Pentax 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Income

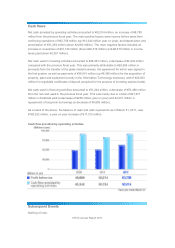

A

s outlined above, net sales increased 2.7% year on year to ¥413,349 million. In addition, cost

cutting initiatives centering on fixed costs resulted in lower expenditure. As a result, income

before taxes from continuing operations rose 26.2% year on year, to ¥63,758 million.

The pretax margin was 15.4%, up 2.8 percentage points year on year from 12.6%.

Contributing factors to the increase in income before taxes included the following: The Company

reported brisk growth in sales of glass disks for hard disk drives (HDDs), optical lenses and

optical glass. In digital cameras, meanwhile, new product launches and price protection

initiatives combined with cost reductions in sales promotion to boost profitability, such that the

business went from posting a large pretax loss the previous fiscal year to delivering a pretax

profit in this.

In the Life Care business, healthcare related products (eyeglass lenses and contact lenses)

fared well, while in medical related products (endoscopes for medical use), profitability improved

year on year amid a recovery in the market.

On April 28, 2010, moreover, Hoya Corporation completed an agreement to transfer the hard

disk glass media manufacturing business and related assets operated by Hoya Corporation and

Hoya Magnetics Singapore, Pte., Ltd., its wholly owned subsidiary, to the U.S. company Western

Digital Corporation as of June 30, 2010. For the fiscal year under review, Hoya classified the

HDD glass media business as a discontinued operation, booking a ¥10,343 million gain on the

sale. Including income for the year from discontinued operations, income for the year from all

operations increased 43.5% year on year, to ¥59,579 million.

The hard disk market is expected to continue to see high growth going forward, mainly for

notebook PCs and digital household appliances. Following the transfer, Hoya aims to leverage

its glass materials technology and precision processing technology and concentrate

management resources on its HDD glass substrates, which currently holds the leading global

market share, to further enhance business competitiveness and achieve growth.

Return on assets (ROA) was 10.5%, and return on equity attributable to owners of the Company

(ROE) was 16.3%, both representing year-on-year improvements.