Panera Bread 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

PART II

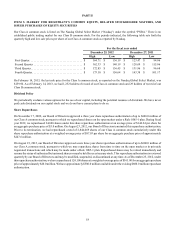

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND

ISSUER PURCHASES OF EQUITY SECURITIES

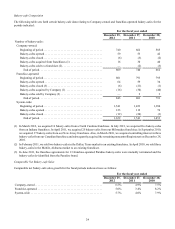

Our Class A common stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “PNRA.” There is no

established public trading market for our Class B common stock. For the periods indicated, the following table sets forth the

quarterly high and low sale prices per share of our Class A common stock as reported by Nasdaq.

For the fiscal year ended

December 25, 2012 December 27, 2011

High Low High Low

First Quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 164.71 $ 136.19 $ 123.47 $ 94.86

Second Quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 162.33 $ 140.19 $ 128.69 $ 115.86

Third Quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 172.85 $ 136.45 $ 131.96 $ 96.68

Fourth Quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 173.10 $ 156.64 $ 143.38 $ 101.17

On February 14, 2013, the last sale price for the Class A common stock, as reported on the Nasdaq Global Select Market, was

$159.96. As of February 14, 2013, we had 1,252 holders of record of our Class A common stock and 29 holders of record of our

Class B common stock.

Dividend Policy

We periodically evaluate various options for the use of our capital, including the potential issuance of dividends. We have never

paid cash dividends on our capital stock and we do not have current plans to do so.

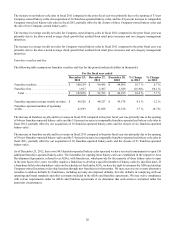

Share Repurchases

On November 17, 2009, our Board of Directors approved a three year share repurchase authorization of up to $600.0 million of

our Class A common stock, pursuant to which we repurchased shares on the open market under a Rule 10b5-1 plan. During fiscal

year 2012, we repurchased 34,600 shares under this share repurchase authorization at an average price of $144.24 per share for

an aggregate purchase price of $5.0 million. On August 23, 2012, our Board of Directors terminated this repurchase authorization.

Prior to its termination, we had repurchased a total of 2,844,669 shares of our Class A common stock cumulatively under this

share repurchase authorization at a weighted-average price of $87.03 per share for an aggregate purchase price of approximately

$247.6 million.

On August 23, 2012, our Board of Directors approved a new three year share repurchase authorization of up to $600.0 million of

our Class A common stock, pursuant to which we may repurchase shares from time to time on the open market or in privately

negotiated transactions and which may be made under a Rule 10b5-1 plan. Repurchased shares may be retired immediately and

resume the status of authorized but unissued shares or may be held by us as treasury stock. This repurchase authorization is reviewed

quarterly by our Board of Directors and may be modified, suspended, or discontinued at any time. As of December 25, 2012, under

this repurchase authorization, we have repurchased 124,100 shares at a weighted-average price of $161.00 for an aggregate purchase

price of approximately $20.0 million. We have approximately $580.0 million available under the existing $600.0 million repurchase

authorization.