North Face 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

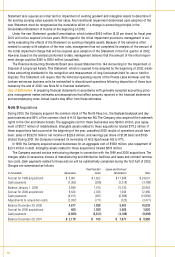

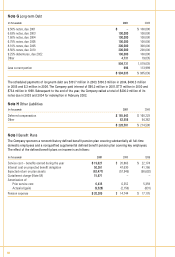

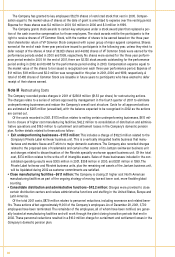

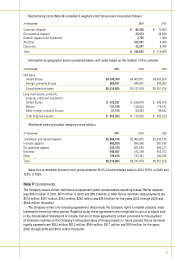

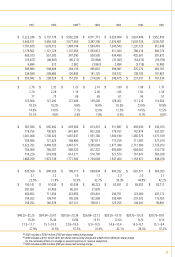

Activity in the 2001 restructuring accrual is summarized as follows:

Facilities Other Lease and

Exit Asset Contract

In thousands Severance Costs Write-downs Termination Total

Total restructuring costs $87,921 $ 59,386 $ 72,953 $16,562 $236,822

Noncash charges:

Inventories – – (15,236) – (15,236)

Intangible assets – – (37,427) – (37,427)

Pension plan partial curtailment – – (15,970) – (15,970)

Other – (54,173) (4,320) – (58,493)

Cash payments (9,522) (35) – – (9,557)

Balance December 29, 2001 $78,399 $ 5,178 $ – $16,562 $100,139

Substantially all of the remaining severance and other cash payments will be made during 2002.

In the fourth quarter of 2000, the Company recorded a total of $119.9 million of restructuring charges to exit

certain unprofitable businesses and to reduce its overall cost structure. Details of these actions follow:

• Exit underperforming businesses–$69.7 million: The Company transferred its Wrangler business in

Japan to a licensee and recorded a loss on disposition of $26.8 million, of w hich $23.8 million related to the

write-off of intangible assets. The Company discontinued certain small occupational apparel business units

and unprofitable product lines arising from companies acquired in 1998 and 1999 and certain intimate apparel

product lines having limited profit and grow th potential. Sales of these businesses included in the consoli-

dated operating results w ere $101 million in 2000 and $138 million in 1999.

• Close manufacturing facilities–$18.5 million: Charges were incurred to close six higher cost North

American manufacturing facilities.

• Consolidate distribution and administrative functions–$31.7 million: The Company incurred charges to

close distribution centers and consolidate administrative offices and functions in the United States, Europe

and Latin America.

For the 2000 restructuring, $22.4 million of the above costs relate to personnel reductions. These actions

affected approximately 2,700 of the Company’s employees, all of whom were terminated in late 2000 or in 2001.

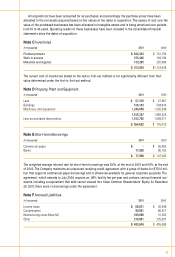

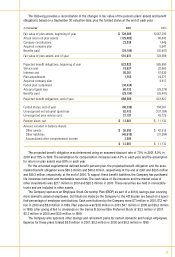

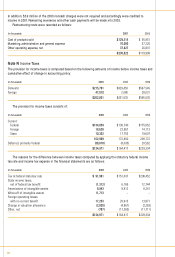

Activity in the 2000 restructuring accrual is summarized as follows:

Facilities Other Lease and

Exit Asset Contract

In thousands Severance Costs Write-downs Termination Total

Total restructuring costs $ 22,367 $ 21,850 $ 59,996 $15,695 $119,908

Noncash charges:

Inventories – – (22,392) – (22,392)

Intangible assets – – (23,819) – (23,819)

Other – (20,381) (13,785) – (34,166)

Cash payments (1,976) (8) – (154) (2,138)

Balance December 30, 2000 20,391 1,461 – 15,541 37,393

Reduction of accrual (2,573) – – (4,495) (7,068)

Cash payments (16,174) (1,012) – (4,182) (21,368)

Balance December 29, 2001 $ 1,644 $ 449 $ – $ 6,864 $ 8,957

61