Panera Bread 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

64

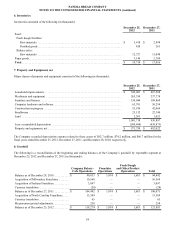

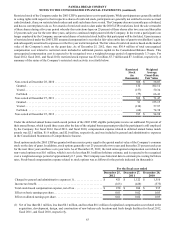

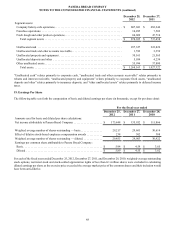

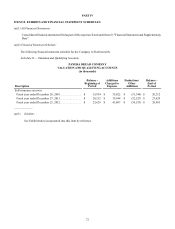

The following table summarizes the Company’s stock option activity under its stock-based compensation plans during fiscal 2012,

fiscal 2011, and fiscal 2010:

Shares

(in

thousands)

Weighted

Average

Exercise

Price

Weighted

Average

Contractual

Term

Remaining

(Years)

Aggregate

Intrinsic

Value (1)

(in

thousands)

Outstanding at December 29, 2009 . . . . . . . . . . . . . . . . . . . 814 $ 44.04

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 67.94

Exercised. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (598) 42.68 $ 20,867

Cancelled. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4) 49.63

Outstanding at December 28, 2010 . . . . . . . . . . . . . . . . . . . 216 $ 48.17

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 103.64

Exercised. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (65) 49.37 4,703

Cancelled. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6) 49.14

Outstanding at December 27, 2011 . . . . . . . . . . . . . . . . . . . 149 $ 48.98

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 139.17

Exercised. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (96) 46.60 10,335

Cancelled. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9) 45.97

Outstanding at December 25, 2012 . . . . . . . . . . . . . . . . . . . 46 $ 59.94 2.0 4,507

Exercisable at December 25, 2012 . . . . . . . . . . . . . . . . . . . 35 $ 63.18 2.1 $ 3,350

(1) Intrinsic value for activities other than exercises is defined as the difference between the grant price and the market value on

the last day of fiscal 2012 of $158.34 for those stock options where the market value is greater than the exercise price. For

exercises, intrinsic value is defined as the difference between the grant price and the market value on the date of exercise.

Cash received from the exercise of stock options in fiscal 2012, fiscal 2011, and fiscal 2010 was $4.5 million, $3.2 million, and

$25.6 million respectively. Windfall tax benefits realized from exercised stock options in fiscal 2012, fiscal 2011, and fiscal 2010

were $8.6 million, $5.0 million, and $3.6 million, respectively, and were included as cash flows from financing activities in the

Consolidated Statements of Cash Flows.

