North Face 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

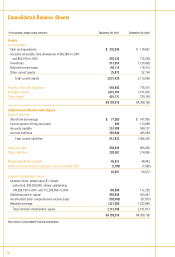

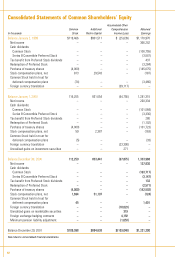

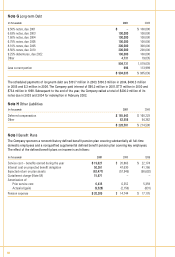

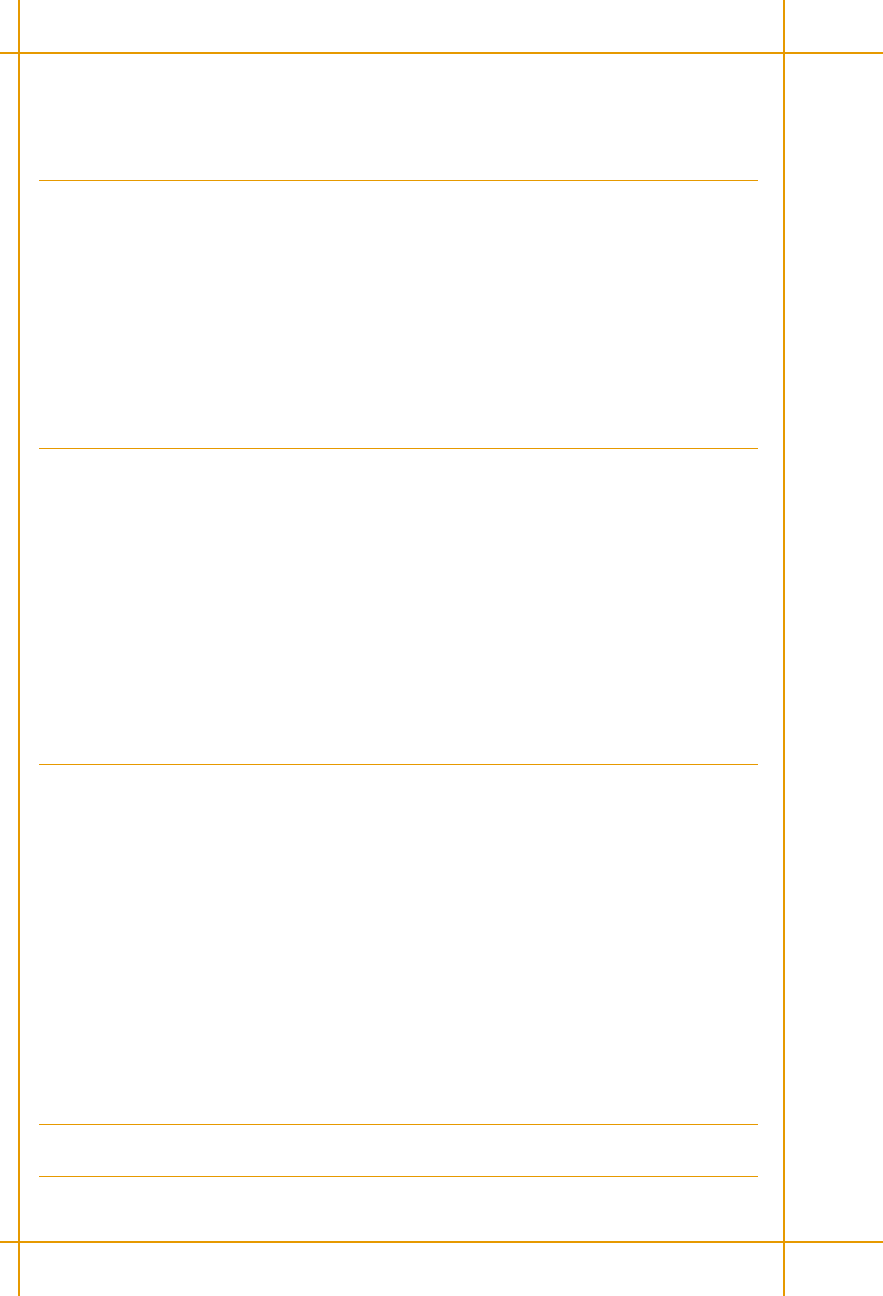

Consolidated Statements of Common Shareholders’ Equity

Accumulated Other

Common Additional Comprehensive Retained

In thousands Stock Paid-in Capital Income (Loss) Earnings

Balance January 2, 1999 $119,466 $801,511 $ (25,639) $1,170,970

Net income – – – 366,242

Cash dividends:

Common Stock – – – (100,755)

Series B Convertible Preferred Stock – – – (3,547)

Tax benefit from Preferred Stock dividends – – – 437

Redemption of Preferred Stock – – – (3,284)

Purchase of treasury shares (4,000) – – (145,075)

Stock compensation plans, net 813 29,543 – (187)

Common Stock held in trust for

deferred compensation plans (74) – – (3,486)

Foreign currency translation – – (39,117) –

Balance January 1, 2000 116,205 831,054 (64,756) 1,281,315

Net income – – – 260,334

Cash dividends:

Common Stock – – – (101,584)

Series B Convertible Preferred Stock – – – (3,336)

Tax benefit from Preferred Stock dividends – – – 280

Redemption of Preferred Stock – – – (1,102)

Purchase of treasury shares (4,000) – – (101,723)

Stock compensation plans, net 59 2,387 – (163)

Common Stock held in trust for

deferred compensation plans (5) – – (33)

Foreign currency translation – – (23,390) –

Unrealized gains on investment securities – – 271 –

Balance December 30, 2000 112,259 833,441 (87,875) 1,333,988

Net income – – – 137,830

Cash dividends:

Common Stock – – – (103,717)

Series B Convertible Preferred Stock – – – (3,147)

Tax benefit from Preferred Stock dividends – – – 132

Redemption of Preferred Stock – – – (2,571)

Purchase of treasury shares (4,000) – – (142,592)

Stock compensation plans, net 1,694 51,197 – (124)

Common Stock held in trust for

deferred compensation plans 45 – – 1,401

Foreign currency translation – – (18,023) –

Unrealized gains on marketable securities – – 319 –

Foreign exchange hedging contracts – – 4,192 –

Minimum pension liability adjustment – – (1,653) –

Balance December 29, 2001 $109,998 $884,638 $(103,040) $1,221,200

See notes to consolidated financial statements.