North Face 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

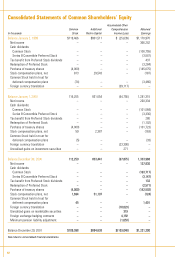

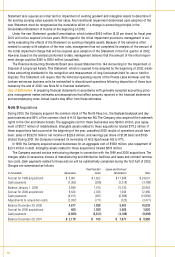

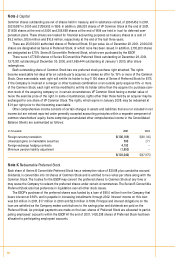

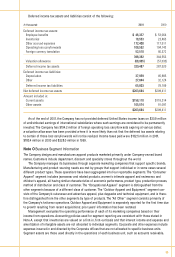

Note L Stock Option Plan

The Company has granted nonqualified stock options to officers, directors and key employees under a stock

compensation plan at prices not less than fair market value on the date of grant. Options become exercisable

generally one year after the date of grant and expire ten years after the date of grant. Activity in the stock

compensation plan is summarized as follows:

Weighted

Shares Average

Under Exercise

Options Price

Balance January 2, 1999 5,702,306 $33.65

Options granted 1,975,400 43.20

Options exercised (795,400) 31.87

Options canceled (250,810) 32.88

Balance January 1, 2000 6,631,496 36.74

Options granted 2,213,025 26.20

Options exercised (51,130) 21.60

Options canceled (294,500) 34.46

Balance December 30, 2000 8,498,891 34.17

Options granted 2,419,090 35.59

Options exercised (1,699,860) 26.41

Options canceled (208,140) 40.33

Balance December 29, 2001 9,009,981 $35.87

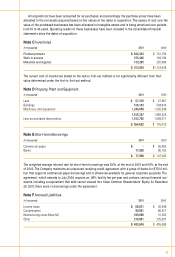

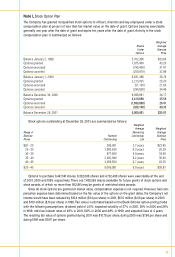

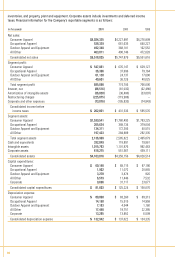

Stock options outstanding at December 29, 2001, are summarized as follows:

Weighted

Average Weighted

Range of Remaining Average

Exercise Number Contractual Exercise

Prices Outstanding Life Price

$20 –25 306,061 2.7 years $23.65

25–30 1,983,630 6.3 years 26.28

30–35 977,800 4.9 years 34.49

35–40 2,382,940 9.2 years 35.60

40–45 3,359,550 6.7 years 43.25

$20–45 9,009,981 6.9 years $35.87

Options to purchase 6,447,041 shares, 6,332,066 shares and 4,702,496 shares w ere exercisable at the end

of 2001, 2000 and 1999, respectively. There are 7,439,269 shares available for future grants of stock options and

stock awards, of which no more than 952,841 may be grants of restricted stock awards.

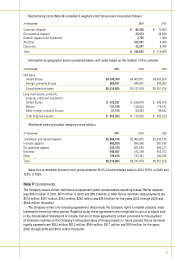

Since all stock options are granted at market value, compensation expense is not required. However, had com-

pensation expense been determined based on the fair value of the options on the grant dates, the Company's net

income w ould have been reduced by $15.4 million ($.14 per share) in 2001, $10.5 million ($.09 per share) in 2000

and $11.9 million ($.10 per share) in 1999. Fair value is estimated based on the Black-Scholes option-pricing model

with the following assumptions: dividend yield of 2.0%; expected volatility of 37% in 2001, 36% in 2000 and 26%

in 1999; risk-free interest rates of 4.9% in 2001, 6.8% in 2000 and 4.8% in 1999; and expected lives of 4 years.

The resulting fair value of options granted during 2001 was $10.78 per share, during 2000 was $7.66 per share and

during 1999 was $9.97 per share.

59