Panera Bread 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

53

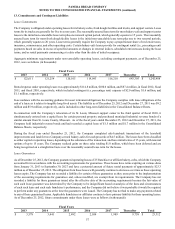

Accrued Purchase Price Payments

During the fiscal years ended December 25, 2012 and December 27, 2011, the Company paid approximately $2.1 million and

$5.0 million, respectively, including accrued interest, of previously accrued acquisition purchase price in accordance with the asset

purchase agreements. There were no payments of previously accrued purchase price during the fiscal year ended December 28,

2010. There was $4.1 million and $2.6 million of accrued purchase price remaining as of December 25, 2012 and December 27,

2011, respectively.

4. Noncontrolling Interest

On September 10, 2008, the Company’s Canadian subsidiary, Panera Bread ULC, as lender, entered into a Cdn. $3.5 million

secured revolving credit facility agreement and franchise agreements with Millennium Bread Inc. (“Millennium”) and certain of

Millennium’s present and future subsidiaries (the “Franchise Guarantors”), pursuant to which Millennium would operate three

Panera Bread bakery-cafes in Ontario, Canada.

On March 30, 2010, PB Biscuit, ULC (“PB Biscuit”) was formed by Panera Bread ULC through the contribution of its Cdn. $3.5

million note receivable from Millennium and cash. On March 31, 2010, PB Biscuit acquired certain assets and liabilities and the

operations of Millennium’s three Panera Bread bakery-cafes. In exchange for the bakery-cafe operations and certain assets and

liabilities, PB Biscuit assigned the Cdn. $3.5 million note receivable to and issued non-controlling interest to Millennium at a fair

value of $0.6 million (28.5 percent ownership of PB Biscuit’s voting shares), for a total consideration of $4.1 million, subject to

certain closing adjustments. The Consolidated Statements of Comprehensive Income include the results of operations from the

operating bakery-cafes from the date of the acquisition. This non-cash transaction was excluded from the Consolidated Statements

of Cash Flows for the year ended December 28, 2010. The pro forma impact of the acquisition on prior periods is not presented,

as the impact was not material to reported results. The Company allocated the purchase price to the tangible and intangible assets

acquired in the acquisition at their estimated fair values with the remainder allocated to tax deductible goodwill as follows: $2.3

million to property and equipment, $0.5 million of net assumed current liabilities, and $2.3 million to goodwill. The fair value

measurement of tangible and intangible assets and liabilities as of the acquisition date is based on significant inputs not observable

in the market and thus represents a Level 3 measurement.

Goodwill recorded in connection with this acquisition was attributable to the workforce of the acquired bakery-cafes and synergies

expected to arise from cost savings opportunities. All of the recorded goodwill is anticipated to be tax deductible and is included

in the Company Bakery-Cafe Operations segment.

On December 28, 2010, the Company acquired the remaining non-controlling interest of Millennium for $0.7 million. The

transaction was accounted for as an equity transaction, by adjusting the carrying amount of the noncontrolling interest balance to

reflect the change in the Company’s ownership interest in Millennium, with the difference between fair value of the consideration

paid and the amount by which the noncontrolling interest was adjusted recognized in equity attributable to the Company.

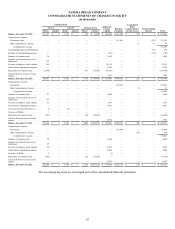

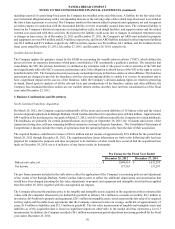

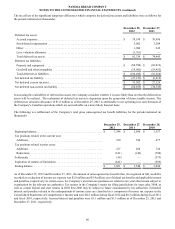

The following table illustrates the effect on the Company’s equity of its acquisition of the remaining 28.5 percent of outstanding

stock of Millennium on December 28, 2010 (in thousands):

For the fiscal

year ended

December 28,

2010

Net income attributable to the Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 111,866

Decrease in equity for acquisition of noncontrolling interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (367)

Change from net income attributable to the Company and the acquisition of noncontrolling interest . . . . . . . . . $ 111,499

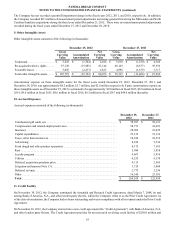

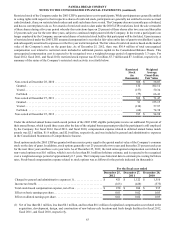

5. Fair Value Measurements

The Company’s $99.4 million and $27.5 million in cash equivalents at December 25, 2012 and December 27, 2011, respectively,

were carried at fair value in the Consolidated Balance Sheets based on quoted market prices for identical securities (Level 1 inputs).

The Company’s remaining cash balance in the Consolidated Balance Sheets was held in FDIC insured accounts. As of December 25,

2012 and December 27, 2011, the Company held municipal industrial revenue bonds in the amount of $1.5 million and 1.7 million,

respectively. These bonds are designated as held-to-maturity and stated at cost in the Consolidated Balance Sheets as of

December 25, 2012 and December 27, 2011.