North Face 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

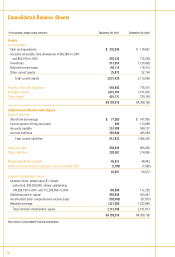

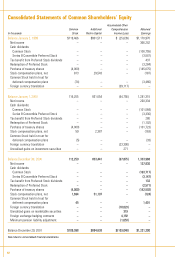

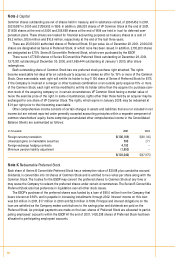

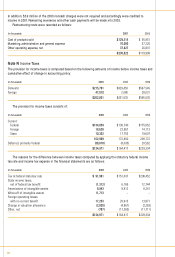

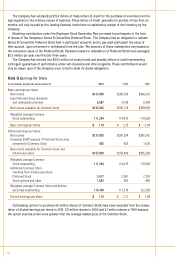

Note J Capital

Common shares outstanding are net of shares held in treasury, and in substance retired, of 29,141,452 in 2001,

25,139,897 in 2000 and 21,136,952 in 1999. In addition, 266,203 shares of VF Common Stock at the end of 2001,

311,608 shares at the end of 2000 and 306,698 shares at the end of 1999 are held in trust for deferred com-

pensation plans. These shares are treated for financial accounting purposes as treasury shares at a cost of

$9.2 million, $10.6 million and $10.5 million, respectively, at the end of the last three years.

There are 25,000,000 authorized shares of Preferred Stock, $1 par value. As of December 29, 2001, 2,000,000

shares are designated as Series A Preferred Stock, of which none has been issued. In addition, 2,105,263 shares

are designated as 6.75% Series B Convertible Preferred Stock, which w ere purchased by the ESOP.

There w ere 1,477,930 shares of Series B Convertible Preferred Stock outstanding at December 29, 2001,

1,570,301 outstanding at December 30, 2000, and 1,669,444 outstanding at January 1, 2000, after share

redemptions.

Each outstanding share of Common Stock has one preferred stock purchase right attached. The rights

become exercisable ten days after an outside party acquires, or makes an offer for, 15% or more of the Common

Stock. Once exercisable, each right will entitle its holder to buy 1/ 100 share of Series A Preferred Stock for $175.

If the Company is involved in a merger or other business combination or an outside party acquires 15% or more

of the Common Stock, each right will be modified to entitle its holder (other than the acquirer) to purchase com-

mon stock of the acquiring company or, in certain circumstances, VF Common Stock having a market value of

twice the exercise price of the right. In some circumstances, rights other than those held by an acquirer may be

exchanged for one share of VF Common Stock. The rights, which expire in January 2008, may be redeemed at

$.01 per right prior to their becoming exercisable.

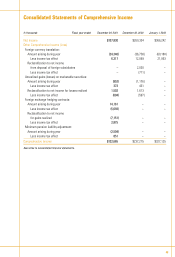

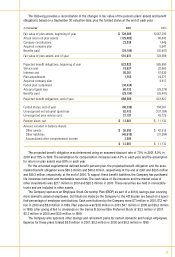

Other comprehensive income consists of certain changes in assets and liabilities that are not included in net

income but are instead reported under generally accepted accounting principles within a separate component of

common shareholders’ equity. Items comprising accumulated other comprehensive income in the Consolidated

Balance Sheets are summarized as follows:

In thousands 2001 2000

Foreign currency translation $(106,169) $(88,146)

Unrealized gains on marketable securities 590 271

Foreign exchange hedging contracts 4,192 –

M inimum pension liability adjustment (1,653) –

$(103,040) $(87,875)

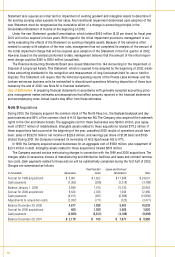

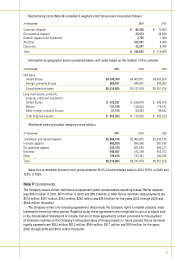

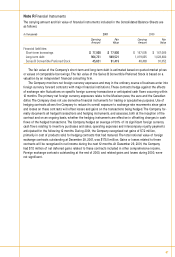

Note K Redeemable Preferred Stock

Each share of Series B Convertible Preferred Stock has a redemption value of $30.88 plus cumulative accrued

dividends, is convertible into 1.6 shares of Common Stock and is entitled to two votes per share along with the

Common Stock. The trustee for the ESOP may convert the preferred shares to Common Stock at any time or

may cause the Company to redeem the preferred shares under certain circumstances. The Series B Convertible

Preferred Stock also has preference in liquidation over all other stock issues.

The ESOP's purchase of the preferred shares w as funded by a loan of $65.0 million from the Company that

bears interest at 9.80% and is payable in increasing installments through 2002. Interest income on this loan

was $.9 million in 2001, $1.7 million in 2000 and $2.6 million in 1999. Principal and interest obligations on the

loan are satisfied as the Company makes contributions to the savings plan and dividends are paid on the

Preferred Stock. As principal payments are made on the loan, shares of Preferred Stock are allocated to partici-

pating employees' accounts within the ESOP. At the end of 2001, 1,420,338 shares of Preferred Stock had been

allocated to participating employees’ accounts.

58