NetFlix 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

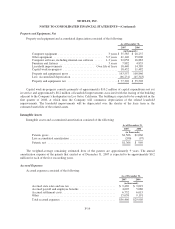

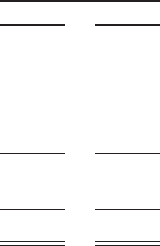

The tax effects of temporary differences and tax carryforwards that give rise to significant portions of the

deferred tax assets and liabilities are presented below:

Year Ended December 31,

2007 2006

Deferred tax assets:

Accrualsandreserves .......................................... $ 2,986 $ 3,109

Depreciation ................................................. 473 1,393

Stock-basedcompensation ...................................... 15,736 12,769

Other ....................................................... (699) 1,564

Grossdeferredtaxassets ............................................ 18,496 18,835

Valuation allowance against deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . — (80)

Netdeferredtaxassets.............................................. $18,496 $18,755

The total valuation allowance for the years ended December 31, 2007 and 2006 decreased by $0.08 million

and $0.016 million, respectively.

As a result of the Company’s analysis of expected future income at December 31, 2005, it was considered

more likely than not that substantially all deferred tax assets would be realized, resulting in the release of the

previously recorded valuation allowance and generating a $34.9 million tax benefit. In evaluating its ability to

realize the deferred tax assets, the Company considered all available positive and negative evidence, including its

past operating results and the forecast of future market growth, forecasted earnings, future taxable income, and

prudent and feasible tax planning strategies. As of December 31, 2007 it was considered more likely than not that

substantially all deferred tax assets would be realized, and no valuation allowance was recorded.

As of December 31, 2006, the Company had unrecognized net operating loss carryforwards for federal tax

purposes of approximately $56 million attributable to excess tax deductions related to stock options. In 2007 all

of the unrecognized net operating loss was used to reduce the taxable income and the benefit was credited to

equity.

The Company files income tax returns in the U.S. federal jurisdiction and all of the states where income tax

is imposed. The Company is subject to U.S. federal or state income tax examinations by tax authorities for years

after 1997.

9. Employee Benefit Plan

The Company maintains a 401(k) savings plan covering substantially all of its employees. Eligible

employees may contribute up to 60% of their annual salary through payroll deductions, but not more than the

statutory limits set by the Internal Revenue Service. The Company matches employee contributions at the

discretion of the Board of Directors. During 2007, 2006 and 2005, the Company’s matching contributions totaled

$1.5 million, $1.4 million and $0.9 million, respectively.

F-23