North Face 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

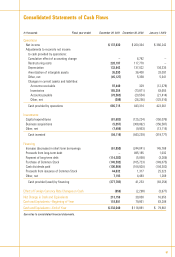

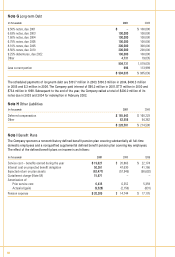

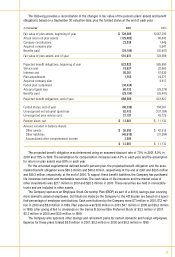

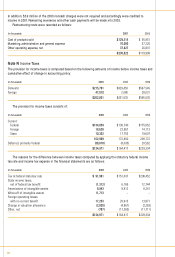

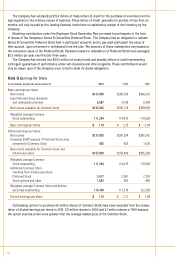

Note G Long-term Debt

In thousands 2001 2000

9.50% notes, due 2001 $–$ 100,000

6.63% notes, due 2003 100,000 100,000

7.60% notes, due 2004 100,000 100,000

6.75% notes, due 2005 100,000 100,000

8.10% notes, due 2005 300,000 300,000

8.50% notes, due 2010 200,000 200,000

9.25% debentures, due 2022 100,000 100,000

Other 4,731 19,035

904,731 1,019,035

Less current portion 696 113,999

$ 904,035 $ 905,036

The scheduled payments of long-term debt are $101.7 million in 2003, $100.3 million in 2004, $400.3 million

in 2005 and $.3 million in 2006. The Company paid interest of $95.2 million in 2001, $77.1 million in 2000 and

$73.4 million in 1999. Subsequent to the end of the year, the Company called a total of $200.0 million of its

notes due in 2003 and 2004 for redemption in February 2002.

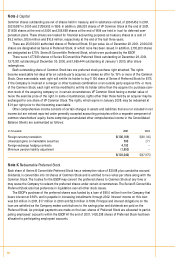

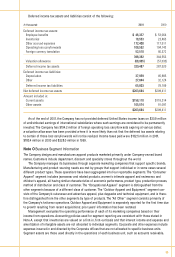

Note H Other Liabilities

In thousands 2001 2000

Deferred compensation $ 165,943 $ 160,228

Other 62,558 54,362

$ 228,501 $ 214,590

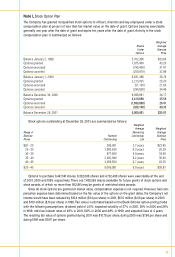

Note I Benefit Plans

The Company sponsors a noncontributory defined benefit pension plan covering substantially all full-time

domestic employees and a nonqualified supplemental defined benefit pension plan covering key employees.

The effect of the defined benefit plans on income is as follows:

In thousands 2001 2000 1999

Service cost – benefits earned during the year $ 19,627 $ 20,863 $ 22,174

Interest cost on projected benefit obligation 50,261 47,630 41,166

Expected return on plan assets (62,477) (57,945) (50,692)

Curtailment charge (Note M) 15,971 ––

Amortization of:

Prior service cost 6,435 6,352 5,359

Actuarial (gain) (9,528) (2,156) (831)

Pension expense $ 20,289 $ 14,744 $ 17,176

56