Pentax 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

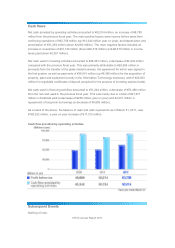

Cash flows

Net cash provided by operating activities amounted to ¥92,514 million, an increase of ¥8,780

million from the previous fiscal year. The main positive factors were income before taxes from

continuing operations of ¥63,758 million (up ¥13,244 million year on year), and depreciation and

amortization of ¥31,294 million (down ¥2,660 million). The main negative factors included an

increase in inventories of ¥10,126 million (down ¥20,219 million) and ¥8,370 million in income

taxes paid (down ¥2,357 million).

Net cash used in investing activities amounted to ¥38,491 million, a decrease of ¥2,232 million

compared with the previous fiscal year. This was primarily attributable to ¥20,654 million in

proceeds from the transfer of the glass media business, the agreement for which was signed in

the first quarter, as well as payments of ¥36,041 million (up ¥9,390 million) for the acquisition of

property, plant and equipment (mostly in the Information Technology business), and of ¥20,000

million for negotiable certificates of deposit (acquired for the purpose of investing surplus funds).

Net cash used in financing activities amounted to ¥31,244 million, a decrease of ¥53,486 million

from the net cash used in the previous fiscal year. This was mainly due to a total of ¥27,971

million in dividends paid (a decrease of ¥265 million year on year) and ¥3,337 million in

repayments of long-term borrowings (a decrease of ¥5,808 million).

A

s a result of the above, the balance of cash and cash equivalents as of March 31, 2011, was

¥

185,252 million, a year on year increase of ¥17,313 million.

Cash flow provided by operating activities

Subsequent Events

Nothing of note.

HOYA Annual Re

p

ort 2011