NetFlix 2007 Annual Report Download - page 36

Download and view the complete annual report

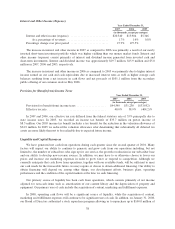

Please find page 36 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

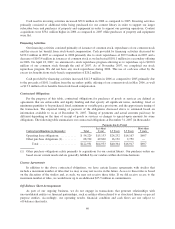

We record a tax provision for the anticipated tax consequences of our reported results of operations. In

accordance with SFAS No. 109, Accounting for Income Taxes, the provision for income taxes is computed using

the asset and liability method, under which deferred tax assets and liabilities are recognized for the expected

future tax consequences of temporary differences between the financial reporting and tax bases of assets and

liabilities, and for operating loss carryforwards. Deferred tax assets and liabilities are measured using the

currently enacted tax rates that apply to taxable income in effect for the years in which those tax assets are

expected to be realized or settled. We record a valuation allowance to reduce deferred tax assets to the amount

that is believed more likely than not to be realized.

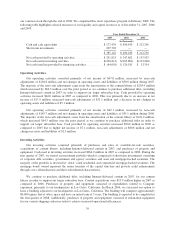

At December 31, 2007, our deferred tax assets were $18.5 million. As of December 31, 2006, deferred tax

assets did not include the tax benefits attributable to approximately $56 million of excess tax deductions related

to stock options. In 2007, these benefits were realized as a reduction of taxes payable and credited to equity.

In evaluating our ability to recover our deferred tax assets, in full or in part, we consider all available

positive and negative evidence, including our past operating results, and our forecast of future market growth,

forecasted earnings, future taxable income and prudent and feasible tax planning strategies. The assumptions

utilized in determining future taxable income require significant judgment and are consistent with the plans and

estimates we are using to manage the underlying businesses. We believe that the deferred tax assets recorded on

our balance sheet will ultimately be realized. In the event we were to determine that we would not be able to

realize all or part of our net deferred tax assets in the future, an adjustment to the deferred tax assets would be

charged to earnings in the period in which we make such determination.

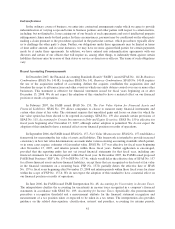

Descriptions of Consolidated Statements of Operations Components

Revenues

We generate all our revenues in the United States. We derive substantially all of our revenues from monthly

subscription fees and recognize subscription revenues ratably over each subscriber’s monthly subscription

period. We record refunds to subscribers as a reduction of revenues.

Cost of Revenues

Subscription

We acquire titles from studios and distributors through direct purchases, revenue sharing agreements or

license agreements. Direct purchases of DVDs normally result in higher upfront costs than titles obtained through

revenue sharing agreements. Cost of subscription revenues consists of postage and packaging costs related to

shipping titles to paying subscribers, amortization of our content library and revenue sharing expenses. Costs

related to free-trial subscribers are allocated to marketing expenses.

Postage and Packaging. Postage and packaging expenses consist of the postage costs to mail DVDs to and

from our paying subscribers and the packaging and label costs for the mailers. The rate for first-class postage was

$0.37 between June 29, 2002 and January 7, 2006. Between January 8, 2006 and May 13, 2007, the rate for first-

class postage was $0.39. The U.S. Postal Service increased the rate of first class postage by 2 cents to $0.41

effective May 14, 2007 and by one cent to $0.42 effective May 12, 2008. We receive discounts on outbound

postage costs related to our mail preparation practices.

Amortization of Content Library. The useful life of the new release DVDs and back catalog DVDs is

estimated to be 1 year and 3 years, respectively. We provide a salvage value of $3.00 per DVD for those direct

purchase DVDs that we estimate will sell at the end of their useful lives. For those DVDs that we do not expect

to sell, no salvage value is provided. We amortize license fees on Internet-based content on a straight-line basis

consistent with the terms of the license agreements.

31