North Face 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

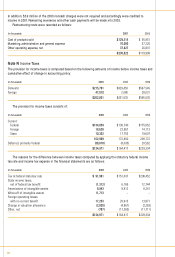

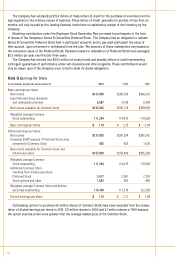

Note R Financial Instruments

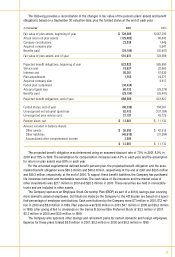

The carrying amount and fair value of financial instruments included in the Consolidated Balance Sheets are

as follows:

In thousands 2001 2000

Carrying Fair Carrying Fair

Amount Value Amount Value

Financial liabilities:

Short-term borrowings $ 77,900 $ 77,900 $ 147,005 $ 147,005

Long-term debt 904,731 949,521 1,019,035 1,028,460

Series B Convertible Preferred Stock 45,631 91,419 48,483 91,052

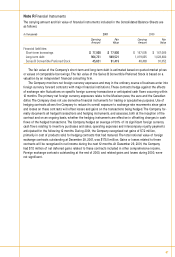

The fair value of the Company's short-term and long-term debt is estimated based on quoted market prices

or values of comparable borrowings. The fair value of the Series B Convertible Preferred Stock is based on a

valuation by an independent financial consulting firm.

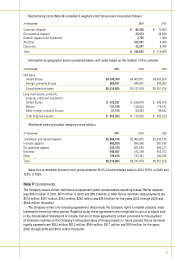

The Company monitors net foreign currency exposures and may in the ordinary course of business enter into

foreign currency forw ard contracts with major financial institutions. These contracts hedge against the effects

of exchange rate fluctuations on specific foreign currency transactions or anticipated cash flows occurring within

12 months. The primary net foreign currency exposures relate to the M exican peso, the euro and the Canadian

dollar. The Company does not use derivative financial instruments for trading or speculative purposes. Use of

hedging contracts allows the Company to reduce its overall exposure to exchange rate movements since gains

and losses on these contracts will offset losses and gains on the transactions being hedged. The Company for-

mally documents all hedged transactions and hedging instruments, and assesses, both at the inception of the

contract and on an ongoing basis, whether the hedging instruments are effective in offsetting changes in cash

flows of the hedged transactions. The Company hedges an average of 50% of its significant foreign currency

cash flows relating to inventory purchases and sales, operating expenses and intercompany royalty payments

anticipated for the following 12 months. During 2001, the Company recognized net gains of $7.2 million,

primarily in cost of products sold, for hedging contracts that had matured. The total notional value of foreign

exchange contracts outstanding at December 29, 2001, was $175.5 million. Gains or losses related to these

contracts will be recognized in net income during the next 12 months. At December 29, 2001, the Company

had $7.0 million of net deferred gains related to these contracts included in other comprehensive income.

Foreign exchange contracts outstanding at the end of 2000, and related gains and losses during 2000, were

not significant.

67