Pentax 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2011 Business Overview and Results Outlook for Fiscal 2012

Fiscal 2011 Business Overview and Results

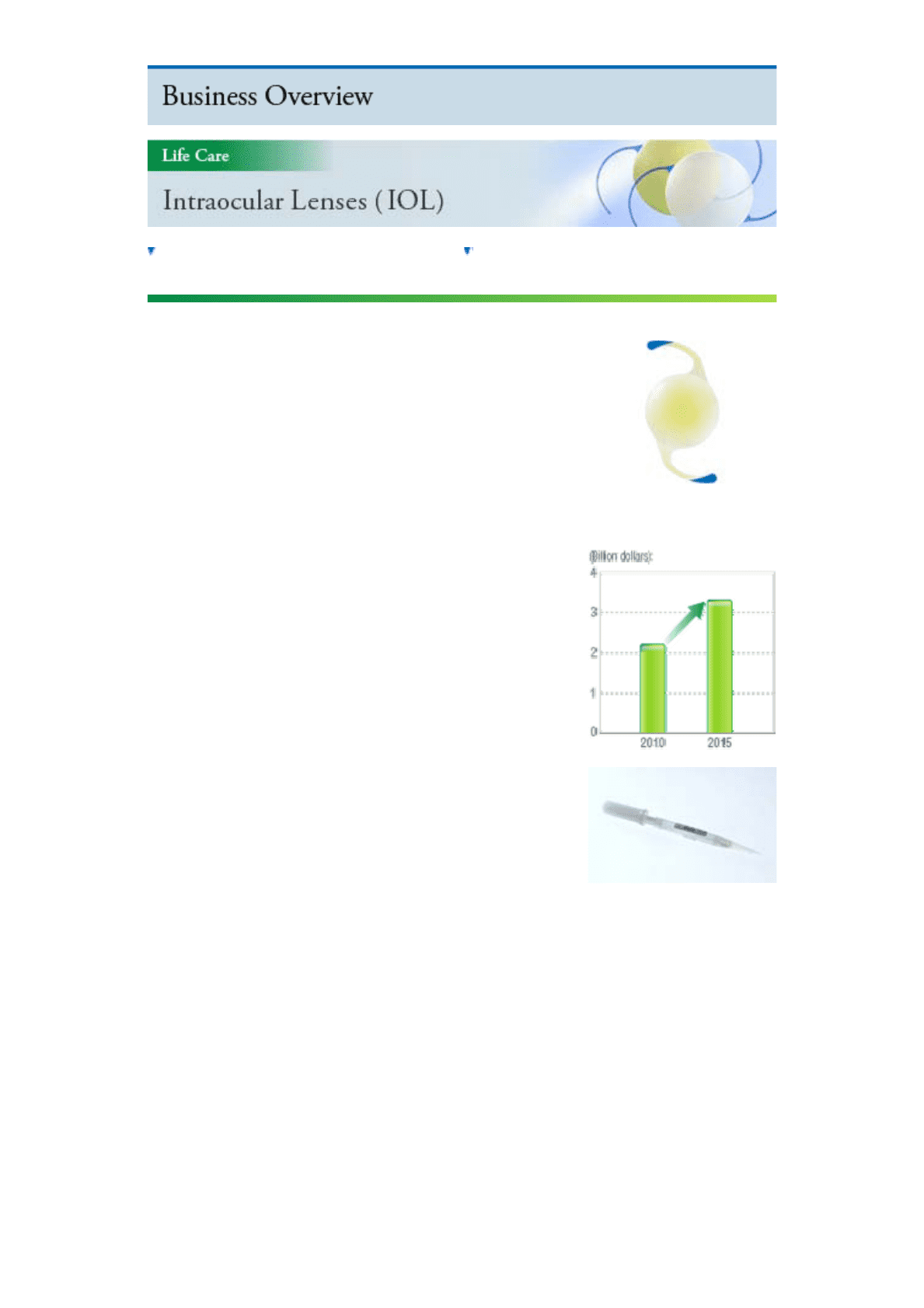

The global economy remained overcast in 2010. Yet, it was

against this backdrop that the global market for intraocular

lenses (IOL) in the surgical treatment of cataracts grew 7% to

8% in size. In terms of the number of these cataract

procedures, growth among major markets was approximately

3% in the U.S., 1% in Japan, 2% in Western Europe and 6% in

China. Among emerging markets, India in particular exhibited

exceptional growth. Longer term, the dollar value of this global

market for cataract procedures is projected to grow from an

estimated US$2.2 billion in 2010, to US$3.3 billion in 2015.

Currently the majority of IOL surgically implanted to replace the

eye’s clouded crystalline lens and restore vision are standard,

aspheric single-focus lenses. But there is also a growing market

for premium IOL, with a variety of corrective functions, that an

increasing number of patients concerned with their quality of life

are willing to pay for. Such premium, micro-incision IOL and

toric IOL for correcting astigmatism, multi-focal IOL, and even a

special IOL Hoya is developing for correcting presbyopia. This

premium segment, involving not only the developed markets but

the wealthier patients from China, India and other emerging

markets, is where much of the market growth is expected to

concentrate over the next five years.

Hoya is the fastest growing IOL company globally, particularly

in the micro-incision IOL and enhanced monofocal segments. It

is also the first company in the world to package soft

hydrophobic IOL, lathe-cut to precision*, in a novel pre-loaded

surgical insertion system. Together, this package delivers safe

and efficient procedures for surgeons, while minimizing the incision size and surgically induced

astigmatism. Combining such superior products with agile marketing, Hoya’s market share of

IOL increased in practically every region of the world; from Japan, the U.S. and Europe, to Asia.

Moreover, the Company waged a very successful brand awareness campaign involving

presentations at medical congresses in the U.S. and reports published in various medical

j

ournals, among other tactics.

The fiscal year in review was also the year in which Hoya’s IOL business truly began to

globalize. In the U.S., the single largest IOL market in the world, a business Hoya launched in

2009 with the iSert™ preloaded IOL system performed exceedingly well. No more than two

years after establishment, this embryonic business captured 4% to 5% of the market share

where the three other key competitors controlled the remaining 93%. This was an exceptionally

good start. Currently, the Company has three major IOL products in the U.S. undergoing clinical

Intraocular Lenses (IOL)

IOL Global Market size

iSert™ pre-loaded IOL delivery

system