Panera Bread 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

55

The Company has not recorded a goodwill impairment charge in the fiscal years 2012, 2011, and 2010, respectively. In addition,

the Company recorded $0.3 million of measurement period adjustments increasing goodwill involving the Milwaukee and North

Carolina franchise acquisitions during the fiscal year ended December 25, 2012. There were no measurement period adjustments

recorded during the fiscal years ended December 27, 2011 and December 28, 2010.

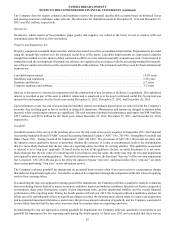

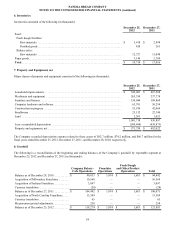

9. Other Intangible Assets

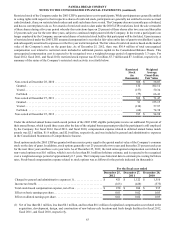

Other intangible assets consisted of the following (in thousands):

December 25, 2012 December 27, 2011

Gross

Carrying

Value Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value Accumulated

Amortization

Net

Carrying

Value

Trademark . . . . . . . . . . . . . . . . . . $ 5,610 $ (1,504) $ 4,106 $ 5,610 $ (1,250) $ 4,360

Re-acquired territory rights . . . . . 97,129 (15,985) 81,144 68,129 (8,537) 59,592

Favorable leases . . . . . . . . . . . . . . 5,056 (2,233) 2,823 4,996 (1,679) 3,317

Total other intangible assets. . . . . $ 107,795 $ (19,722) $ 88,073 $ 78,735 $ (11,466) $ 67,269

Amortization expense on these intangible assets for the fiscal years ended December 25, 2012, December 27, 2011, and

December 28, 2010, was approximately $8.2 million, $5.7 million, and $2.0 million respectively. Future amortization expense on

these intangible assets as of December 25, 2012 is estimated to be approximately: $9.0 million in fiscal 2013, $8.8 million in fiscal

2014, $8.6 million in fiscal 2015, $8.6 million in fiscal 2016, $8.5 million in fiscal 2017 and $44.6 million thereafter.

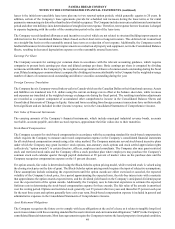

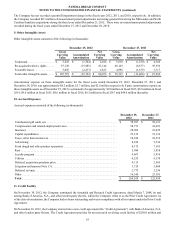

10. Accrued Expenses

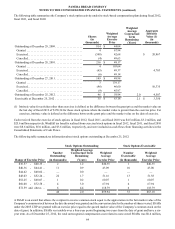

Accrued expenses consisted of the following (in thousands):

December 25,

2012 December 27,

2011

Unredeemed gift cards, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 78,587 $ 58,321

Compensation and related employment taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58,751 41,491

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,903 23,629

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,135 19,116

Taxes, other than income tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,224 18,512

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,526 5,334

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,175 7,101

Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,986 5,958

Loyalty program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,667 5,916

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,255 4,170

Deferred acquisition purchase price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,111 2,565

Litigation settlements (Note 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,729 5,000

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,775 2,236

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,345 23,101

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 268,169 $ 222,450

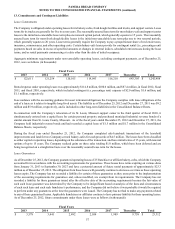

11. Credit Facility

On November 30, 2012, the Company terminated the Amended and Restated Credit Agreement, dated March 7, 2008, by and

among Bank of America, N.A., and other lenders party thereto, which the Company refers to as the Prior Credit Agreement. As

of the date of termination, the Company had no loans outstanding and was in compliance with all covenants under the Prior Credit

Agreement.

On November 30, 2012, the Company entered into a new credit agreement (the “Credit Agreement”) with Bank of America, N.A.

and other lenders party thereto. The Credit Agreement provides for an unsecured revolving credit facility of $250.0 million and