North Face 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

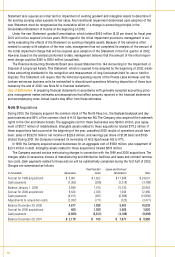

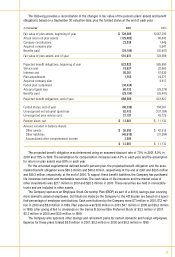

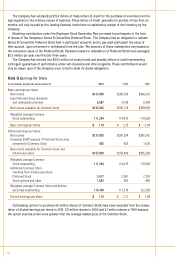

In addition, $3.9 million of the 2000 noncash charges were not required and accordingly were credited to

income in 2001. Remaining severance and other cash payments will be made into 2002.

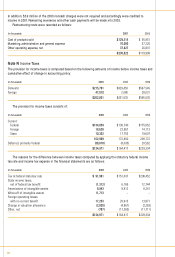

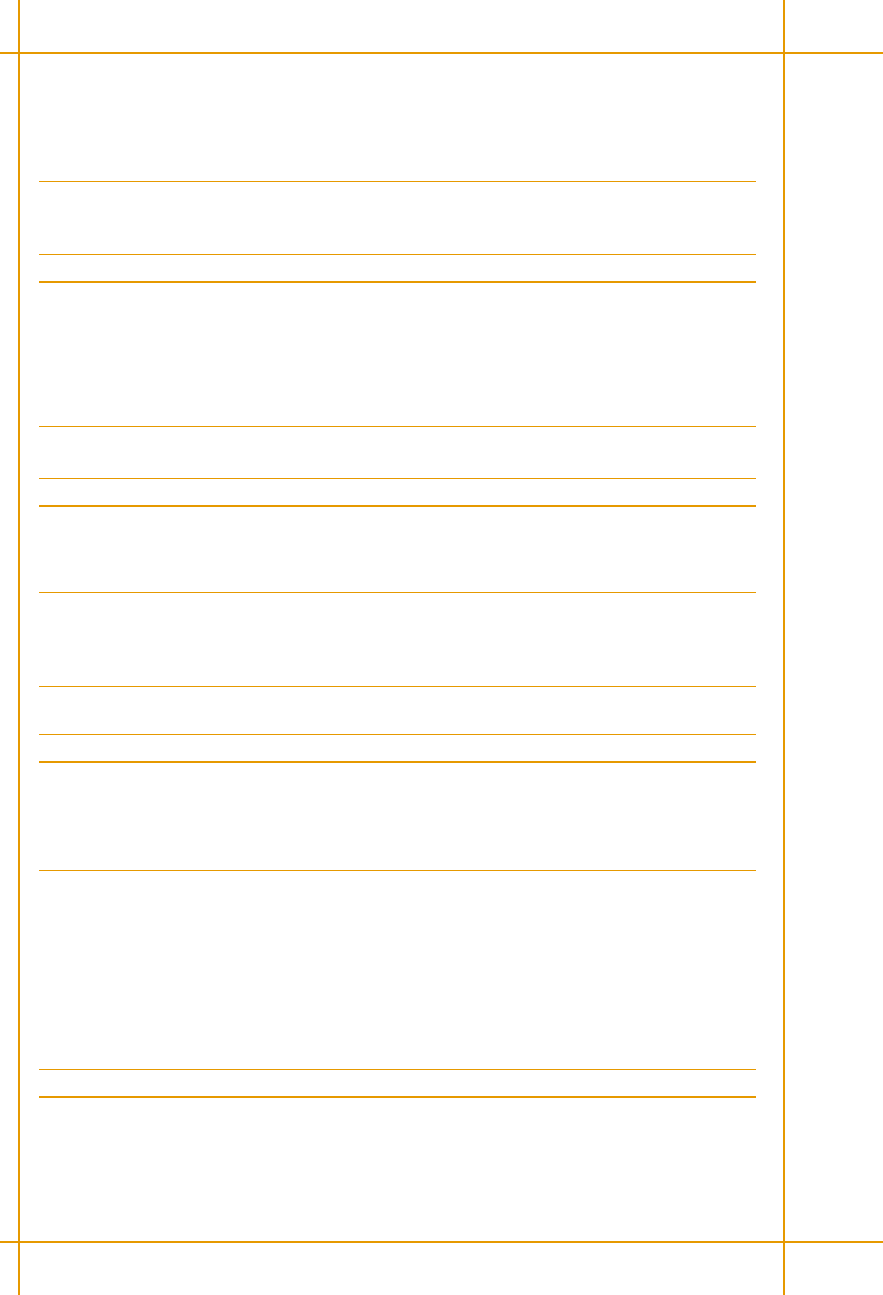

Restructuring costs were recorded as follows:

In thousands 2001 2000

Cost of products sold $129,315 $ 55,851

M arketing, administrative and general expense 70,080 37,226

Other operating expense, net 37,427 26,831

$236,822 $119,908

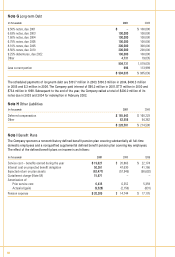

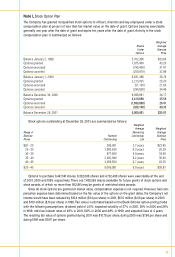

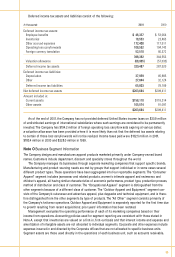

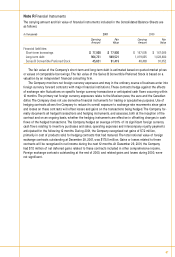

Note N Income Taxes

The provision for income taxes is computed based on the following amounts of income before income taxes and

cumulative effect of change in accounting policy:

In thousands 2001 2000 1999

Domestic $215,791 $429,453 $567,545

Foreign 47,010 2,080 28,031

$262,801 $431,533 $595,576

The provision for income taxes consists of:

In thousands 2001 2000 1999

Current:

Federal $134,059 $130,740 $175,052

Foreign 18,628 23,957 14,113

State 10,302 17,753 19,607

162,989 172,450 208,772

Deferred, primarily federal (38,018) (8,033) 20,562

$124,971 $164,417 $229,334

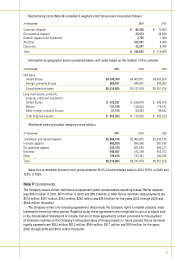

The reasons for the difference between income taxes computed by applying the statutory federal income

tax rate and income tax expense in the financial statements are as follows:

In thousands 2001 2000 1999

Tax at federal statutory rate $ 91,981 $151,037 $208,452

State income taxes,

net of federal tax benefit (1,312) 6,169 12,744

Amortization of intangible assets 8,943 8,812 8,241

Write-off of intangible assets 11,713 ––

Foreign operating losses

with no current benefit 17,253 20,613 13,871

Change in valuation allowance (2,820) (4,951) (2,263)

Other, net (787) (17,263) (11,711)

$124,971 $164,417 $229,334

62