Panera Bread 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

67

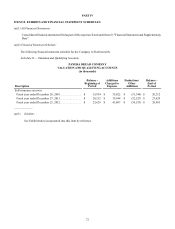

The Franchise Operations segment is comprised of the operating activities of the franchise business unit, which licenses qualified

operators to conduct business under the Panera Bread or Paradise Bakery & Café names and also monitors the operations of these

bakery-cafes. Under the terms of most of the agreements, the licensed operators pay royalties and fees to the Company in return

for the use of the Panera Bread or Paradise Bakery & Café names.

The Fresh Dough and Other Product Operations segment supplies fresh dough, produce, tuna, cream cheese, and indirectly supplies

proprietary sweet goods items through a contract manufacturing arrangement, to Company-owned and franchise-operated bakery-

cafes. The fresh dough is sold to a number of both Company-owned and franchise-operated bakery-cafes at a delivered cost

generally not to exceed 27 percent of the retail value of the end product. The sales and related costs to the franchise-operated

bakery-cafes are separately stated line items in the Consolidated Statements of Comprehensive Income. The operating profit related

to the sales to Company-owned bakery-cafes is classified as a reduction of the costs in the cost of food and paper products in the

Consolidated Statements of Comprehensive Income.

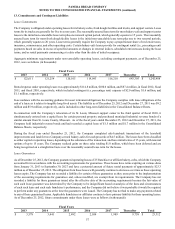

The accounting policies applicable to each segment are consistent with those described in Note 2, “Summary of Significant

Accounting Policies.” Segment information related to the Company’s three business segments is as follows (in thousands):

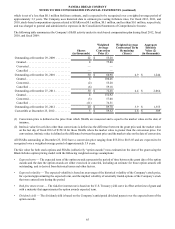

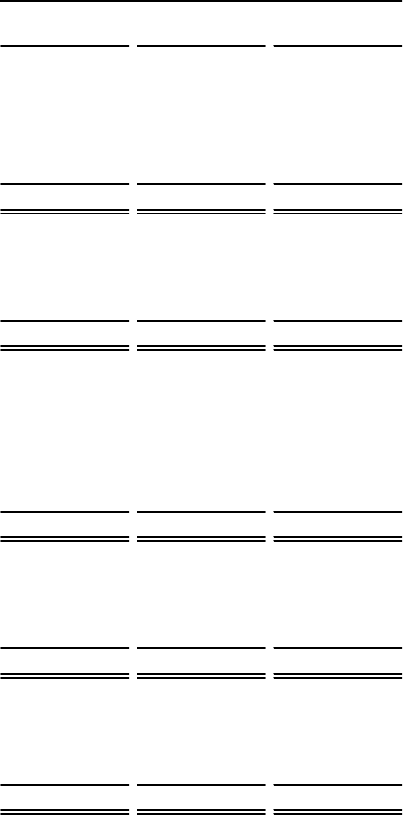

For the fiscal year ended

December 25,

2012 December 27,

2011 December 28,

2010

Revenues:

Company bakery-cafe operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,879,280 $ 1,592,951 $ 1,321,162

Franchise operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102,076 92,793 86,195

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . 312,308 275,096 252,045

Intercompany sales eliminations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (163,607)(138,808)(116,913)

Total revenues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,130,057 $ 1,822,032 $ 1,542,489

Segment profit:

Company bakery-cafe operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 380,432 $ 307,012 $ 249,177

Franchise operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95,420 86,148 80,397

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . 17,695 20,021 24,146

Total segment profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 493,547 $ 413,181 $ 353,720

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90,939 79,899 68,673

Unallocated general and administrative expenses. . . . . . . . . . . . . . . . . . . . 111,276 106,438 95,696

Pre-opening expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,462 6,585 4,282

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,082 822 675

Other (income) expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,208)(466) 4,232

Income before income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 282,996 $ 219,903 $ 180,162

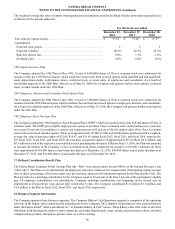

Depreciation and amortization:

Company bakery-cafe operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 78,198 $ 68,651 $ 57,031

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . 6,793 6,777 7,495

Corporate administration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,948 4,471 4,147

Total depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 90,939 $ 79,899 $ 68,673

Capital expenditures:

Company bakery-cafe operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 122,868 $ 94,873 $ 66,961

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . 13,434 6,483 6,452

Corporate administration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,026 6,576 8,813

Total capital expenditures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 152,328 $ 107,932 $ 82,226