NetFlix 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Stock-Based Compensation

Vested stock options granted before June 30, 2004 can be exercised up to three months following

termination of employment. Vested stock options granted after June 30, 2004 and before January 1, 2007 can be

exercised up to one year following termination of employment. For newly granted options, beginning in January

2007, employee stock options will remain exercisable for the full ten year contractual term regardless of

employment status. In conjunction with this change, the Company changed its method of calculating the fair

value of new stock-based compensation awards granted under its stock option plans from a Black-Scholes model

to a lattice-binomial model. The Company believes that the lattice-binomial model is more capable of

incorporating the features of the Company’s employee stock options than closed-form models such as the Black-

Scholes model. The lattice-binomial model has been applied prospectively to options granted in 2007. The

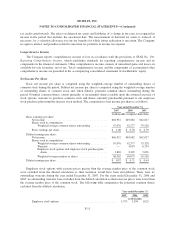

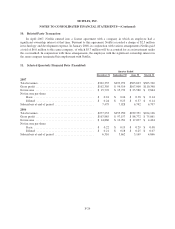

following table summarizes the assumptions used to value option grants using the Black-Scholes model in 2005

and 2006 and a lattice-binomial model in 2007:

2007 2006 2005

Dividendyield ............................... 0% 0% 0%

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43% – 52% 48% 59%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . 4.40% – 4.92% 4.76% 3.67%

Expected life (in years) . . . . . . . . . . . . . . . . . . . . . . . . — 3.93 3.08

Suboptimal exercise factor . . . . . . . . . . . . . . . . . . . . . . 1.77-2.09 — —

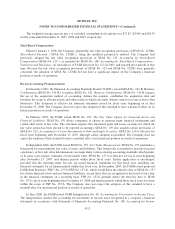

The fair value of shares issued under the ESPP is estimated using the Black-Scholes option pricing model.

The following table summarizes the assumptions used to value shares issued under the ESPP:

Year Ended December 31,

2007 2006 2005

Dividendyield................................... 0% 0% 0%

Expectedvolatility ............................... 42% 39% 45%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.62% 5.07% 3.80%

Expected life (in years) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.5 0.5 1.3

The Company estimates expected volatility based on a blend of historical volatility of the Company’s

common stock and implied volatility of tradable forward call options to purchase shares of its common stock.

The Company believes that implied volatility of publicly traded options in its common stock is expected to be

more reflective of market conditions and, therefore, can reasonably be expected to be a better indicator of

expected volatility than historical volatility of its common stock.

The Company bifurcates its option grants into two employee groupings (executive and non-executive) based

on exercise behavior and considers several factors in determining the estimate of expected life for each group,

including the historical option exercise behavior, the terms and vesting periods of the options granted. In the year

ended December 31, 2007, under the lattice-binomial model, the Company used a suboptimal exercise factor

ranging from 2.06 to 2.09 for executives and 1.77 to 1.78 for non-executives, which resulted in a calculated

expected life of the option grants of 5 years for executives and 4 years for non-executives. From the second

quarter through the fourth quarter of 2006, under the Black-Scholes model, the Company used an estimate of

expected life of 5 years for executives and 3 years for non-executives. The Company used an estimate of

expected life of 4 years for executives and 3 years for non-executives from the second quarter of 2005 through

the first quarter of 2006.

The Company bases the risk-free interest rate on U.S. Treasury zero-coupon issues with remaining terms

similar to the expected term on the options. The Company does not anticipate paying any cash dividends in the

F-21