Pentax 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

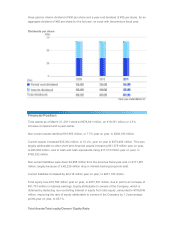

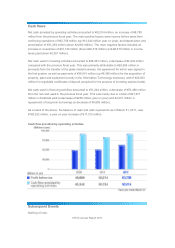

Hoya paid an interim dividend of ¥30 per share and a year-end dividend of ¥35 per share, for an

aggregate dividend of ¥65 per share for the full year, on a par with the previous fiscal year.

Dividends per share

Financial Position

Total assets as of March 31, 2011 stood at ¥578,641 million, an ¥18,351 million or 3.3%

increase compared with a year earlier.

Non-current assets declined ¥16,953 million, or 7.7% year on year, to ¥204,185 million.

Current assets increased ¥35,304 million, or 10.4%, year on year to ¥374,456 million. This was

largely attributable to other short-term financial assets increasing ¥21,379 million year on year,

to ¥26,964 million, and to cash and cash equivalents rising ¥17,313 million year on year, to

¥

185,252 million.

Non-current liabilities were down ¥2,658 million from the previous fiscal year-end, to ¥111,961

million, largely because of a ¥2,226 million drop in interest-bearing long-term debt.

Current liabilities increased by ¥2,218 million year on year, to ¥201,100 million.

Total equity rose ¥18,792 million year on year, to ¥377,541 million, due in part to an increase of

¥

31,703 million in retained earnings. Equity attributable to owners of the Company, which is

obtained by deducting non-controlling interest in equity from total equity, amounted to ¥376,836

million, improving the ratio of equity attributable to owners of the Company by 1.3 percentage

points year on year, to 65.1%.

Total Assets/Total equity/Owners' Equity Ratio