North Face 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

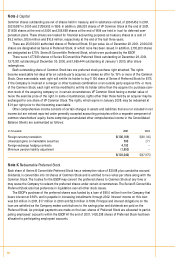

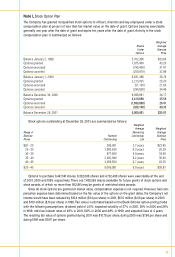

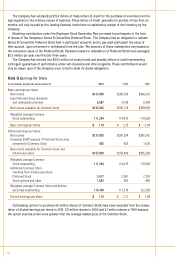

The Company has granted to key employees 58,279 shares of restricted stock that vest in 2005. Compen-

sation equal to the market value of shares at the date of grant is amortized to expense over the vesting period.

Expense for these shares w as $.2 million in 2001, $.6 million in 2000 and $.3 million in 1999.

The Company grants stock awards to certain key employees under a stock award plan that replaced a por-

tion of the cash incentive compensation for those employees. The stock awards entitle the participants to the

right to receive shares of VF Common Stock, with the number of shares to be earned based on the three year

total shareholder return of VF Common Stock compared with a peer group of major apparel companies. Shares

earned at the end of each three year period are issued to participants in the following year, unless they elect to

defer receipt of the shares. A total of 39,923 shares and 44,962 shares of VF Common Stock were earned for the

performance periods ended in 2000 and 1999, respectively. No shares were earned for the three year perform-

ance period ended in 2001. At the end of 2001, there are 52,130 stock awards outstanding for the performance

period ending in 2002 and 60,468 for the performance period ending in 2003. Compensation expense equal to

the market value of the shares to be issued is recognized over each three year performance period. Expense of

$1.1 million, $1.8 million and $2.0 million was recognized for this plan in 2001, 2000 and 1999, respectively. A

total of 67,485 shares of Common Stock are issuable in future years to participants who have elected to defer

receipt of their shares earned.

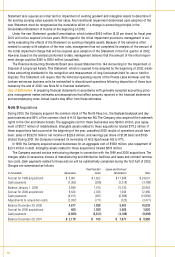

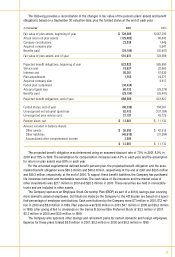

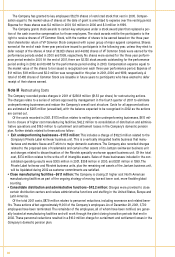

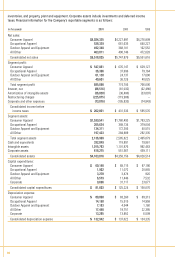

Note M Restructuring Costs

The Company recorded pretax charges in 2001 of $236.8 million ($1.53 per share) for restructuring actions.

The charges relate to a series of actions approved by management in the fourth quarter of 2001 to eliminate

underperforming businesses and reduce the Company’s overall cost structure. Costs for all approved actions

are estimated at $265 million (unaudited), with the balance expected to be recognized in 2002 as the actions

are carried out.

Of the costs recorded in 2001, $117.5 million relates to exiting certain underperforming businesses, $61.1 mil-

lion to closure of higher cost manufacturing facilities, $42.2 million to consolidation of distribution and adminis-

trative operations and $16.0 million to curtailment and settlement losses in the Company’s domestic pension

plan. Further details related to these actions follow :

• Exit underperforming businesses–$117.5 million: This includes a charge of $102.5 million related to the

Company’s Private Label knitwear business unit. This is a vertically integrated textile business that manu-

factures and markets fleece and T-shirts to major domestic customers. The Company also recorded charges

related to the proposed sale of trademarks and certain other assets of its Jantzen swimw ear business unit

and charges related to discontinuation of the Fibrotek specialty workwear apparel business unit. Of the total

cost, $37.4 million relates to the write-off of intangible assets. Sales of these businesses included in the con-

solidated operating results were $305 million in 2001, $358 million in 2000, and $331 million in 1999. The

Private Label knitwear and Fibrotek business units, plus the remaining net assets of the Jantzen business unit,

will be liquidated during 2002 as customer commitments are satisfied.

• Close manufacturing facilities–$61.1 million: The Company is closing 21 higher cost North American

manufacturing facilities as part of the ongoing strategy of moving toward lower cost, more flexible global

sourcing.

• Consolidate distribution and administrative functions–$42.2 million: Charges were provided to close

certain distribution centers and reduce administrative functions and staffing in the United States, Europe and

Latin America.

Of the total 2001 costs, $87.9 million relates to personnel reductions, including severance and related bene-

fits. These actions affect approximately 11,000 of the Company's employees. As of December 29, 2001, 3,700

employees have been terminated. The remainder of the employees, all of whom have been notified, are gener-

ally located at manufacturing facilities and will w ork through the plant closing transition periods that end in

2002. These personnel reductions resulted in a $16.0 million charge for curtailment and settlement losses in the

Company’s domestic pension plan.

60