Proctor and Gamble 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report

P&G 2002 Annual Re

p

ort

Table of contents

-

Page 1

P&G 2002 Annual Report 2002 Annual Report -

Page 2

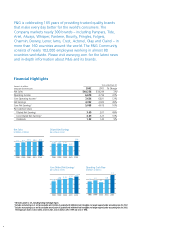

... 102,000 employees working in almost 80 countries worldwide. Please visit www.pg.com for the latest news and in-depth information about P&G and its brands. Financial Highlights Amounts in millions except per share amounts Years ended June 30 Net Sales Operating Income Core Operating Income †Net... -

Page 3

... and store price, we win that ï¬rst moment of truth. Winning the ï¬rst moment of truth is only half the battle. Soon after, P&G brands face a second moment of truth. Nearly two billion times a day, P&G products are put to the test when consumers use Tide to clean their clothes, Pampers to care for... -

Page 4

... accelerating volume and sales in the growth secondaccelerating half of the year. in the second half of the year. This growth is broad-scale. Every business unit delivered proï¬table growth at rates above the corporate objective. Every geographic region delivered volume growth. We have work yet to... -

Page 5

... spending target to below 5% of sales, and continue to look for opportunities to improve asset efficiencies. We are delivering superior total shareholder return (TSR). TSR is the key business unit metric upon which P&G's business planning and management compensation are based. The combination of... -

Page 6

..., and the biggest retail customers and country markets. And, we're investing in faster-growing, higher-margin, more asset-efï¬cient businesses. A good example is the acquisition of Clairol, which complements the core Hair Care business and helps P&G enter the fast-growing hair colorant category... -

Page 7

...steps to ensure strong corporate governance. We reiterated clear expectations for ethical behavior. We instituted a broad-based Financial Stewardship program - more than 18 months ago - to provide even more focus on fiduciary responsibilities, internal controls and accounting processes. We continue... -

Page 8

... laundry every day. Ariel More than 300 million pieces of clothing are washed with Ariel every day. Always/Whisper On an average day, over 25 million women are using Always. Pantene Nearly 1.7 million consumers purchase a Pantene product every day. Charmin Every day, 50 million households in North... -

Page 9

... and cats with superior nutrition every day. Crest A Crest product brings a beautiful, healthy smile to over 150 million faces every day. Folgers Americans drink 85 million cups of Folgers every day. Pringles People pop 275 million Pringles every day. Downy/Lenor Downy softens and freshens over... -

Page 10

-

Page 11

... to reset expectations for performance and price. Olay Total Effects is a good illustration. In global research, women identiï¬ed seven distinct signs of aging that affect the condition of their skin. Many products addressed one or two of these signs, but no single product fought all seven. Further... -

Page 12

-

Page 13

...this leadership stature will ï¬nd it difï¬cult to compete effectively with the best store brands. Based on our internal global share measures, we have the #1 or #2 brand in 17 of our 19 key global categories - categories that account for about 70% of sales and earnings. P&G is in a strong position... -

Page 14

-

Page 15

...and has quadrupled the sales of the original Dr. John's product. When we developed the bisphosphonate technology in Actonel, we increased marketing capability by partnering with Aventis, whose ï¬eld sales force had broad access to and credibility with doctors. The partnership worked well, and today... -

Page 16

... clear strategic choices, strengthening operational excellence and operating with rigorous ï¬nancial discipline. We're delivering the earnings growth to which we've committed - ahead of plan. We're generating cash from every business unit - at record levels. We're delivering returns that exceed the... -

Page 17

... Clark Named Vice-Chairmen Bruce Byrnes, President, Global Beauty & Feminine Care and Global Health Care, and Kerry Clark, President, Global Market Development & Business Operations, were named vice-chairmen of the Board of Directors and directors of the Company, effective July 1, 2002. Mr. Byrnes... -

Page 18

... Contents Financial Review Results of Operations Financial Condition Segment Results Critical Accounting Policies Hedging and Derivative Financial Instruments Restructuring Program Independent Auditors' Report Audited Consolidated Financial Statements Earnings Balance Sheet Shareholders' Equity Cash... -

Page 19

... customers in the biggest geographic markets; and investing in faster-growing, higher-margin, more asset-efficient businesses. This requires some difficult decisions, including those reflected in the Company's restructuring program to reduce overheads and streamline manufacturing and other work... -

