Proctor and Gamble 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 The Procter & Gamble Company and Subsidiaries

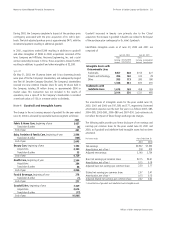

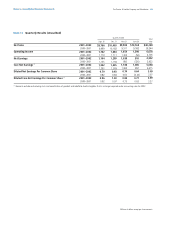

Components of the net periodic benefit cost are as follows:

In addition to the net periodic benefit cost, additional expense of $46

was recognized during the year ended June 30, 2002, for special termi-

nation benefits provided as part of early retirement packages in con-

nection with the Company’s restructuring program.

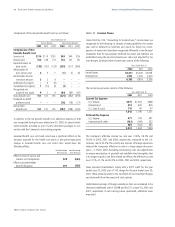

Assumed health care cost trend rates have a significant effect on the

amounts reported for the health care plans. A one-percentage point

change in assumed health care cost trend rates would have the

following effects:

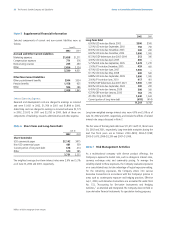

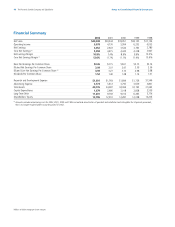

Note 11 Income Taxes

Under SFAS No. 109, ”Accounting for Income Taxes,” income taxes are

recognized for the following: a) amount of taxes payable for the current

year, and b) deferred tax liabilities and assets for future tax conse-

quences of events that have been recognized differently in the financial

statements than for tax purposes. Deferred tax assets and liabilities are

established using the enacted statutory tax rates and adjusted for tax

rate changes. Earnings before income taxes consist of the following:

The income tax provision consists of the following:

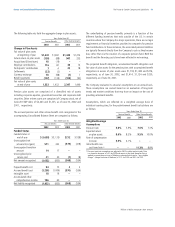

The Company’s effective income tax rate was 31.8%, 36.7% and

36.0% in 2002, 2001 and 2000, respectively, compared to the U.S.

statutory rate of 35.0%. The country mix impacts of foreign operations

reduced the Company’s effective tax rate to a larger degree than prior

years – 3.1% for 2002. Excluding restructuring costs and adjustments

to remove amortization of goodwill and indefinite-lived intangibles that

is no longer required, and their related tax effects, the effective tax rate

was 31.1%, 31.1% and 32.5% in 2002, 2001 and 2000, respectively.

Taxes impacted shareholders’ equity with a $477 credit for the year

ended June 30, 2002 and a $155 charge for the year ended June 30,

2001. These primarily relate to the tax effects of net investment hedges

and tax benefits from the exercise of stock options.

Undistributed earnings of foreign subsidiaries that are considered to be

reinvested indefinitely were $10,698 and $9,231 at June 30, 2002 and

2001, respectively. If such earnings were repatriated, additional taxes

may result.

One-Percentage

Point Increase

One-Percentage

Point Decrease

Effect on total of service and

interest cost components

Effect on postretirement

benefit obligation

$(23)

(239)

$29

291

Notes to Consolidated Financial Statements

Millions of dollars except per share amounts

Years Ended June 30

2002

Current Tax Expense

U.S. Federal

International

U.S. State & Local

Deferred Tax Expense

U.S. Federal

International & other

$975

551

116

1,642

571

(182)

389

2,031

$1,030

676

90

1,796

142

(244)

(102)

1,694

$648

816

67

1,531

241

222

463

1,994

2000

2001

Years Ended June 30

United States

International

$4,411

1,972

6,383

$3,340

1,276

4,616

$3,006

2,530

5,536

2002 2000

2001

2002

Years Ended June 30

Pension Benefits Other Retiree Benefits

Components of Net

Periodic Benefit Cost

Service cost

Interest cost

Expected return on

plan assets

Amortization of

prior service cost

Amortization of prior

transition amount

Settlement loss (gain)

Curtailment loss (gain)

Recognized net

actuarial loss (gain)

Gross benefit cost

Dividends on ESOP

preferred stock

Net periodic

benefit cost

$114

153

(133)

4

3

–

1

9

151

–

151

$115

149

(127)

5

3

6

(13)

3

141

–

141

$120

151

(122)

7

4

(6)

(3)

4

155

–

155

$49

116

(320)

(1)

–

–

(1)

(64)

(221)

(76)

(297)

$40

101

(317)

(1)

–

–

–

(85)

(262)

(76)

(338)

$39

90

(294)

(2)

–

–

–

(92)

(259)

(77)

(336)

20002001

2002 20002001