North Face 2001 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

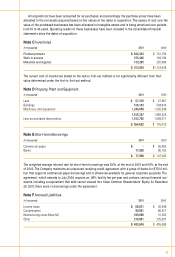

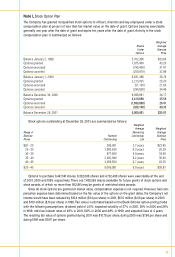

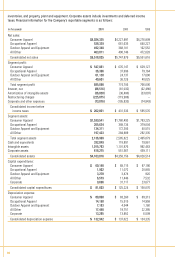

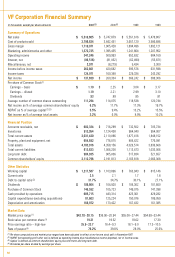

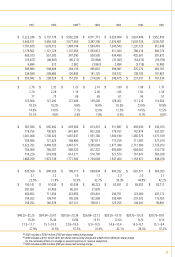

Restructuring costs (Note M ) included in segment profit above w ere incurred as follows:

In thousands 2001 2000

Consumer Apparel $ 84,436 $ 70,950

Occupational Apparel 23,913 34,646

Outdoor Apparel and Equipment 3,725 1,000

All Other 102,501 4,966

Corporate 22,247 8,346

Total $ 236,822 $ 119,908

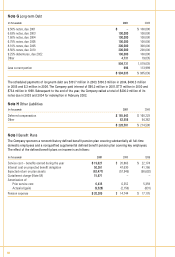

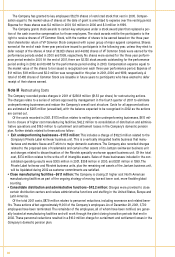

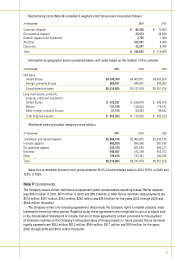

Information by geographic area is presented below, with sales based on the location of the customer:

In thousands 2001 2000 1999

Net sales:

United States $4,549,368 $4,803,872 $4,605,624

Foreign, primarily Europe 969,437 944,007 945,992

Consolidated net sales $5,518,805 $5,747,879 $5,551,616

Long-lived assets, primarily

property, plant and equipment:

United States $ 422,291 $ 536,879 $ 586,679

Mexico 141,798 149,903 119,912

Other foreign, primarily Europe 91,414 90,044 98,642

Total long-lived assets $ 655,503 $ 776,826 $ 805,233

Worldwide sales by product category are as follows:

In thousands 2001 2000 1999

Jeanswear and related apparel $2,866,734 $2,985,975 $2,936,196

Intimate apparel 869,509 894,580 981,798

Occupational apparel 538,339 661,635 640,227

Knitwear 448,407 472,298 453,103

Other 795,816 733,391 540,292

Total $5,518,805 $5,747,879 $5,551,616

Sales to one domestic discount store group comprise 14.3% of consolidated sales in 2001, 13.9% in 2000 and

13.0% in 1999.

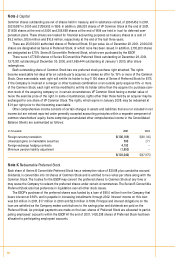

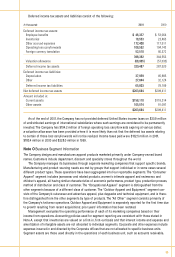

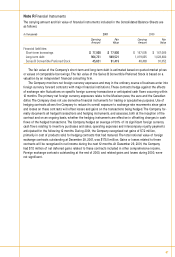

Note P Commitments

The Company leases certain facilities and equipment under noncancelable operating leases. Rental expense

was $65.0 million in 2001, $67.1 million in 2000 and $59.3 million in 1999. Future minimum lease payments are

$57.4 million, $46.7 million, $35.0 million, $28.1 million and $19.9 million for the years 2002 through 2006 and

$63.8 million thereafter.

The Company enters into licensing agreements that provide the Company rights to market products under

trademarks owned by other parties. Royalties under these agreements are recognized in cost of products sold

in the Consolidated Statements of Income. Certain of these agreements contain provisions for the payment

of minimum royalties on the Company’s anticipated sales of those products in future periods. Future minimum

royalty payments are $18.2 million, $21.2 million, $18.9 million, $12.7 million and $10.4 million for the years

2002 through 2006 and $10.5 million thereafter.

65