Panera Bread 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

50

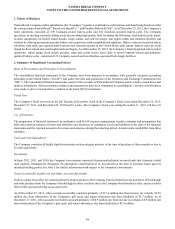

including removal of certain long-lived assets the Company has installed at the end of the lease. A liability for the fair value of an

asset retirement obligation along with a corresponding increase to the carrying value of the related long-lived asset is recorded at

the time a lease agreement is executed. The Company amortizes the amount added to property and equipment, net and recognizes

accretion expense in connection with the discounted liability over the reasonably assured lease term. The estimated liability is

based on the Company’s historical experience in closing bakery-cafes, fresh dough facilities, and support centers and the related

external cost associated with these activities. Revisions to the liability could occur due to changes in estimated retirement costs

or changes in lease terms. As of December 25, 2012 and December 27, 2011, the Company's net ARO asset included in property

and equipment, net was $4.6 million and $2.4 million, respectively, and its net ARO liability included in other long-term liabilities

was $9.2 million and $5.9 million, respectively. ARO accretion expense was $0.4 million, $0.3 million, and $0.4 million for the

fiscal years ended December 25, 2012, December 27, 2011, and December 28, 2010, respectively.

Variable Interest Entities

The Company applies the guidance issued by the FASB on accounting for variable interest entities (“VIE”), which defines the

process for how an enterprise determines which party consolidates a VIE as primarily a qualitative analysis. The enterprise that

consolidates the VIE (the primary beneficiary) is defined as the enterprise with (1) the power to direct activities of the VIE that

most significantly affect the VIE’s economic performance and (2) the obligation to absorb losses of the VIE or the right to receive

benefits from the VIE. The Company does not possess any ownership interests in franchise entities or other affiliates. The franchise

agreements are designed to provide the franchisee with key decision-making ability to enable it to oversee its operations and to

have a significant impact on the success of the franchise, while the Company’s decision-making rights are related to protecting

its brand. Based upon its analysis of all the relevant facts and considerations of the franchise entities and other affiliates, the

Company has concluded that these entities are not variable interest entities and they have not been consolidated as of the fiscal

year ended December 25, 2012.

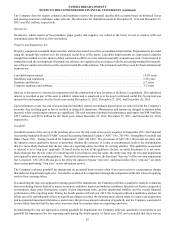

3. Business Combinations and Divestitures

North Carolina Franchisee Acquisition

On March 28, 2012, the Company acquired substantially all the assets and certain liabilities of 16 bakery-cafes and the related

area development rights from its Raleigh-Durham, North Carolina franchisee for a purchase price of $48.0 million. Approximately

$44.4 million of the purchase price was paid on March 27, 2012, with $3.6 million retained by the Company for certain holdbacks.

The holdbacks are primarily for certain indemnifications and expire on September 28, 2013, the 18 month anniversary of the

transaction closing date, with any remaining holdback amounts reverting to the prior franchisee. The Consolidated Statements of

Comprehensive Income include the results of operations from the operating bakery-cafes from the date of their acquisition.

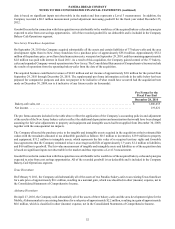

The acquired business contributed revenues of $36.0 million and net income of approximately $2.9 million for the period from

March 28, 2012 through December 25, 2012. The supplemental pro forma information set forth in the following table has been

prepared for comparative purposes and does not purport to be indicative of what would have occurred had the acquisition been

made on December 29, 2010, nor is it indicative of any future results (in thousands):

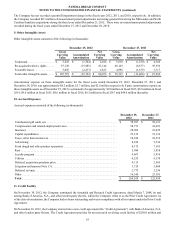

Pro Forma for the Fiscal Year Ended

December 25, 2012 December 27, 2011

Bakery-cafe sales, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,888,914 $ 1,632,295

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 173,763 137,297

The pro forma amounts included in the table above reflect the application of the Company’s accounting policies and adjustment

of the results of the Raleigh-Durham, North Carolina bakery-cafes to reflect the additional depreciation and amortization that

would have been charged assuming the fair value adjustments to property and equipment and intangible assets had been applied

from December 29, 2010, together with the consequential tax impacts.

The Company allocated the purchase price to the tangible and intangible assets acquired in the acquisition at their estimated fair

values with the remainder allocated to tax deductible goodwill as follows: $0.1 million to accounts receivable; $0.3 million to

inventories; $6.4 million to property and equipment; $29.1 million to intangible assets, which represent the fair value of re-acquired

territory rights and favorable lease agreements that the Company estimated to have an average useful life of approximately 12

years; $1.4 million to liabilities; and $13.5 million to goodwill. The fair value measurement of tangible and intangible assets and

liabilities as of the acquisition date is based on significant inputs not observable in the market and thus represents a Level 3

measurement. In addition, the Company recorded a $0.1 million measurement period adjustment increasing goodwill for the fiscal

year ended December 25, 2012.