2001 and 11.1% in 2000. The margin increase in 2002

reflects excellent operating earnings progress and the

benefits of lower interest expense. In 2001, the core net

margin increase reflected the gains from minor brand

divestitures and lower taxes, partially offset by increased

product costs and unfavorable exchange impacts.

Non-Operating Items

Interest expense was $603 million in 2002, compared to

$794 million in 2001 and $722 million in 2000. The decline

in interest expense was driven by lower interest rates

partially offset by an increase in debt. The increase in 2001

reflected higher debt levels, primarily due to share repurch-

asing and acquisitions.

Other non-operating income, net, which consists primarily of

interest and investment income and divestiture gains,

contributed $308 million in 2002, compared to $674 million

in 2001 and $304 million in 2000. This decline is driven by

significantly lower income from divestitures and asset sales in

2002 versus 2001 as the Company’s activity to divest

non-core brands declined. Going forward, divestitures are

expected to remain at these lower levels.

The Company’s effective tax rate for the current year was

31.8%, compared to 36.7% in 2001 and 36.0% in 2000.

Excluding restructuring costs, amortization of goodwill and

indefinite-lived intangibles and related tax effects, the core

effective tax rate was flat versus 2001 at 31.1% compared to

32.5% in 2000.

Financial Condition

The Company’s financial condition remains solid – particularly

regarding cash flow generation. One of the Company’s focus

areas is to improve its cash efficiency as a key element of

achieving superior shareholder return.

Cash

Operating cash flow provides the primary source of funds to

finance operating needs, capital expenditures and share-

holder dividends. This is supplemented by additional borrow-

ings to provide funds to finance the share repurchase

program and acquisitions. The overall cash position of the

Company reflects a global strategy to optimize cash man-

agement while considering off-shore funding needs, liquidity

management objectives and other economic considerations.

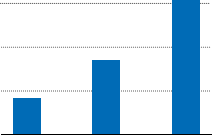

Free cash flow, defined as operating cash flow less capital

expenditures, for 2002 was $6.06 billion, up over 80% from

2000 2001 2002

$6

4

2

0

Free Cash Flow

(in billions of dollars)