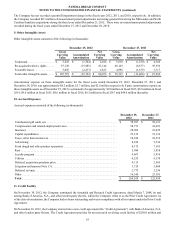

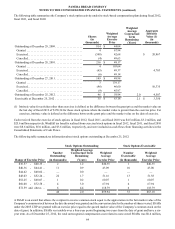

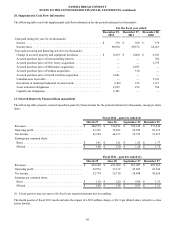

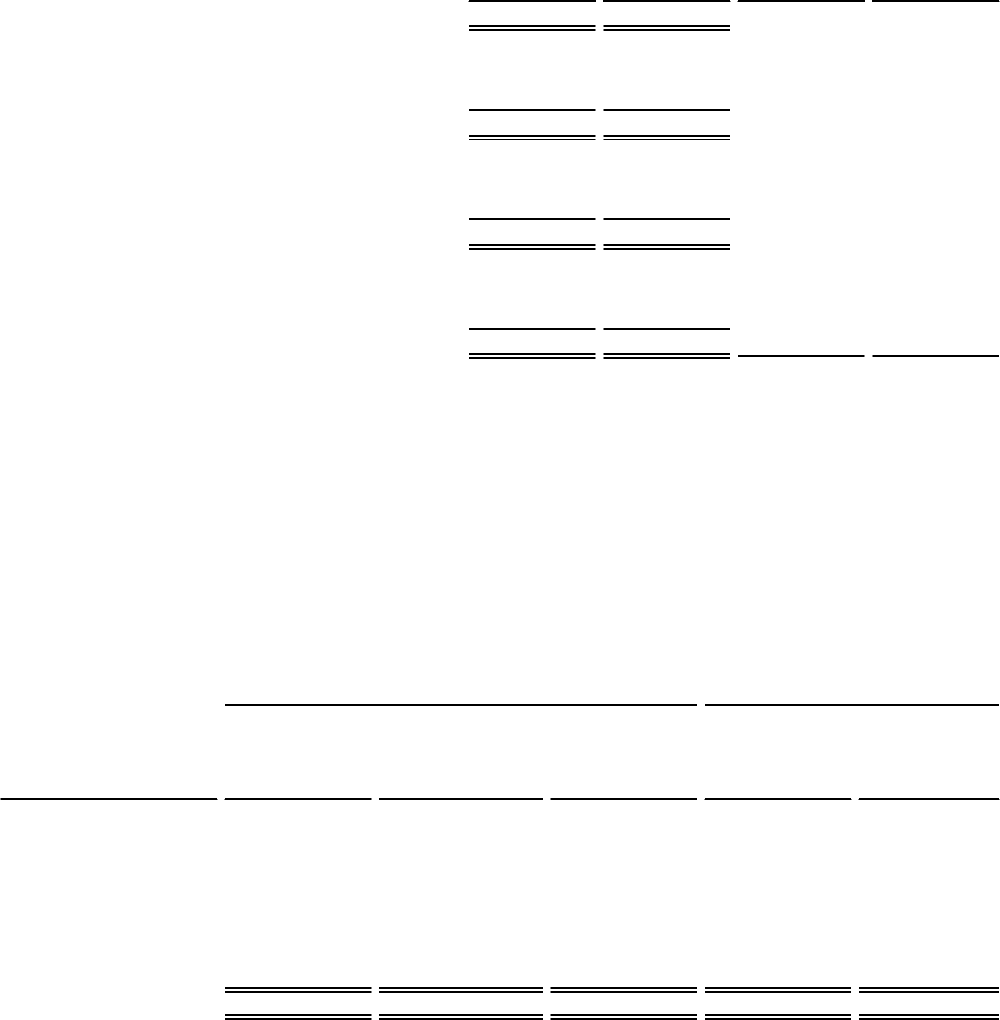

The following table summarizes information about stock options outstanding at December 25, 2012:

Stock Options Outstanding Stock Options Exercisable

Number

Outstanding

Weighted Average

Contractual Term

Remaining Weighted

Average Number

Exercisable Weighted

Average

Range of Exercise Price (in thousands) (Years) Exercise Price (in thousands) Exercise Price

$36.57 - $40.35 . . 2 1.2 $40.35 1 $40.35

$40.36 - $44.41 . . 11 0.9 43.09 10 43.00

$44.42 - $48.02 . . — 0.0 — — —

$48.03 - $52.24 . . 22 1.7 51.16 13 51.38

$52.25 - $60.07 . . 1 0.2 60.07 1 60.07

$60.08 - $72.58 . . 4 3.0 67.94 4 67.94

$72.59 and above. . . 6 4.4 118.79 6 118.79

46 2.0 $59.94 35 $63.18

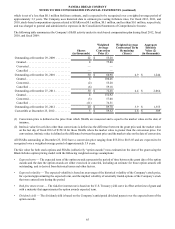

A SSAR is an award that allows the recipient to receive common stock equal to the appreciation in the fair market value of the

Company’s common stock between the date the award was granted and the conversion date for the number of shares vested. SSARs

under the 2005 LTIP are granted with an exercise price equal to the quoted market value of the Company’s common stock on the

date of grant. In addition, SSARs vest ratably over a four-year period beginning two years from the date of grant and have a six-

year term. As of December 25, 2012, the total unrecognized compensation cost related to non-vested SSARs was $0.4 million,