Panera Bread 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

Impairment of Long-Lived Assets

We evaluate whether events and circumstances have occurred that indicate the remaining estimated useful life of long-lived assets

may warrant revision or that the remaining balance of an asset may not be recoverable. When appropriate, we compare anticipated

undiscounted cash flows from the related long-lived assets of a bakery-cafe or fresh dough facility with their respective carrying

values to determine if the long-lived assets are recoverable. If the sum of the anticipated undiscounted cash flows for the long-

lived assets is less than their carrying value, an impairment loss would be recognized for the difference between the anticipated

discounted cash flows, which approximates fair value, and the carrying value of the long-lived assets. Our estimates of cash flow

were based upon, among other things, certain assumptions about expected future operating performance, such as revenue growth

rates, operating margins, risk-adjusted discount rates, and future economic and market conditions. Our estimates of cash flow may

differ from actual cash flow due to, among other things, economic conditions, changes to our business model or changes in operating

performance. The long-term financial forecasts that we utilize represent the best estimate that we have at this time time and we

believe that its underlying assumptions are reasonable.

We recognized impairment losses of $0.3 million and $0.1 million during the fiscal years ended December 25, 2012 and

December 28, 2010, respectively, related to distinct underperforming Company-owned bakery-cafes. These losses were recorded

in other operating expenses in the Consolidated Statements of Comprehensive Income. No impairment loss was recognized during

the fiscal year ended December 27, 2011.

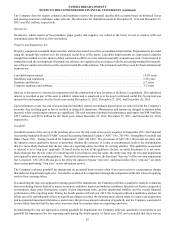

Contractual Obligations and Other Commitments

We currently anticipate $175 million to $200 million of capital expenditures in fiscal 2013. We expect to fund our capital

expenditures principally through internally generated cash flow and available borrowings under our existing credit facility, if

needed.

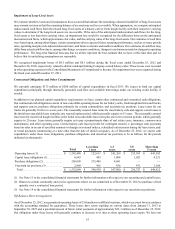

In addition to our planned capital expenditure requirements, we have certain other contractual and committed cash obligations.

Our contractual cash obligations consist of non-cancelable operating leases for our bakery-cafes, fresh dough facilities and trucks,

and support centers; purchase obligations primarily for certain commodities; and uncertain tax positions. Lease terms for our

trucks are generally for five to seven years. The reasonably assured lease terms for most bakery-cafe and support center leases is

the initial non-cancelable lease term plus one renewal option period, which generally equates to 15 years. The reasonably assured

lease term for most fresh dough facilities is the initial non-cancelable lease term plus one to two renewal periods, which generally

equates to 20 years. Lease terms generally require us to pay a proportionate share of real estate taxes, insurance, common area

maintenance, and other operating costs. Certain bakery-cafe leases provide for contingent rental (i.e. percentage rent) payments

based on sales in excess of specified amounts or changes in external indices, scheduled rent increases during the lease terms, and/

or rental payments commencing at a date other than the date of initial occupancy. As of December 25, 2012, we expect cash

expenditures under these lease obligations, purchase obligations, and uncertain tax positions to be as follows for the periods

indicated (in thousands):

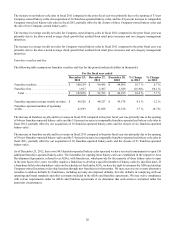

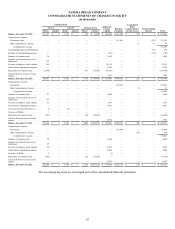

Total Less than

1 year 1-3

years 3-5

years More than

5 years

Operating leases (1) . . . . . . . . . . . . . . . . . $ 1,242,488 $ 122,611 $ 241,269 $ 235,303 $ 643,305

Capital lease obligations (1). . . . . . . . . . . 6,643 495 1,004 1,023 4,121

Purchase obligations (2). . . . . . . . . . . . . . 280,099 275,408 4,691 — —

Uncertain tax positions (3). . . . . . . . . . . . 2,869 416 836 431 1,186

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,532,099 $ 398,930 $ 247,800 $ 236,757 $ 648,612

(1) See Note 13 to the consolidated financial statements for further information with respect to our operating and capital leases.

(2) Relates to certain commodity and service agreements where we are committed as of December 25, 2012 to purchase a fixed

quantity over a contracted time period.

(3) See Note 14 to the consolidated financial statements for further information with respect to our uncertain tax positions.

Off-Balance Sheet Arrangements

As of December 25, 2012, we guaranteed operating leases of 25 franchisee or affiliate locations, which we account for in accordance

with the accounting standard for guarantees. These leases have terms expiring on various dates from January 31, 2013 to

September 30, 2027 and a potential amount of future rental payments of approximately $23.3 million as of December 25, 2012.

Our obligation under these leases will generally continue to decrease over time as these operating leases expire. We have not