Panera Bread 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

28, 2010 for $0.7 million. Additionally, in fiscal 2010, we acquired substantially all the assets and certain liabilities of 37 bakery-

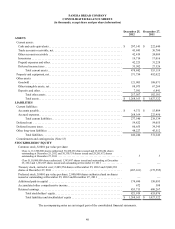

cafes from our New Jersey franchisee. As of December 25, 2012 and December 27, 2011, $4.1 million and $2.6 million respectively,

were included within our Consolidated Balance Sheets for contingent or accrued purchase price remaining from previously

completed acquisitions. See Note 3 to the consolidated financial statements for further information with respect to our acquisition

activity in fiscal 2012, fiscal 2011, and fiscal 2010.

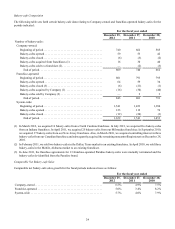

Financing Activities

Financing activities in fiscal 2012 included $31.6 million used to repurchase shares of our Class A common stock, $2.1 million

used on the payment of deferred acquisition holdbacks, and $1.1 million used on capitalized debt issuance costs, offset by $8.6

million received from the tax benefit from exercise of stock options, $4.5 million received from the exercise of employee stock

options, and $2.5 million received from the issuance of common stock. Financing activities in fiscal 2011 included $96.6 million

used to repurchase shares of our Class A common stock and $5.0 million used on payment of deferred acquisition holdbacks, offset

by $5.0 million received from the tax benefit from exercise of stock options, $3.2 million received from the exercise of employee

stock options, and $2.0 million received from the issuance of common stock. Financing activities in fiscal 2010 included $153.5

million used to repurchase shares of our Class A common stock offset by $25.6 million received from the exercise of employee

stock options, $3.6 million received from the tax benefit from the exercise of stock options, and $1.8 million received from the

issuance of common stock.

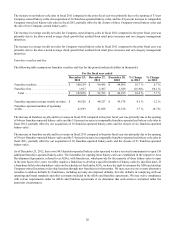

Share Repurchases

On November 17, 2009, our Board of Directors approved a three year share repurchase authorization of up to $600.0 million of

our Class A common stock, pursuant to which we repurchased shares on the open market under a Rule 10b5-1 plan. During fiscal

year 2012, we repurchased 34,600 shares under this share repurchase authorization at an average price of $144.24 per share for

an aggregate purchase price of $5.0 million. During fiscal year 2011, we repurchased 877,100 shares under this share repurchase

authorization at an average price of $103.55 per share for an aggregate purchase price of $90.8 million. During fiscal year 2010,

we repurchased 1,905,540 shares under this share repurchase authorization at an average price of $78.72 per share for an aggregate

purchase price of $150.0 million. On August 23, 2012, our Board of Directors terminated this repurchase authorization. Prior to

its termination, we had repurchased a total of 2,844,669 shares of our Class A common stock cumulatively under this share

repurchase authorization at a weighted-average price of $87.03 per share for an aggregate purchase price of approximately $247.6

million.

On August 23, 2012, our Board of Directors approved a new three year share repurchase authorization of up to $600.0 million of

our Class A common stock, pursuant to which we may repurchase shares from time to time on the open market or in privately

negotiated transactions and which may be made under a Rule 10b5-1 plan. Repurchased shares may be retired immediately and

resume the status of authorized but unissued shares or may be held by us as treasury stock. This repurchase authorization is reviewed

quarterly by our Board of Directors and may be modified, suspended, or discontinued at any time. As of December 25, 2012, under

this repurchase authorization, we have repurchased 124,100 shares at a weighted-average price of $161.00 for an aggregate purchase

price of approximately $20.0 million. We have approximately $580.0 million available under the existing $600.0 million repurchase

authorization.

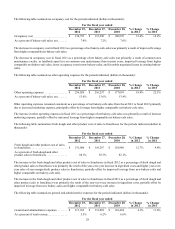

We have historically repurchased shares of our Class A common stock through a share repurchase authorization approved by our

Board of Directors from participants of the Panera Bread 1992 Stock Incentive Plan and the Panera Bread 2006 Stock Incentive

Plan, as amended, or collectively, the Plans. Repurchased shares are netted and surrendered as payment for applicable tax

withholding on the vesting of participants’ restricted stock. During fiscal 2012, we repurchased 42,100 shares of Class A common

stock surrendered by participants of the Plans at a weighted-average price of $156.53 per share for an aggregate purchase price

of approximately $6.6 million pursuant to the terms of the Plans and the applicable award agreements. During fiscal 2011, we

repurchased 52,146 shares of Class A common stock surrendered by participants of the Plans at a weighted-average price of

$109.33 per share for an aggregate purchase price of $5.7 million pursuant to the terms of the Plans and the applicable award

agreements. During fiscal 2010, we repurchased 44,002 shares of Class A common stock surrendered by participants in the Plans

at a weighted-average price of $77.99 per share for an aggregate purchase price of $3.5 million pursuant to the terms of the Plans

and the applicable award agreements.

Credit Facility

On November 30, 2012, we terminated our Amended and Restated Credit Agreement, dated March 7, 2008, by and among Bank

of America, N.A., and other lenders party thereto, which we refer to as the Prior Credit Agreement. As of the date of termination,

we had no balance outstanding under the Prior Credit Agreement and we were in compliance with all covenants under the Prior

Credit Agreement.