Page 20

... & Gamble Company and Subsidiaries Financial Review Additionally, the Company is beginning to see gross margin improvement from the shift to higher-margin businesses, such as health care and beauty care. Excluding restructuring charges, gross margin in 2001 reflects fairly stable cost of products... -

Page 21

... purchase of shares annually on the open market. A primary purpose of the program is to mitigate the dilutive impact of stock option grants - effectively prefunding the exercise obligation. Additionally, there is a discretionary component under which it may repurchase additional outstanding shares... -

Page 22

... statutory tax rates. The effects of these conventions are eliminated in the corporate segment to adjust management reporting conventions to accounting principles generally accepted in the United States of America. 2002 Net Sales by Business Segment 30% 29% Health Care Fabric and Home Care Baby... -

Page 23

... program of product and overhead cost reductions, including benefits from restructuring activities that have streamlined manufacturing operations. Family care volume grew 7% behind strength in the North America Bounty and Charmin businesses. Net sales increased 1%, as commodity pricing actions... -

Page 24

... of operations or financial condition. The Company does apply certain key accounting policies as required by accounting principles generally accepted in the United States of America. These key accounting policies govern revenue recognition, restructuring, income taxes and certain employee benefits... -

Page 25

... estimated fair value of the options. Hedging and Derivative Financial Instruments As a multinational company with diverse product offerings, the Company is exposed to market risks, such as changes in interest rates, currency exchange rates and commodity prices. To manage the volatility relating to... -

Page 26

..., options and swap contracts to manage the volatility related to the above exposures. Commodity hedging activity is not considered material to the Company's financial statements. Restructuring Program In 1999, concurrent with a reorganization of its operations into product-based global business... -

Page 27

... key customer relationships; (4) the achievement of growth in significant developing markets such as China, Turkey, Mexico, the Southern Cone of Latin America, the countries of Central and Eastern Europe and the countries of Southeast Asia; (5) the ability to successfully manage regulatory, tax and... -

Page 28

..., shareholders' equity and cash flows for each of the three years in the period ended June 30, 2002. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits... -

Page 29

The Procter & Gamble Company and Subsidiaries 27 Consolidated Statement of Earnings Amounts in millions except per share amounts Years Ended June 30 2002 2001 2000 Net Sales Cost of products sold Marketing, research, administrative and other expense Operating Income Interest expense Other non-... -

Page 30

... & Gamble Company and Subsidiaries Consolidated Balance Sheet Amounts in millions 2002 June 30 2001 ASSETS Current Assets Cash and cash equivalents Investment securities Accounts receivable Inventories Materials and supplies Work in process Finished goods Total Inventories Deferred income taxes... -

Page 31

... share (200 shares authorized) Common stock, stated value $1 per share (5,000 shares authorized; shares outstanding: 2002 - 1,300.8, 2001 - 1,295.7) Additional paid-in capital Reserve for ESOP debt retirement Accumulated other comprehensive income Retained earnings Total Shareholders' Equity Total... -

Page 32

... income: Financial statement translation Net investment hedges, net of $238 tax benefit Other, net of tax benefit Total comprehensive income Dividends to shareholders: Common Preferred, net of tax benefit Spin-off of Jif and Crisco (7,681) Treasury purchases 8,323 Employee plan issuances... -

Page 33

... of stock options Treasury purchases Total Financing Activities Effect of Exchange Rate Changes on Cash and Cash Equivalents Change in Cash and Cash Equivalents Cash and Cash Equivalents, End of Year Supplemental Disclosure Cash payments for: Interest Income taxes Non-cash spin-off of Jif and Crisco... -

Page 34

... does not control the financial and operating decisions, are accounted for using the equity method. These investments are managed as integral parts of the Company's business units, and segment reporting reflects such investments as consolidated subsidiaries with applicable adjustments to comply with... -

Page 35

... of its operations into product-based global business units, the Company initiated a multi-year restructuring program. The program is designed to accelerate growth and deliver cost reductions by streamlining management decisionmaking, manufacturing and other work processes and discontinuing... -

Page 36

... Squibb Company for approximately $5.0 billion in cash, financed primarily with debt. Total cash paid includes final purchase price adjustments based on a working capital formula. The Clairol business consists of hair care, hair colorants and personal care products, giving the Company entry into the... -

