Panera Bread 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

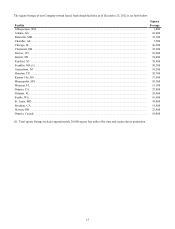

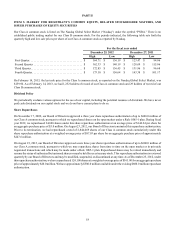

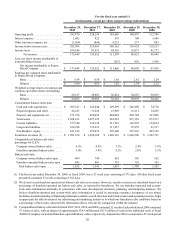

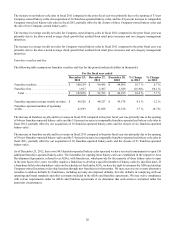

For the fiscal year ended (1)

(in thousands, except per share and percentage information)

December 25,

2012 December 27,

2011 December 28,

2010 December 29,

2009 December 30,

2008

Operating profit . . . . . . . . . . . . . . . . . . . . 282,870 220,259 185,069 140,897 112,706

Interest expense . . . . . . . . . . . . . . . . . . . . 1,082 822 675 700 1,606

Other (income) expense, net . . . . . . . . . . (1,208) (466) 4,232 273 883

Income before income taxes . . . . . . . . . . 282,996 219,903 180,162 139,924 110,217

Income taxes . . . . . . . . . . . . . . . . . . . . . . 109,548 83,951 68,563 53,073 41,272

Net income. . . . . . . . . . . . . . . . . . 173,448 135,952 111,599 86,851 68,945

Less: net (loss) income attributable to

noncontrolling interest . . . . . . . . . . . . . . . — — (267) 801 1,509

Net income attributable to Panera

Bread Company . . . . . . . . . . . . . . . . $ 173,448 $ 135,952 $ 111,866 $ 86,050 $ 67,436

Earnings per common share attributable

to Panera Bread Company:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . $ 5.94 $ 4.59 $ 3.65 2.81 $ 2.24

Diluted . . . . . . . . . . . . . . . . . . . . . . . $ 5.89 $ 4.55 $ 3.62 $ 2.78 $ 2.22

Weighted average shares of common and

common equivalent shares outstanding:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . 29,217 29,601 30,614 30,667 30,059

Diluted . . . . . . . . . . . . . . . . . . . . . . . 29,455 29,903 30,922 30,979 30,422

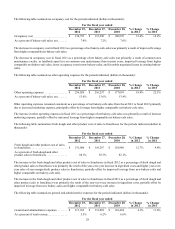

Consolidated balance sheet data:

Cash and cash equivalents. . . . . . . . . . . $ 297,141 $ 222,640 $ 229,299 $ 246,400 $ 74,710

Prepaid expenses and other . . . . . . . . . . 42,223 31,228 23,905 16,211 14,265

Property and equipment, net . . . . . . . . . 571,754 492,022 444,094 403,784 417,006

Total assets. . . . . . . . . . . . . . . . . . . . . . . 1,268,163 1,027,322 924,581 837,165 673,917

Current liabilities. . . . . . . . . . . . . . . . . . 277,540 238,334 211,516 142,259 114,014

Long-term liabilities . . . . . . . . . . . . . . . 168,704 133,912 117,457 97,870 61,217

Stockholders’ equity . . . . . . . . . . . . . . . 821,919 655,076 595,608 597,036 495,162

Franchisee revenues (2) . . . . . . . . . . . . . . $ 1,981,674 $ 1,828,188 $ 1,802,116 $ 1,640,309 $ 1,542,791

Comparable net bakery-cafe sales

percentage for (2)(3):

Company-owned bakery-cafes . . . . . . . 6.5% 4.9% 7.5% 2.4% 3.8%

Franchise-operated bakery-cafes. . . . . . 5.0% 3.4% 8.2% 2.0% 3.5%

Bakery-cafe data:

Company-owned bakery-cafes open . . . 809 740 662 585 562

Franchise-operated bakery-cafes open . 843 801 791 795 763

Total bakery-cafes open . . . . . . . . . . . 1,652 1,541 1,453 1,380 1,325

(1) The fiscal year ended December 30, 2008, or fiscal 2008, was a 53 week year consisting of 371 days. All other fiscal years

presented contained 52 weeks consisting of 364 days.

(2) We do not record franchise-operated net bakery-cafe sales as revenues. However, royalty revenues are calculated based on a

percentage of franchise-operated net bakery-cafe sales, as reported by franchisees. We use franchise-operated and system-

wide sales information internally in connection with store development decisions, planning, and budgeting analyses. We

believe franchise-operated and system-wide sales information is useful in assessing consumer acceptance of our brand,

facilitates an understanding of financial performance and the overall direction and trends of sales and operating income, helps

us appreciate the effectiveness of our advertising and marketing initiatives to which our franchisees also contribute based on

a percentage of their sales, and provides information that is relevant for comparison within the industry.

(3) Comparable net bakery-cafe sales for fiscal 2012, 2011, 2010, and 2009 contained 52 weeks of sales while fiscal 2008 contained

53 weeks of sales, with an impact of approximately $14.4 million and $21.4 million of sales in the additional week of fiscal

2008 for Company-owned and franchise-operated bakery-cafes, respectively. Adjusted to reflect a comparative 52 week period