North Face 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

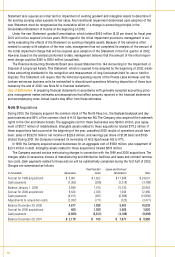

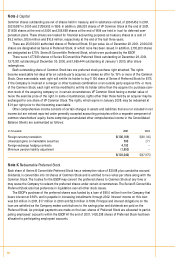

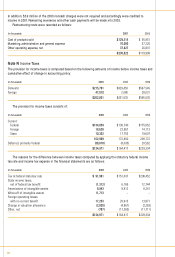

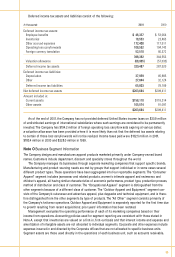

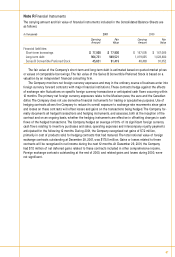

Deferred income tax assets and liabilities consist of the following:

In thousands 2001 2000

Deferred income tax assets:

Employee benefits $ 46,337 $ 53,064

Inventories 18,553 23,463

Other accrued expenses 172,400 117,511

Operating loss carryforwards 108,592 104,143

Foreign currency translation 52,510 46,372

398,392 344,553

Valuation allowance (68,905) (57,033)

Deferred income tax assets 329,487 287,520

Deferred income tax liabilities:

Depreciation 37,959 45,985

Other 27,844 32,124

Deferred income tax liabilities 65,803 78,109

Net deferred income tax assets $263,684 $209,411

Amount included in:

Current assets $158,110 $118,314

Other assets 105,574 91,097

$263,684 $209,411

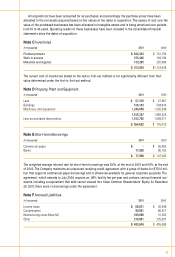

As of the end of 2001, the Company has not provided deferred United States income taxes on $30.9 million

of undistributed earnings of international subsidiaries where such earnings are considered to be permanently

invested. The Company has $194.2 million of foreign operating loss carryforw ards expiring at various dates;

a valuation allow ance has been provided where it is more likely than not that the deferred tax assets relating

to certain of those loss carryforwards will not be realized. Income taxes paid were $132.5 million in 2001,

$183.4 million in 2000 and $228.0 million in 1999.

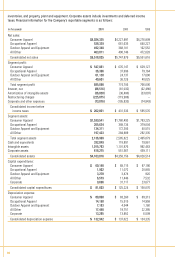

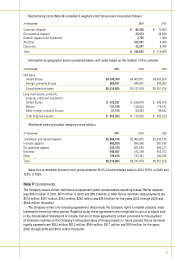

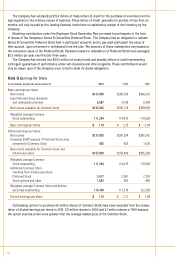

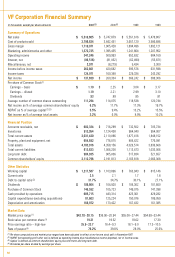

Note O Business Segment Information

The Company designs and manufactures apparel products marketed primarily under Company-owned brand

names. Customers include department, discount and specialty stores throughout the world.

The Company manages its businesses through separate marketing companies that support specific brands.

M anufacturing and product sourcing needs are met by groups that support individual or in some cases several

different product types. These operations have been aggregated into four reportable segments. The “Consumer

Apparel” segment includes jeanswear and related products, women's intimate apparel and swimw ear, and

children's apparel, all having similar characteristics of economic performance, product type, production process,

method of distribution and class of customer. The “Occupational Apparel” segment is distinguished from the

other segments because of a different class of customer. The “Outdoor Apparel and Equipment” segment con-

sists of the Company’s outerw ear and adventure apparel, plus daypacks and technical equipment, and is there-

fore distinguished from the other segments by type of products. The “All Other” segment consists primarily of

the Company's knitwear operations. Outdoor Apparel and Equipment is separately reported for the first time due

to grow th resulting from recent acquisitions; prior years’ information has been restated.

M anagement evaluates the operating performance of each of its marketing companies based on their

income from operations. Accounting policies used for segment reporting are consistent with those stated in

Note A, except that inventories are valued on a first-in, first-out basis and that interest income and expense and

amortization of intangible assets are not allocated to individual segments. Corporate and other expenses include

expenses incurred in and directed by the Corporate offices that are not allocated to specific business units.

Segment assets are those used directly in the operations of each business unit, such as accounts receivable,

63