Page 37

... of $2,508. Spin-off On May 31, 2002, the Jif peanut butter and Crisco shortening brands were spun off to the Company's shareholders, and subsequently merged into The J.M. Smucker Company (Smucker). The Company's shareholders received one new common Smucker share for every 50 shares held in the... -

Page 38

...731 $675 559 414 585 2,233 Note 7 Risk Management Activities As a multinational company with diverse product offerings, the Company is exposed to market risks, such as changes in interest rates, currency exchange rates and commodity pricing. To manage the volatility related to these exposures, the... -

Page 39

... risk management or other financial instruments. Interest Rate Management The Company's policy is to manage interest cost using a mix of fixed- and variable-rate debt. To manage this risk in a cost efficient manner, the Company enters into interest rate swaps in which the Company agrees to exchange... -

Page 40

... stock options are granted annually to key managers and directors at the market price on the date of grant. Grants were made under stock-based compensation plans approved by shareholders in 1992 and 2001. Grants issued since 1998 are fully exercisable after three years and have a fifteen-year life... -

Page 41

... health care benefits. These shares are considered plan assets of the other retiree benefits plan as discussed in Note 10. Debt service requirements are $94 per year, funded by preferred stock dividends and cash contributions from the Company. Each share is convertible at the option of the holder... -

Page 42

... Retirement Plans The most significant employee benefit plan offered is the defined contribution plan in the United States, which is fully funded. Under the defined contribution profit sharing plan, annual credits to participants' accounts are based on individual base salaries and years of service... -

Page 43

...Assumptions Discount rate Expected return on plan assets Rate of compensation increase Initial health care cost trend rate (1) (1) Five 5.6% 8.6% 3.5% - 5.9% 8.3% 4.1% - 7.0% 9.5% - 11.3% 7.3% 10.0% - 8.8% year trend rate assumption was adjusted in 2002 to reflect market trends. Rate is assumed... -

Page 44

... year ended June 30, 2002, for special termination benefits provided as part of early retirement packages in connection with the Company's restructuring program. Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A one-percentage point... -

Page 45

... exists, in the opinion of management and Company counsel, the ultimate liabilities resulting from such lawsuits and claims would not materially affect the Company's financial statements. Total Deferred Tax Assets Other postretirement benefits Loss and other carryforwards Other Valuation allowances... -

Page 46

... personal health care, oral care, pharmaceuticals and pet health and nutrition. • Food and beverage includes coffee, snacks, commercial services, juice, peanut butter and shortening and oil. The corporate segment includes both operating and non-operating elements such as financing and investing... -

Page 47

... to Consolidated Financial Statements The Procter & Gamble Company and Subsidiaries 45 Note 14 Quarterly Results (Unaudited) Quarters Ended Sept. 30 Dec. 31 Mar. 31 June 30 Total Year Net Sales Operating Income Net Earnings Core Net Earnings (1) Diluted Net Earnings Per Common Share Diluted Core... -

Page 48

... Procter & Gamble Company and Subsidiaries Notes to Consolidated Financial Statements Financial Summary Net Sales Operating Income Net Earnings Core Net Earnings (1) Net Earnings Margin Core Net Earnings Margin (1) Basic Net Earnings Per Common Share Diluted Net Earnings Per Common Share Diluted... -

Page 49

... - North America Charlotte R. Otto Global External Relations Ofï¬cer Jorge S. Mesquita President - Global Home Care Jeffrey P. Ansell President - Global Pet Health and Nutrition Richard G. Pease Senior Vice President - Human Resources, Global Baby & Family Care Michael J. Power Global Business... -

Page 50

..., Geneva, Lausanne, Zurich, Frankfurt, Brussels, Tokyo www.pg.com/investor You can now access your Shareholder Investment Program account, including your account balance and transactions, 24 hours a day on pg.com/investor. This site is designed for you, the investor, with stock purchase information... -

Page 51

..., Puffs, Tempo, Codi Always, Whisper, Tampax, Lines Feminine Care, Linidor, Evax, Ausonia, Orkid Tide, Ariel, Downy, Lenor, Gain, Cascade, Ace Laundry, Cheer, Bold, Swiffer, Bounce, Dash, Dawn, Fairy Dish, Joy, Febreze, Ace Bleach, Era, Bonux, Dreft, Daz, Vizir, Salvo, Mr. Proper, Mr. Clean, Flash... -

Page 52

P&G 2002 Annual Report © 2002 Procter & Gamble 0038-7120