Panera Bread 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

59

In addition, the Company is subject to other routine legal proceedings, claims, and litigation in the ordinary course of its business.

Defending lawsuits requires significant management attention and financial resources and the outcome of any litigation, including

the matters described above, is inherently uncertain. The Company does not believe the ultimate resolution of these actions will

have a material adverse effect on its consolidated financial statements. However, a significant increase in the number of these

claims, or one or more successful claims under which the Company incurs greater liabilities than is currently anticipated, could

materially and adversely affect its consolidated financial statements.

Other

The Company is subject to on-going federal and state income tax audits and sales and use tax audits and any unfavorable rulings

could materially and adversely affect its consolidated financial condition or results of operations. The Company believes reserves

for these matters are adequately provided for in its consolidated financial statements.

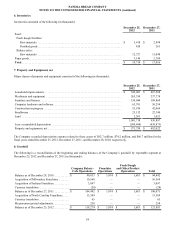

14. Income Taxes

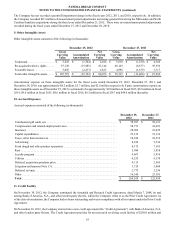

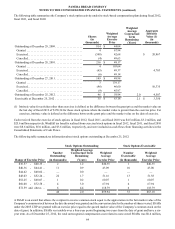

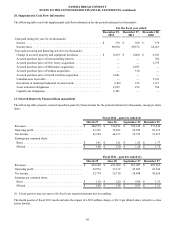

The components of income (loss) before income taxes, by tax jurisdiction, were as follows for the periods indicated (in thousands):

For the fiscal year ended

December 25,

2012 December 27,

2011 December 28,

2010

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 286,702 $ 221,906 $ 180,458

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,706)(2,003)(296)

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 282,996 $ 219,903 $ 180,162

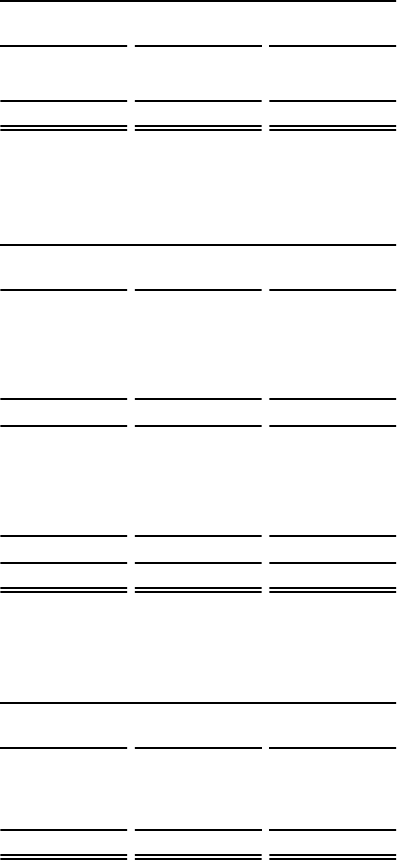

The provision for income taxes consisted of the following for the periods indicated (in thousands):

For the fiscal year ended

December 25,

2012 December 27,

2011 December 28,

2010

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 72,434 $ 67,466 $ 64,471

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,955 15,705 8,919

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (571)(167)

88,389 82,600 73,223

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,640 1,084 (4,306)

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,603 267 (354)

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 916 — —

21,159 1,351 (4,660)

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 109,548 $ 83,951 $ 68,563

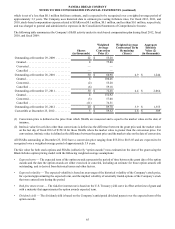

A reconciliation of the statutory U.S. federal income tax rate to the effective tax rate is as follows for the periods indicated:

For the fiscal year ended

December 25,

2012 December 27,

2011 December 28,

2010

Statutory rate provision. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

State income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 4.5 5.0

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.8)(1.3)(1.9)

Effective tax rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38.7% 38.2% 38.1%